How to Pay Your International Freelancers

Staying compliant while minimizing fees means planning ahead. Options include fintech solutions, PayPal, wire transfers and good old money orders.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Freelancers living abroad count on receiving payments on time, and it’s your job as a business owner to ensure that happens. If you consistently run into difficulties sending funds overseas, you run the risk of damaging your relationship with a key cog in your business, or even losing them outright.

Fortunately, a slew of modern payment solutions makes keeping current on your international invoices much easier and less expensive than in the past.

Staying compliant with reporting and record-keeping requirements also poses far fewer challenges now than in the days of money orders.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What Is an International Contractor?

Before deciding on a payment solution, you’ll need to confirm whether your contractors qualify as “international” for purposes of reporting to the IRS. If you work primarily with U.S. citizens living abroad, for example, you’ll need to request Form W-9 from your contractors, as well as pay close attention to hours billed and manner of oversight to avoid getting slapped with a fine for misclassification.

If your contractors perform their work outside the U.S. and aren’t U.S. citizens, you won’t need a Form W-9, but you should take the time to brush up on the local legal landscape. Clarify in advance what local regulations apply to your relationship with an independent contractor.

Why Hire an International Contractor?

When you have too much work for one person, but not enough for two, a contractor might be the best staffing solution. You won’t take on the expense of hiring a full-time employee, but you’ll still avoid the risk of overworking your team.

You might also find that you have a specific need that requires specialized knowledge, such as website construction, social media management or content design, but find the economics of hiring someone in the U.S. challenging. Thanks to sites such as Upwork and Fiverr, you have an entire world of freelancers at your fingertips, many of whom offer highly competitive rates.

How Do I Pay an International Contractor?

Ideally, your onboarding discussions with a new contractor will include a discussion of your respective payment preferences. For example, self-employed people and independent contractors working in Europe may prefer to be paid via bank transfer for accounting purposes, while freelancers in developing countries may prefer the security and traceability of an ACH wire. Other countries with more robust banking infrastructure or less restrictive regulations allow transfers via PayPal or other solutions, provided everyone keeps detailed records.

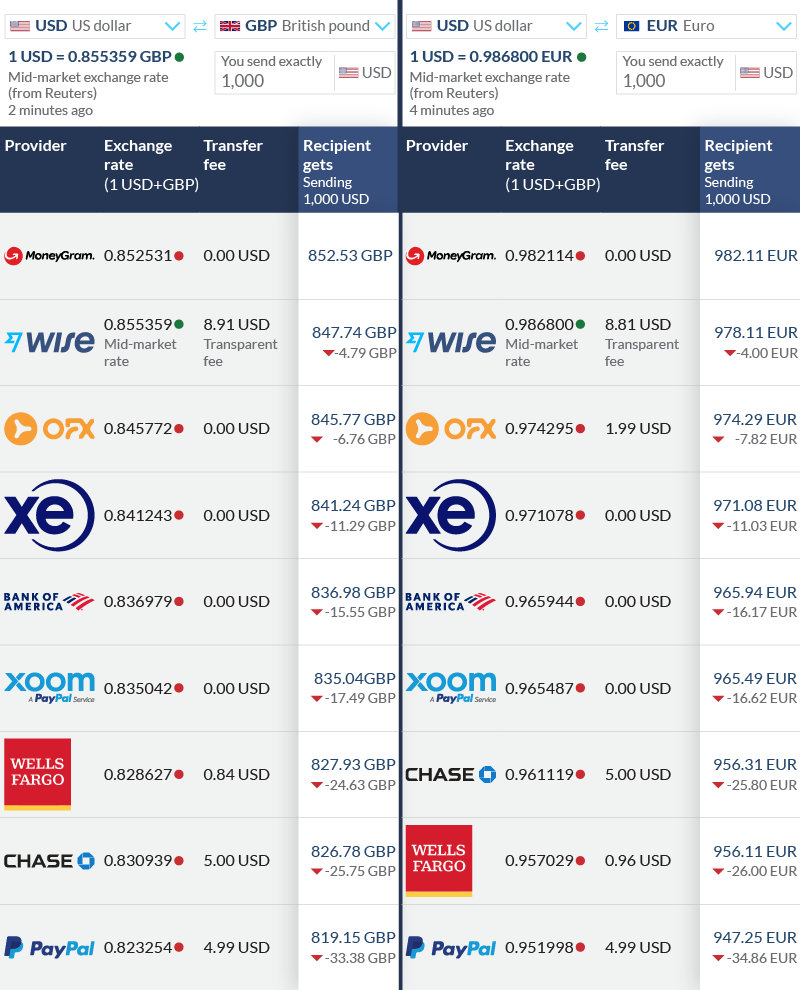

On Sept. 13, two cost simulations were done using payment methods for the two most exchanged currency pairs (U.S. dollar to euro and U.S. dollar to British pound) for international payments. In both scenarios, international payment providers such as MoneyGram, Wise, OFX and XE had significantly lower costs compared to the banks, while PayPal had the highest costs.

Image compiled using Wise.com payment-comparison aggregator.

Here is more detail on each of these payment types to help you decide which one is right for your business.

Wise for Business

Popular fintech company Wise allows Americans to open a business account capable of holding and receiving up to 50 different currencies. If your team of contractors spans the globe, Wise makes it easy for you to pay in local currency without additional fees. Wise also allows you to create and send multiple payments simultaneously using its batching tool, which can dramatically simplify your monthly accounting.

To open a Wise business account, you’ll need to submit documentation to verify that your business exists and confirm your identity. Once approved, you can begin sending payments immediately. Wise doesn’t charge a monthly fee to maintain your account, but you will pay a small commission on every transfer. Contractors need only provide their preferred bank account information to receive payments.

Wise by the numbers:

- Exchange rate: Actual exchange rate

- Transaction fees: From 0.41%

- Account maintenance fees: None

- Currencies supported: 50-plus

PayPal for Business

The original digital payment platform has evolved from a simple online wallet to a full-fledged business solution with several attractive features. Receive invoices directly from contractors and pay with a single click. Cash flow issues? PayPal allows you to add funds to your account or make payments via credit card. Hold and receive up to 26 different currencies.

Be aware, however, that PayPal charges a transaction fee of 4.5% for international transactions and uses the retail exchange rate if you’re paying in another currency.

To open a PayPal business account, you’ll need to share your Employer Identification Number or Social Security number, as well as provide proof of identity. Once you’ve linked a bank account or credit card, you’re ready to send payments. Your contractors must have their own PayPal accounts to receive payments through the platform.

PayPal by the numbers:

- Exchange rate: Markup of 4.0%

- Transaction fees: 2% of total transaction amount

- Account maintenance fees: None

- Currencies supported: 25

Wire Transfers

If your contractor lives in a country that frowns on digital payments for entrepreneurs, or your contractor prefers a more secure transfer method, traditional wire transfers might be an option. However, be sure to agree which party will shoulder any foreign exchange fees, which can be hefty. Unlike fintech solutions and digital wallets, banks will charge a significant markup to change currencies.

The good news? You’ll pay a single, standard fee for any transfer, no matter the size. That means no surprises or extra costs if you send large amounts. Then again, it can make sending smaller monthly payments more expensive.

To send a wire transfer, you’ll need your contractor’s bank account information, including the IBAN, SWIFT code and routing number. Contact your bank directly to confirm the fees associated with paying in multiple currencies.

Wire transfers by the numbers:

- Exchange rate: Varies, typically a markup of 4%

- Transaction fees: Vary, typically between $35 and $50

- Account maintenance fees: Vary

- Currencies supported: Any

Money Orders

Though more commonly used by individuals, businesses can also make use of money order services, such as Western Union or MoneyGram, to pay contractors living in countries where banks charge significant withdrawal fees. Low limits on the amount you can send – just $1,000 for a single order – might not make these the most practical option for larger projects. However, the lower transaction and exchange fees might make them worth the extra effort involved in purchasing and sending. On average, you’ll pay between $5 and $25 to send a money order, depending on the currency and the size of the order.

To pay an international contractor using money orders, you’ll need to locate a Western Union or MoneyGram agent. You can use your business credit or debit card to purchase an order in your desired amount, for which you’ll receive a receipt. To ensure your contractor receives prompt payment, be certain you fill out the order using their full legal name as printed on a valid form of government ID.

In the 10 years since I founded my online marketing business, I’ve worked with so many dedicated, talented contractors that I’ve lost count. While they might not show up in my official headcount, I take my obligations to them as seriously as my permanent employees.

Making sure they receive timely payments and never need to chase me for an invoice ensures that they know I value their contribution to my bottom line.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Justin’s work has appeared in major publications including Entrepreneur, Finance Magnates and Money Show. Justin has expertise in trading, personal finance and digital marketing. He holds a Commerce degree with honours and Master's in Marketing from Monash University. Justin is the CEO of the digital agency Innovate Online, which he founded 11 years ago. The agency provides direct marketing solutions to some of the largest globally listed companies, and he also assists with small-business start-ups. Previously, he worked for one of the largest advertising agencies with listed financial institutions as clients from ANZ bank to NIB health insurance. He also worked in the UK as marketing manager for a health and safety firm and before that at Federal Highway Administration (VicRoads) in the finance division. He also co-founded the finance website Compare Forex Brokers, which publishes reviews about brokerages to help traders reduce trading fees. Within the US, the site focuses on helping traders select a CFTC-regulated broker based on spreads and trading software features.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.