Jewelry Can Be an Investment. Here's How to Find It

Investing in jewelry can be a fun experience.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the market value of gold continues to increase, this is not just a good time to consider diversifying your portfolio, but an opportune time to consider jewelry made of the precious metal. In 2020, the value of one ounce of gold surpassed $2,000 for the first time ever; today’s price is hovering above $2,400.

Jewelry is not as liquid as gold bullion and bars, but its value does rise in a commensurate fashion, and the longer you hold on to it, the greater the profit. The bonus is the joy of shopping for unique pieces, learning their history, and then wearing your antique and vintage finds.

Qualities that determine value range from purity of the metal and weight to condition and craftsmanship. Spot prices of platinum (approaching $1,000) and sterling silver (near $30), also precious metals, fluctuate at unprecedented highs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here, we look at what to watch out for in jewelry, how to find the goods, and how to have some fun with jewelry investments.

What makes jewelry valuable

Value is very dependent on age – antique is reserved for pieces that are at least 100 years old – and number of karats. Not only is 24-karat gold the purest, it’s also the softest and most easily scratched – the traditional photo op of Olympic athletes biting their medals leads back to the 1800s gold rush when that was the way to test metal's purity. Generally, jewelers recommend 14- and 18-karat (58.5% and 75% pure gold) for everyday wear.

A small jeweler's magnifying loupe enables one to study stamps, karat and dates. Quality silver is usually marked with the number 925, country of origin and the word “Sterling.”

The number of carats applies to gemstone size. Expensive diamond jewelry likely includes grading reports from the Gemological Institute of America documenting carat weight. The GIA’s gem encyclopedia explains “play-of-color,” where certain stones are found (lapis in Afghanistan; opals in Australia), and how tourmalines (mineral deposits that resemble gemstones) are identified by color or locale.

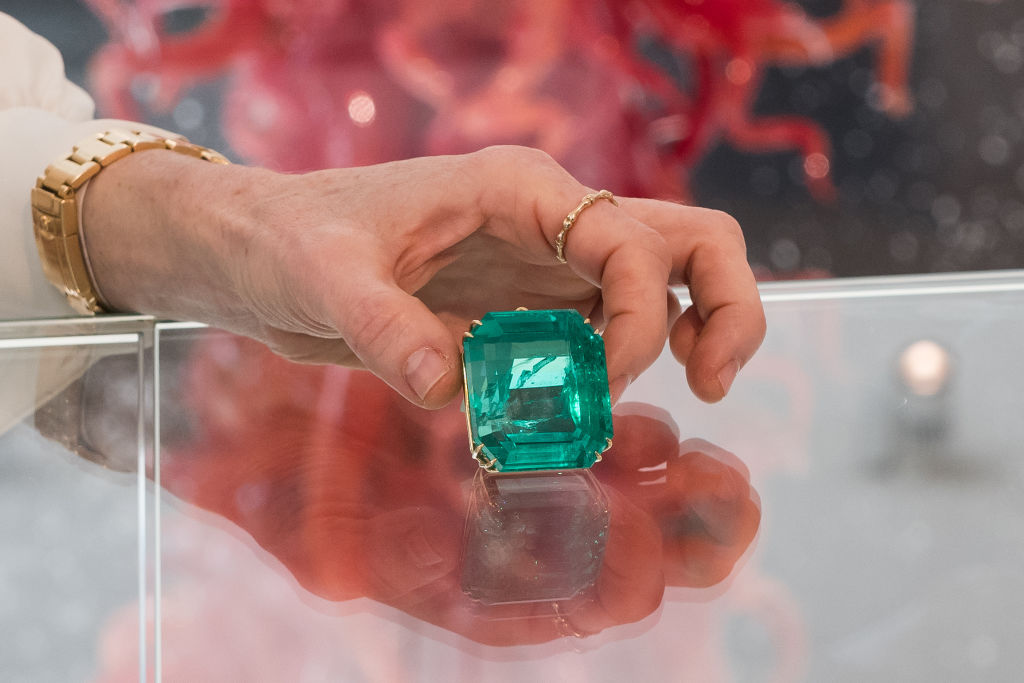

Semi-precious gemstones are highly collectible and wearable, while diamonds, emeralds, sapphires, jadeite, garnets and rubies are more coveted. There's a wealth of difference between synthetic and natural stones; small seed, seawater, freshwater and cultured pearls. Gemstones are graded according to the 4 Cs: Cut, color, clarity and carat weight.

Jewelry is also classified by its type and design. For instance, significant differences in necklace styles described at Spruce Crafts range from rope-like bayaderes to bibs (popular during Greek and Roman times), chokers, collars, festoons and lavallieres (named for a mistress of Louis XIV).

The history of jewelry trends

Knowing the history of jewelry also helps to understand what has value. Ornate Georgian jewelry dates from 1714 to 1830; the Victorian era, 1837-1901, reflects Queen Victoria’s reign; and Edwardian, 1901-1910, refers to King Edward VII. The 1920s and 1930s are the heyday of Art Deco followed by Art Deco Revival, Mid-Century and contemporary.

If you are looking to gain appreciation and knowledge of jewelry (or just look at some beautiful items) fine arts museums are excellent venues to study how historic periods, politics, wars, aristocracy and trends have transformed jewelry-making.

This context shows how what's considered valuable or trendy changes, too. For instance, one of the more dramatic forms of Victorian jewelry was hairwork, which enabled a family member to memorialize their beloved by weaving, framing and gilding strands of their hair.

Visitors at London's Victoria and Albert Museum can observe Bronze Age artifacts and medieval jewelry that illuminate times when lower classes wore copper and pewter. You can also see how in the Renaissance period, different stones were thought to protect people from various illnesses, and you can see the work of avant-garde artists who push the limits with cutting-edge technology and materials.

Custom-made jewelry has been a statement of extreme wealth and triumph for centuries, extending into the modern era. Over-the-top, one-of-a-kind pieces displayed at the American Museum of Natural History's Ice Cold: An Exhibition of Hip-Hop Jewelry (open until January 2025) include shiny signs of success created for Run-DMC, exemplified by Adidas’ 14-karat gold sneaker-shaped pendants.

Where you can find jewelry to invest in

People acquire gold in myriad forms and from unexpected places; Costco sells bars, and according to the New York Times, golden “beans” are popular in China. And between sites like Ruby Lane, Etsy, eBay, 1stDibs and TheRealReal, the internet is a 24/7 emporium for jewelry at every price point conceivable, bombarding followers with seductive images of bespoke, pre-owned and sought-after jewelry.

Before buying online, be sure to read sellers' reviews and check return and exchange policies. You should also look out for charges for resizing, engraving, converting (i.e. earrings into charms, a pendant into a brooch and vice versa), shipping costs, insurance and tracking.

Second-generation jeweler Elizabeth Henry, who oversees six stores in Massachusetts, New Hampshire and Maine, said Instagram helped Market Square Jewelers survive the pandemic. Their frequent live shows have created a loyal community of "jewelry nerds" who can comment, ask questions, and then purchase by writing "mine" plus a price.

You can also shop at auction houses. Bonhams has 89 live and online jewelry auctions in 2024 worldwide, according to their jewelry global director Jean Ghika. Bonhams does valuations for auction and enables interested parties to preview and bid online and onsite. Items from a June auction, which I saw at New York City’s Madison Avenue location, included intricate designs by Piaget, Chopard, David Webb, Van Cleef & Arpels, Bulgari, and a pair of diamond bracelets owned by the late Barbara Walters.

Ghika wrote in an email that “some makers have enduring appeal regardless of time period." She added: "Style-wise we have seen a renewed interest in jewels from the second half of the 20th century, namely the 1950s and 1960s; equally, there is also an emerging interest in the jewels from the 1980s which often focus on bold designs and strong use of color."

Additionally, check out estate sales (estatesales.net is state-specific), stoop sales, garage sales, flea markets, thrift shops and events that could be opportunities for finding valuable jewelry. For example, at the bustling Manhattan Vintage Show, held four times a year in New York City, one can try on distinctive pieces and interact with dealers from all over the country. The three-day event boasts a kaleidoscopic array of clothing, accessories and baubles, all under Metropolitan Pavilion's roof.

Approximately a quarter of the 100 vendors sell jewelry, and if you look carefully, you’ll unearth gems that will appreciate in value, such as a silver ring designed by esteemed architect Frank Gehry in collaboration with Tiffany’s, or modernist pins by Danish silversmith Georg Jensen, founded in 1904 in Copenhagen. Fashionistas love rifling through racks of Gucci and Pucci, pairing bright, still in-vogue patterns with bakelite, turquoise, cameos, coral and Austro-Hungarian crystals, stacking rings and bracelets, and layering necklaces.

At the Jewelry and Object Show (held in New York City, Las Vegas and Miami), dealers explain the provenance and cultural significance of hat and collar pins, ear clips, money clips, tennis bracelets, bangle bracelets, retro charms, and chains of all types (serpentine, Cuban, cable, curb, Figaro, herringbone, mariners, trace, paperclip, ball, belcher, box) and lengths (princess, matinee and opera). There are classic cufflinks, lockets, fine watches, old-fashioned and mourning brooches and pendants for sale.

One piece de resistance at a recent Jewelry and Object Show in the Metropolitan Pavilion was a radiant gold bracelet, circa 1840, designed by Italy's legendary House of Castellani for sale by DK Bressler. While many sellers connect with customers via websites and social media, Bressler’s owner Ron Kawitzky, who has been operating out of New York’s famous diamond district for almost 40 years, said the best way to assess fine jewelry is to see it in person, handle it and observe makers' marks. I suggest scheduling an appointment first.

You could have valuable pieces already without knowing it. Look through your own jewelry box for signed silver pieces, high karatage gold, rare gems, and anything from Cartier, Hermes, Harry Winston, Faberge and Fred Leighton. Watches by Rolex, Montblanc, Piaget, Patek Philippe, Longines and Verdure also have high value as investments.

Be on the lookout for Paloma Picasso’s graffiti X’s and olive leaves; Elsa Peretti's signature waves, open hearts, bone cuffs and bean-shaped pendants. Peretti’s first jewelry design was a sterling bud vase on a leather string inspired by a flea market find.

How to consider jewelry investments

Much like collecting art that will hang on your walls for years, experts encourage investing in high-quality jewelry that resonates on an emotional level. Learn as much as you can and decide how much you’re willing to spend. You should also determine if you’re buying to celebrate a personal milestone, bequeath or sell in the future as the value of gold goes up.

Meghan Dyer, head of sales at EraGem based in Bellevue, Washington, said a beautiful piece of jewelry is viewed as a “future heirloom and long-term investment.” Vis a vis the current precious metal market, Dyer was one of several dealers whose price tags on older stock remain unchanged but, she said, newly listed items will reflect an uptick in troy ounce prices.

When it comes to selling your jewelry, she suggests paying for an independent appraisal. Not one source I spoke to for this story was in favor of melting old jewelry; in fact, they said banishing pieces of history to the furnace was criminal.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa Amand covers culture and neighborhoods in New York City, real estate, California wine country, farmers markets and all things San Francisco. A former restaurant critic and winner of a James Beard Journalism Award, she’s based in Manhattan.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.