Entrepreneurs, 3 More To-Dos Before Year End 2021!

To keep your business sharp and on track into 2022, take a second to check off these three often-overlooked to-do items.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Adding another item to your to-do list before the end of the year may be the last thing that you want to think about, unless of course it is going to positively impact your wallet or your mind.

The last few years have been anything but normal, and based on that we have identified three to-dos for you to consider as we close in on 2022. If you are one of the lucky few who have already addressed each of these areas, congratulations, you are doing a great job, and all the best to you and your company for a strong close to 2021.

1. Review your business’s estimated quarterly income tax payments!

Contact your income tax professional to run a forecast of your year-end revenue and expenses. What is your estimated net income going to look like by Dec. 31, 2021, compared with 2020? Do you have a wide gap when comparing your estimated income tax payments against your estimated income taxes due?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

2020 was an outlier year — for some company’s revenues were down since then, but many other businesses saw their revenues increase. In the illustration below for “ABC Corp.,” you will see that ABC has had a large increase in net income for their business in 2021 vs. 2020. ABC has not adjusted their estimated quarterly income tax payments throughout the year — which could lead to a nasty tax surprise.

To-do #1: Contact your income tax professional to compare your estimated quarterly tax payments against your estimated income taxes due. Are you prepared?

2. Determine whether you are maximizing your retirement plan deductions.

Should you consider revising your retirement plan for your company? Prior to selecting a retirement plan, seek the guidance of a qualified professional, as each plan has its own requirements and protocol to follow.

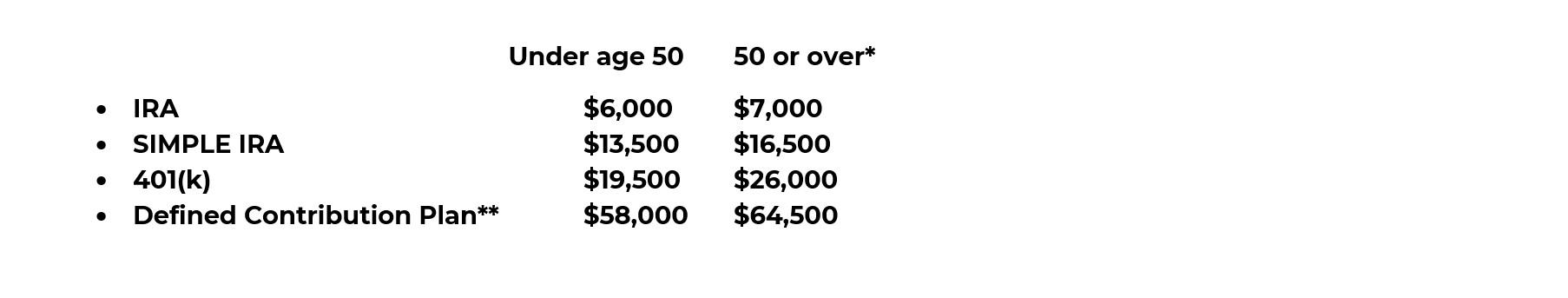

Key items, such as when you can make changes to your plans, plan limits, maximums and calendar year deadlines, all need to be taken into consideration prior to doing anything. Once you have completed your diligence, if you are looking for ways to offset net income with an income tax deduction, several retirement plans can be reviewed. Below, find the maximum contributions limits for 2021 on four common retirement plans, of course many others exist that may suit your needs:

*If you are 50 or older, you are allowed an additional retirement contribution that exceeds the statutory limit, known as the “catch-up” contribution.

** Includes profit sharing or money purchase pension plans.

To-do #2: Review your retirement plans. Are you contributing to the plan that is best for you and your company’s situation? Are you taking into consideration the maximum contribution limits in your planning?

3. Take time to reset and refocus.

Abraham Lincoln once said, “Give me six hours to chop a tree, and I will spend the first four sharpening the ax.” The past few years have been especially interesting, and our thinking has been stretched to accommodate the pandemic. The additional responsibilities, creative thinking and keeping our minds on business solutions have put strain on all of us.

Taking time to “sharpen your ax” will keep you fresh, on your game and solid with your decisions.

To-do #3: Perform a mental reset by asking yourself a few questions about your business:

- What did I learn from 2021? What worked? What didn’t?

- Is my vision “still” aligned with my priorities?

- What can I take from 2020 and 2021 to make 2022 my best year?

Although, to-dos are not typically something we get excited about, reconfirming the ideas above could save you time, money and reconfirm your focus and energy going into 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dennis D. Coughlin, CFP, AIF, co-founded CG Capital with Christopher C. Giambrone in 1999. He has been in practice since 1996 and works with individuals nearing retirement and those whom have already retired. Proud of his humble upbringing, Dennis shares his advice with the same core principles that he was raised with. When not in the office, you will find him with his family enjoying the outdoors.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.