What Does the Upcoming Election Mean to Your Investments?

For smart investors, the surprising answer may be very little. Here’s why, and what you should do (and not do) as election season heats up.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investing during an election year comes with a special kind of risk. Your mind is on sharp alert. The very nature of politics and your nest egg can spark emotions that may drive you to make decisions in the short term that could have a negative impact on your long-term goals.

Consider taking a step back to “pause” and set aside your emotions and bias, keeping your long-term perspective in mind. Ponder the three ideas below as we move closer to the election.

1. Stop worrying about which party is going to win.

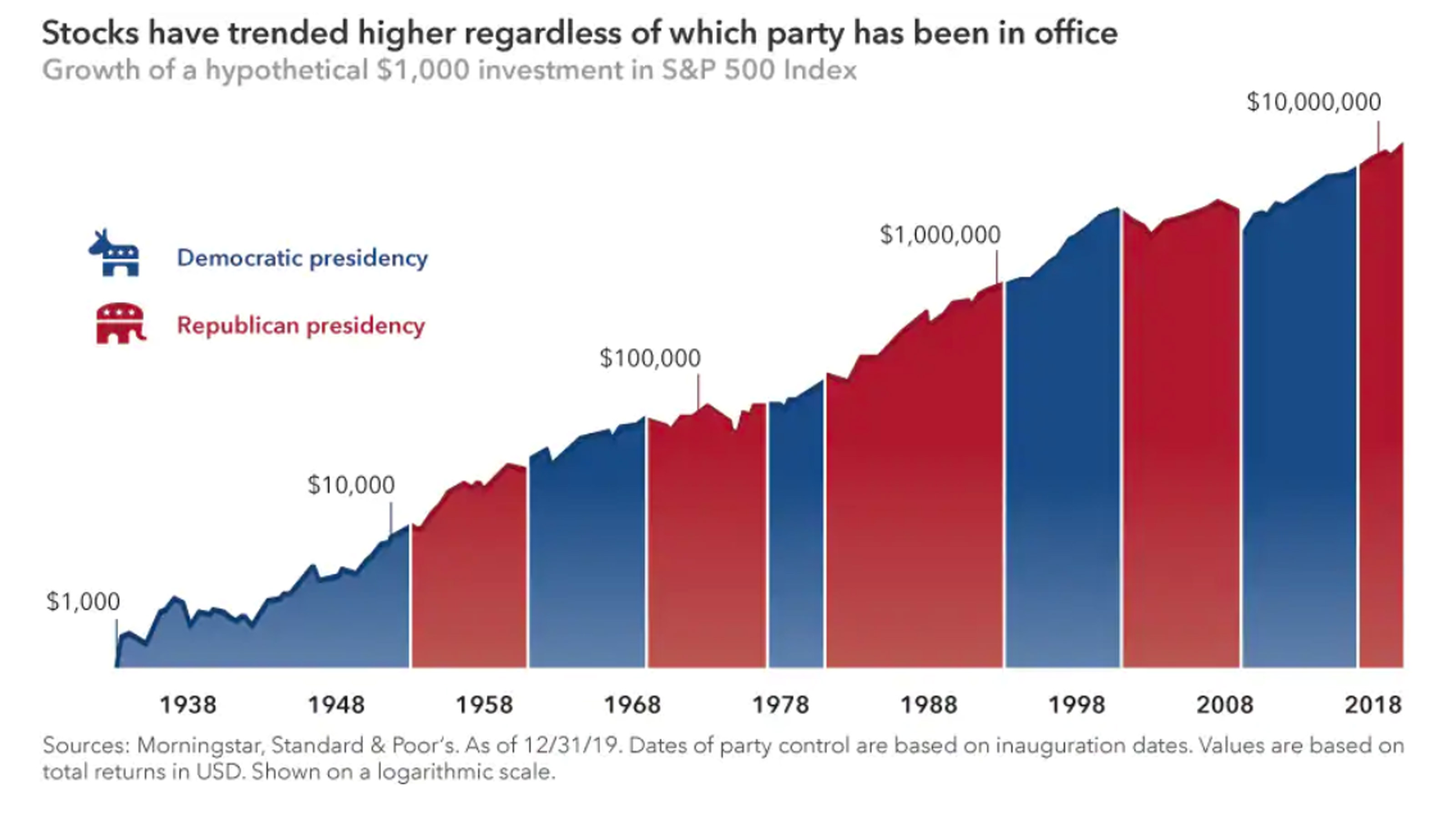

No matter who you believe to be the best fit, investors can create unneeded anxiety if they spend too much energy on the election results — and that can lead to irrational behaviors. In fact, historically speaking, elections have made very little impact over long-term investment returns. As Capital Group economist Darrell Spence says, “There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The graphic below shows that over the years, staying invested and avoiding the temptation to let emotions drive financial decisions has delivered the best overall outcome for investment portfolios. Keep in mind, past performance results are not indicative of future performance, thus, market consequences exist regardless of your favorite party or candidate to your overall performance and returns in the long run.

2. Don’t be surprised to see volatility increasing as we near the election: Expect it.

When volatility happens and it is your personal retirement account or your children’s college tuition fund at stake, it may be very difficult to sit and watch. Taking action may make you feel better during times of crisis, but in actuality sometimes the best advice is to do nothing.

Most people are not analyzing statistical algorithms and charts to determine what decisions they should make. In the real world, our emotions influence our decision-making process. We, as investors, should expect volatility in the markets, as it is a normal characteristic to long-term investing.

The critical takeaway is this: Stay the course. Expect to see rough patches, headlines and bad news — there will always be a flavor of the day when it comes to “financial noise.” Behavioral finance research shows that the average investor tends to buy high and sell low as a result of being pulled into the financial noise and making emotionally driven bad decisions. Capital Group created the graphic below “Cycle of investor emotions,” can you relate?

3. Do not be tempted to time the market during election season. It’s time in the market, not timing the market!

Peter Lynch, former fund manager with Fidelity Investments, is arguably one the most successful investors of all time. Peter is famously quoted as saying “Far more money has been lost by investors trying to anticipate corrections, than lost in the correction themselves.” Between 1977 and 1990, Lynch’s fund averaged an approximate 29% annual rate of return, which more than doubled the S&P 500 index, making it the best-performing fund in the world during that time.

Given this remarkable track record, you might be shocked to learned that the average investor in the fund actually lost money! What? How! The most obvious answer is that withdrawals from retail investor accounts increase during uncertain times, and as the markets recover most believe that it is a good time to start buying back those shares which were sold. In essence, average investors are selling low and buying high instead of just staying the course.

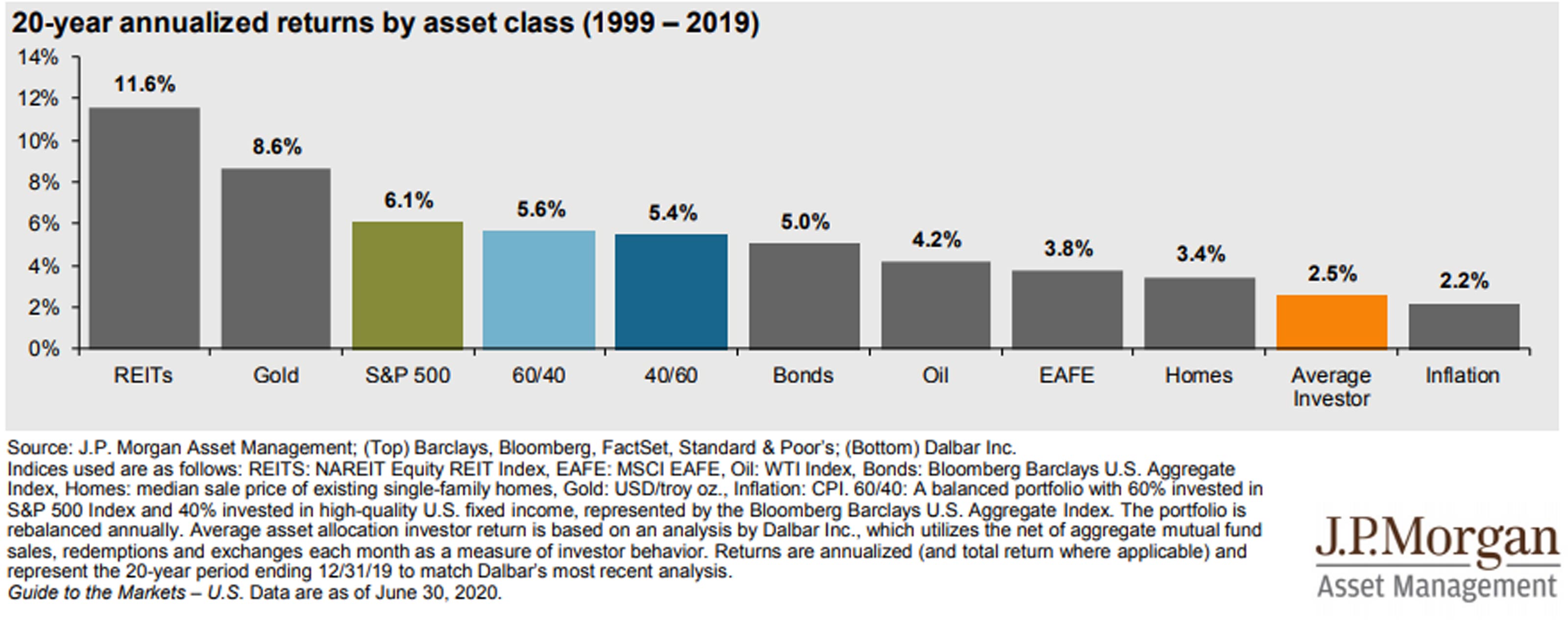

JP Morgan’s “Diversification and the average investor” chart below may beg the question of staying the course. As you can see, the average investor’s rate of return is barely beating inflation…

In closing, expect a sensational election season, along with volatility and the temptation to try to time the markets. We suggest you meet with your financial adviser to review your asset allocation, investment risks, and to specifically stress test your portfolio against your lifestyle goals and desires.

We welcome you to visit our website (www.mycgcapital.com) to start a conversation. Regardless of your investment strategy, remain grounded with clarity and confidence that this too shall pass.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dennis D. Coughlin, CFP, AIF, co-founded CG Capital with Christopher C. Giambrone in 1999. He has been in practice since 1996 and works with individuals nearing retirement and those whom have already retired. Proud of his humble upbringing, Dennis shares his advice with the same core principles that he was raised with. When not in the office, you will find him with his family enjoying the outdoors.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.