The Good News About Recessions for Investors

Yes, an official recession is possible, but based on previous recessions, there could be reasons for investors to smile. With that in mind, here are three ways to position your portfolio now – and one major mistake not to make.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Are we going into a recession? This question has been in the news and on the minds of investors for months, and the recent announcement that GDP has decreased for the second straight quarter makes the question even more pressing.

A recession implies trouble for investors. Many believe that once a recession is announced, the stock market will drop sharply – and so changes will be needed to their portfolios to weather the storm. But history indicates a different scenario. Instead of dropping further when a recession is officially announced, the market often moves up.

That is because, in part, recessions are often declared several months after they have started. The National Bureau of Economic Research, a private, non-partisan organization, makes this call after analyzing many economic data points that take time to collect. This information includes, but is not limited to GDP growth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why Now May Not Be the Time to Be Defensive

But research by CI Brightworth in Atlanta shows that once an official recession is announced, much, if not all of the market’s downturn has already taken place. So, getting more defensive after a recession is announced may be the worst thing an investor can do.

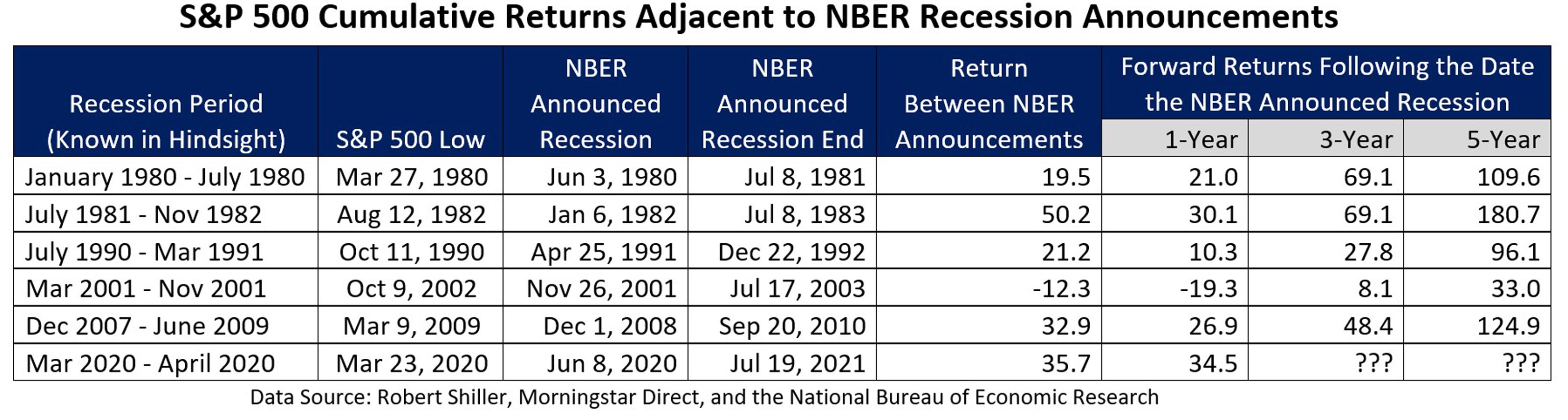

In three of the last six recessions since 1980, the stock market hit a bottom before the recession was officially recognized. Even more important for investors, after those six recessions, the market quickly moved up five times – ranging from 10.3% to 34.5% only one year following the recession announcement. Strong gains continued for three and five years after a recession was declared – in three cases, the gains topped 100%.

So, what does this mean for investors? The data show that taking defensive actions when a recession is announced has worked poorly in five of the six last recessions. A defensive action ranges from reducing exposure to stocks all the way to the “big mistake” of shifting the entire portfolio to cash.

So, what is an investor to do? Here are three recommendations:

Stop Trying to Time the Market

Trying to get into and out of the stock market is a fool’s errand and one of the biggest wealth destroying actions an investor can take. The market is forward looking and moves prior to the underlying economy. If you’re trying to move into and out of the market based on what’s happening in the economy, you are more likely to do the wrong thing at the wrong time and harm – not improve – your returns.

Stay Disciplined

If you are investing new money, either through your 401(k) plan, individual retirement accounts (IRA) or other plans, continue to follow your long-term investment strategy. You should be excited about the opportunity to buy more stocks when they are “on sale.” If it feels painful to add money to a falling market, consider automating your contributions and investments so you can reap the benefits of lower valuations without contemplating the market’s every move.

Add Stocks to Your Portfolio When They are Down

Use the downturn to rebalance your portfolio by selling assets that have performed the best and buying the assets hardest hit by the market’s tumble. For example, this could mean selling investments in some commodities and real estate while picking up high-quality stocks that have lost a significant amount of money this year. Rebalancing your portfolio is one of the most effective ways to ensure you follow the classic adage of buying low and selling high.

No one knows when the next recession will arrive or how the market will respond when it does. However, by following these key steps, investors can be prepared for any further volatility while also helping to favorably position themselves on the other side.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nick Fazio is an Investment Analyst at CI Brightworth in Atlanta. He provides quantitative and qualitative analysis of current and new investments, communicates the firm’s investment philosophy and outlook with advisers and clients, and conducts investment research on behalf of the CI Brightworth Investment Committee. He also serves as an analyst on CI Brightworth’s US Large Cap stock strategy. Nick holds a B.S. in Business Administration from the Georgia Institute of Technology and is a Certified Public Accountant.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.