How to Build a Bond Portfolio

No single bond (or even bond fund) can do it all. We'll help you match your goals with appropriate fixed-income picks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Time was, retirees could generate enough income from safe-haven bond investments to cover living expenses. But those days are long gone, thanks to years of low interest rates. In August, the 10-year Treasury note yielded 0.57%, a far cry from the 2.60% yield it paid a decade ago. In response, many investors have taken on more risk by investing in bonds that fetch higher yields, or by shifting more of their portfolio into stocks.

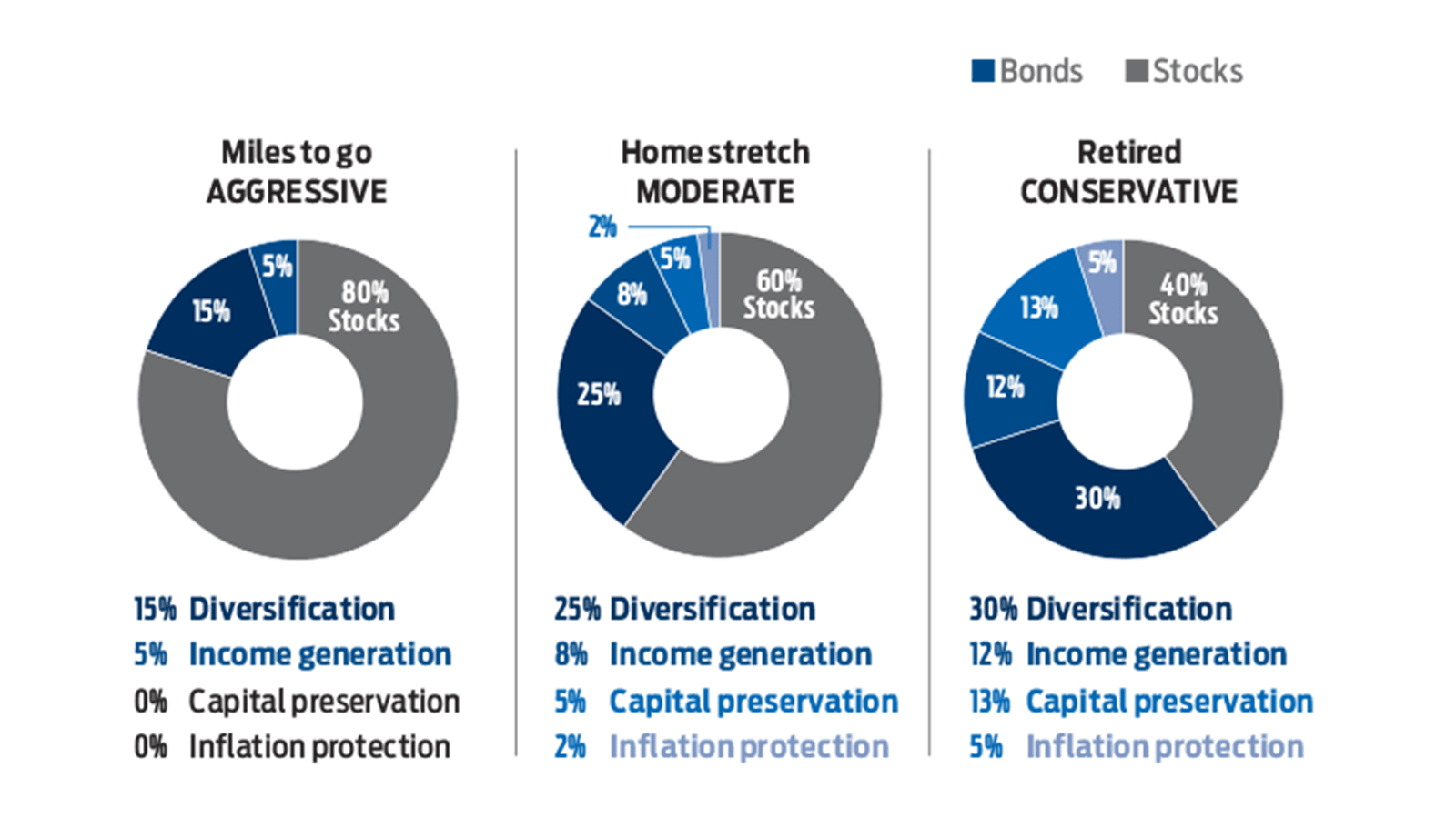

In a changing market, it’s time to remember why we hold bonds in the first place. They should play four key roles in a diversified portfolio. Some bonds provide a counterbalance to your stock holdings by holding steady when stock prices plummet. Others act as safety nets, preserving money you need to tap soon. Some debt still generates decent income, despite low rates. Finally, though a rise in consumer prices for goods and services may not be an immediate threat, some bonds hedge against inflation, too.

No single type of bond, or bond fund, can fill all four roles. “A bond that provides income may not be the best choice to provide preservation of capital,” says Ekta Patel, a director at Altfest Personal Wealth Management. That makes the mix of bonds you hold important. Understanding what your portfolio needs most and choosing funds best suited for those needs is the first step toward building a bond portfolio that’s right for you.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Set your priorities. You may have to prioritize certain portfolio objectives depending on the state of the market overall. Back in the day, when interest rates were higher, generating income was the primary objective in bond portfolios, and protecting that income from the insidious erosion of inflation was a close second. These days, income generation takes a backseat to bonds’ role as diversification from stocks. “In a low-rate, low-inflation environment,” says Patel, “how you use bonds and which types of bonds you use have to change.”

A lot depends, too, on your age or time horizon. If you’re younger and holding 80% of your portfolio in stocks, stick with high-quality debt that zigs when stocks zag. Older investors with 80% in bonds and 20% in stocks might skew a portion of their fixed-income portfolio toward securities that can generate measurable income, even if it entails a bit of risk.

We’ll walk you through the four objectives that bonds should meet in a portfolio and show you how to put the pieces together in model portfolios. Returns are through August 7.

Diversify from stocks

When stock prices fall, the bonds you hold as ballast should rise in value, or at least stay steady. Classic holdings in this category are U.S. Treasuries and other government-backed debt, such as agency mortgage-backed securities. High-quality corporate debt—issued by firms with credit ratings of triple-A to triple-B—can play a role, too.

Bonds to avoid: High-yield corporate debt (IOUs issued by companies with credit ratings from double-B down to single-C), bank loans, emerging-markets bonds and preferred stocks. The prices of these securities tend to move in step with stocks, which is counter to the objective.

Quality matters in this core part of your portfolio. In bond-speak, high-quality issues are liquid—they can be sold quickly in volatile markets without causing a huge drop in price. “The value of a true core bond fund is that when stocks crater, you can sell shares in it to buy more stocks as a way to rebalance,” says Luke Farrell, fixed income investment director at the management firm Capital Group, which runs the American Funds mutual funds.

Our favorite funds for providing a counterbalance to stocks fall in the intermediate core bond fund category. These funds hold mostly Treasuries, government-guaranteed mortgage-backed securities and high-quality corporate debt:

- Vanguard Core Bond (symbol VCORX, expense ratio 0.25%)

- Fidelity Investment Grade Bond (FBNDX, 0.45%)

- Vanguard Intermediate-Term Bond (BIV, 0.05%).

Aggressive investors who have longer time horizons—more than 10 years before they need the money, say—can perk up their core holdings with a sliver in an intermediate-term, core-plus fund. The plus distinction means these funds have more latitude to invest in junkier debt than traditional core bond funds. But they also hold safe-haven government IOUs:

- Metropolitan West Total Return Bond (MWTRX, 0.67%)

- DoubleLine Total Return Bond (DLTNX, 0.73%)

- Pimco Active Bond (BOND, 0.73%)

Generate income

Reset your expectations for how much income your bonds can generate. “The idea that you can pick a yield and get it is no longer realistic,” says Gene Tannuzzo, deputy global head of fixed income at Columbia Threadneedle Investments. Prior to the financial crisis of 2007–09, for instance, 10-year Treasuries yielded nearly 5%. “To earn that today,” says Tannuzzo, “you’d have to put all of your portfolio in high-yield bonds.” And that is too risky a move.

That said, with a careful blend of bond funds, you can eke out a yield of 2% to 3% with only a bit of added risk. Lean on high-quality, investment-grade corporate bonds—those rated between triple-A and triple-B—which currently yield 1.40% to 2.29%. That sounds low, but it’s better than what you’ll earn on cash, which is nothing. “Yield is relative,” says Paul Zemsky, chief investment officer of multi-asset strategies and solutions at Voya. In addition to investing in high-quality corporates, you can boost income—in small doses—with a multisector bond fund or a high-yield bond fund.

- Fidelity Corporate Bond (FCBFX, 0.45%)/Fidelity Corporate Bond (FCOR)

- Pimco Income (PONAX, 1.45%)

- Vanguard High Yield Corporate (VWHEX, 0.23%)

Preserve capital

This strategy strives to prevent losses and is usually reserved for money you’re going to need within three years or so. High-quality short-term bond funds are the best bets for this corner of your bond portfolio. Risk of default is negligible. These funds are also less interest-rate sensitive, which can provide a hedge against rising rates. Though few bond experts expect interest rates to rise in the near term, rates are historically low, so the risk of a move higher is greater:

- Vanguard Short-Term Bond ETF (BSV, 0.05%)/ Vanguard Short-Term Bond (VBIRX, 0.07%)

- iShares Ultra Short-Term Bond (ICSH, 0.08%)

Hedge against inflation

We’re not worried about inflation for now. Kiplinger expects 1.1% inflation for 2020, below the 2.3% rate recorded in 2019. But the Fed’s easy-money policies mean high inflation is a great “likelihood” in the future, says Sam Lau, a strategic commodity portfolio manager with DoubleLine.

Treasury inflation-protected securities, or TIPS, act as an insurance policy against rising prices. They pay a fixed coupon rate on top of principal that is adjusted for inflation and they come with the full faith and credit of the U.S. government. You can buy TIPS directly from Uncle Sam (at www.treasurydirect.gov) or through your brokerage firm. Holding the actual bond ensures you’ll get your inflation-adjusted principal back, plus the bond’s coupon rate, or interest, over time. With a negative 1.04% yield currently, that means you’ll get inflation minus the negative yield.

TIPS matter more for investors who are already retired than for those who are early in their careers. The typical target-date fund for those already retired allocates nearly 10% of assets to TIPS. For those just beginning their working life, target-date funds usually have a fraction of 1% of assets in TIPS. For investors still working but nearing retirement, an allotment of 2% to 5% is more than enough in your bond portfolio. If inflation were to spike, however, we might change our tune. Want TIPS in a fund? Try:

Putting It All Together

As you build the bond portion of your portfolio, consider both the overall allocation in relation to stock holdings and the way your fixed-income objectives fit together depending on how long you have to invest. As investing time horizons shorten, your bond portfolio should shift it focus from diversification from stocks and income generation to capital preservation and inflation protection. Tweak as needed, depending on your goals. If income matters more than capital preservation, kick your income-generating bond funds up a notch and dial back on the more conservative funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.