Take Convertible Bonds for a Spin

Stock investors can smooth the ride with these often overlooked hybrid securities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Given recent market gyrations, it’s clear that more than a few investors are eyeing stocks nervously. After all, stock indexes touched all-time highs despite an economy in recession, a looming presidential election and widespread uncertainty over the timing and efficacy of a remedy for the COVID-19 pandemic.

If you’re feeling queasy about stocks, but you don’t want to miss out on future gains in an unpredictable stock market, consider adding convertible bonds to your portfolio. These hybrid securities combine elements of bonds and common stocks, ideally providing stock-like returns with the relative stability of bonds. Over the past 25 years, the Bank of America Merrill Lynch All US Convertibles index has returned an annualized 8.8%—slightly less than the 9.4% return of the S&P 500, but with 16% less volatility. (Returns are as of September 11.)

Like bonds, convertibles pay a fixed interest rate (typically less than the rate on the issuer’s common bonds) and aim to return their face value to the investor when they mature. But during periods outlined by the issuing company, investors can exchange the bonds for a predetermined amount of the issuer’s stock. The more a convertible’s underlying stock price rises, the more it makes sense for investors to make the conversion.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As prices rise, a convertible tends to trade like a stock, its value moving in lock step with the underlying share price. Convertibles issued by companies whose stock prices are sinking tend to trade more like bonds, with prices driven more by movements in interest rates. The result is an “asymmetric” return profile, says Joe Wysocki, comanager of the Calamos Convertible fund, with convertibles effectively increasing investor exposure to stocks as they rally and limiting exposure when prices are falling.

Pick through the junk. One major drawback: Most issuers of these bonds carry “junk”-level ratings or aren’t rated at all, meaning investors run a real risk that the issuers will default on the debt. Convertibles also are complicated investments that can be difficult for individual investors to analyze, meaning that you should likely leave the picking and choosing to the pros.

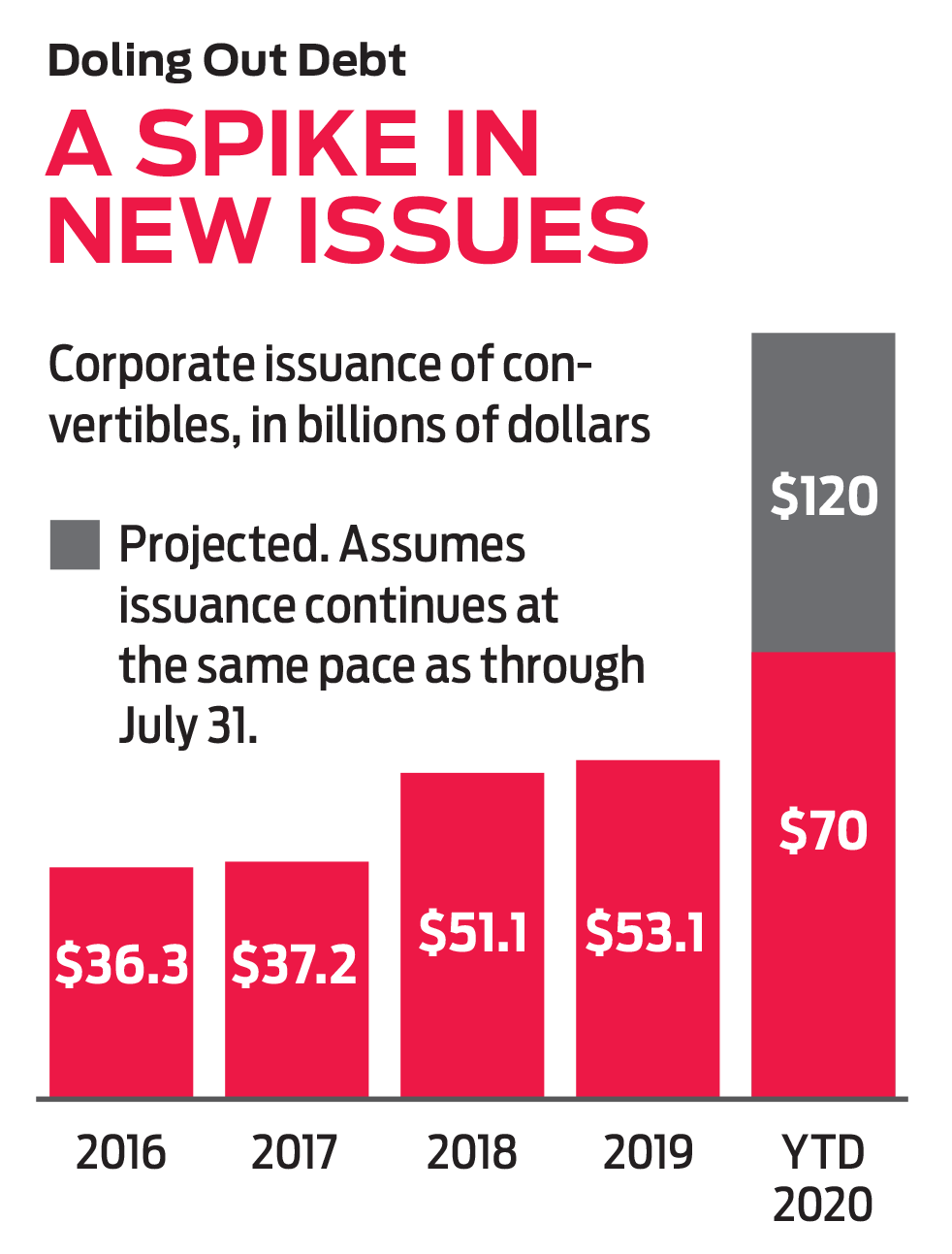

And the pros have had plenty to choose from of late. Companies—many of them looking for funding in the wake of the pandemic—have issued $70 billion worth of convertible bonds so far in 2020, up from $53 billion for the entirety of 2019. The boom in issuance has created unprecedented diversity in the convertible market, says Adam Kramer, comanager of Fidelity Convertible Securities (symbol FCVSX). Typically dominated by fast-growing tech and health care firms, such as Tesla (TSLA) and Illumina (ILMN), the BofA Merrill convertibles index has seen an influx of consumer firms, such as Burlington Stores (BURL) and Dick’s Sporting Goods (DKS), and beaten-down travel-and-leisure companies, such as Southwest Airlines (LUV) and Royal Caribbean (RCL).

Of the one-and-a-half dozen or so mutual funds specializing in convertibles currently, Fidelity’s fund is among the very few that don’t levy a sales charge, and it comes with the category’s lowest expense ratio, at just 0.51%. Kramer runs the fund aggressively, holding 13% of the fund’s assets in post-conversion common stock, compared with a 5% stock weighting among its average peer fund.

Consistently among the category’s top performers: AllianzGI Convertible (ANZAX). The fund’s managers tilt the portfolio toward more stock-like or bond-like convertibles depending on their overall view of the market. Longtime managers Douglas Forsythe and Justin Kass have steered the strategy adeptly. The fund’s 10-year return tops all other convertibles funds, and the portfolio has beaten its average peer in eight of the past 10 calendar years, including so far in 2020. The fund’s Class A shares carry a 5.5% sales charge, but you can purchase them without a load or transaction fee at several online brokerages.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.