Some Self-Employed Taxpayers Get a Big Break Under New Law

The new tax law allows many self-employed workers to deduct up to 20% of qualified business income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you’re self-employed or have a side gig, you could qualify for one of the most generous provisions in the tax overhaul enacted by Congress late last year. But if you don’t already have an accountant or tax preparer, you might need one, because this tax break is also one of the most complex provisions in the Tax Cuts and Jobs Act.

The break could benefit millions of sole proprietors, small-business owners, freelancers and gig workers, who “pass through” their business profits (or losses) to Schedule C of their individual tax returns and pay individual tax rates. Starting this year, many of these taxpayers will be allowed to deduct up to 20% of their qualified business income—net income after they’ve claimed business deductions—before they calculate their tax bill. For example, if you’re self-employed and earn $100,000 in qualified business income this year, you could be eligible to deduct $20,000. If you’re in the 24% tax bracket, that would reduce your tax bill by $4,800.

You don’t have to itemize to claim this new tax break. The deduction won’t reduce your adjusted gross income, nor will it reduce your earnings for purposes of calculating taxes for Social Security and Medicare, says Nathan Rigney, a research analyst at H&R Block’s Tax Institute. (Unlike employees who work for someone else, self-employed workers must pay the full 15.3% of self-employment taxes, although they can deduct half of the amount from their AGI.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Congress made this change in an effort to create tax parity between small-business owners and big corporations. The Tax Cuts and Jobs Act cut the corporate tax rate from 35% to 21% but only reduced the top personal tax rate from 39.6% to 37%. Excluding 20% of qualifying income effectively cuts the top rate from 37% to 29.6%.

Proponents of the tax cut say it will encourage self-employed people and small-business owners to invest in their businesses, thus contributing to economic growth. So far, though, that’s not happening. A survey by the National Association for the Self-Employed conducted before the tax deadline of April 17 found that 83% of its members don’t understand how the tax law will affect their business.

Who gets the deduction. The confusion is understandable because this tax break comes with more caveats than a TV ad for a prescription drug. Several factors could disqualify you for all or part of the pass-through deduction, including the amount of your business income, other sources of income and the nature of your business.

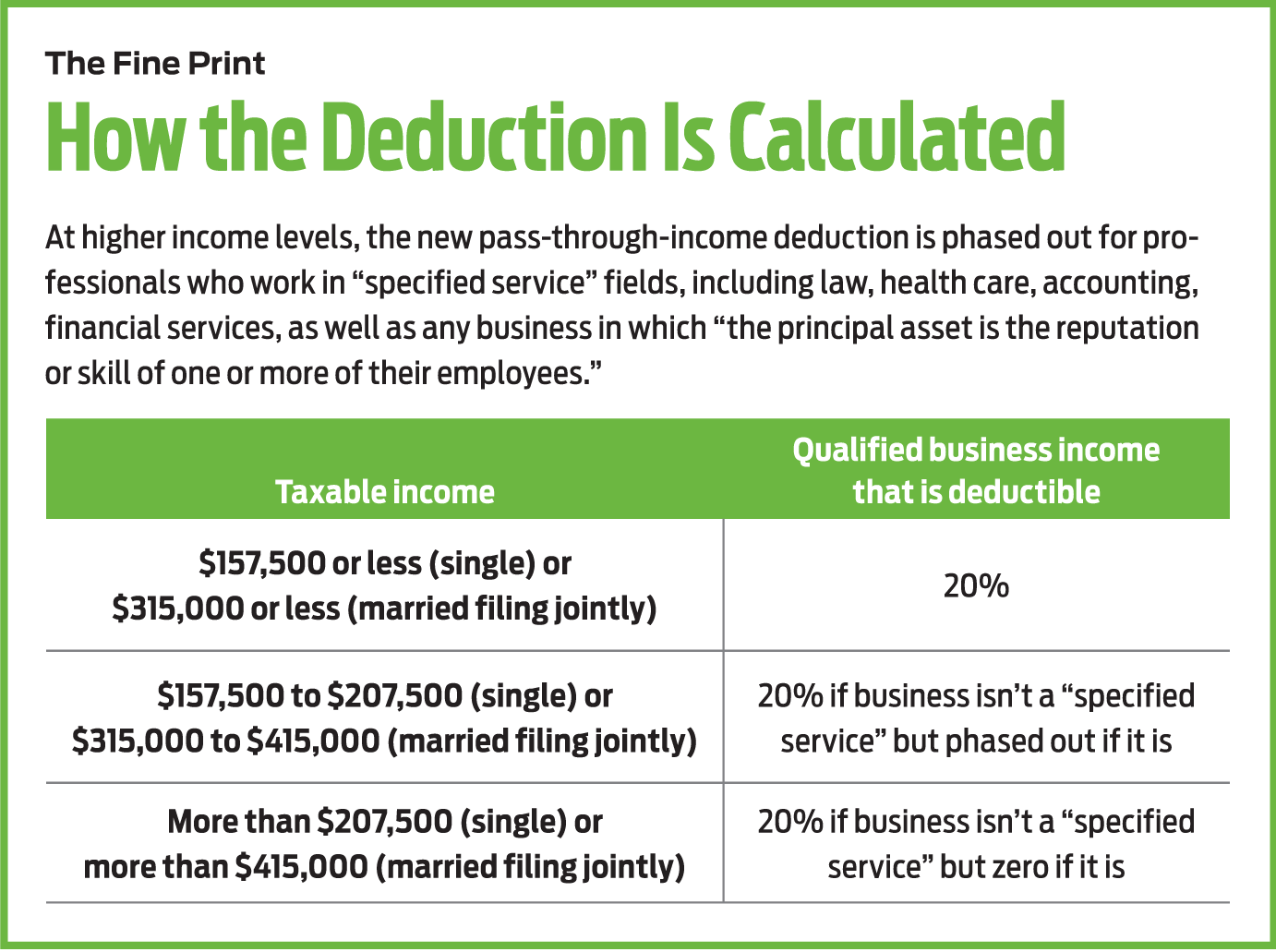

Let’s start with the income thresholds. If your total taxable income—which includes interest and dividends, as well as income reported on Form W-2, if you also have a regular job—is less than $157,500 on an individual return or $315,000 on a joint return, you’re a winner. You can deduct 20% of your qualified business income no matter what type of business you’re in. Keep in mind that the 20% deduction is limited to income from your business. For example, if a married couple who file jointly have taxable income of $150,000, and $75,000 is qualified business income, they can deduct 20% of $75,000, or $15,000.

At higher income levels, the calculation gets more complicated. In an effort to prevent affluent doctors, lawyers and, say, hedge fund managers from gaming the system, Congress created a higher standard for professionals who provide personal services. For these business owners, the deduction phases out once total taxable income exceeds $157,500, or $315,000 for married couples, and disappears once taxable income tops $207,500 for singles and $415,000 for couples.

The tax law says the higher threshold applies to professionals who work in “specified service” fields, including law, health care, accounting, performing arts, consulting, athletics and financial services, as well as any business in which “the principal asset is the reputation or skill of one or more of their employees.” (Business owners who don’t fall into the “specified services” category can take the full deduction, no matter how much taxable income they report.) That’s open to a lot of interpretation, and tax professionals are awaiting guidance from the IRS on what constitutes a “specified service.”

Ted Ma of Point Richmond, Calif., recently started his own business as a motivational speaker for corporate clients. He also works as an independent contractor for a company that sells subscription-based legal services. Ma believes his speaking business falls into the “specified service” category, but his sales job could be exempt. He’s not sure, though, and his accountant isn’t, either. Ma says he’d like to invest more in advertising and “building his brand,” but he’s reluctant to spend the money until he has a better handle on how the new tax break will affect his bottom line.

Evan Antonini, whose New York-based business provides bookkeeping and financial-management services to companies, believes she falls into the “specified service” category, but she says her taxable income (she files jointly with her husband) is low enough to qualify her for the full 20% deduction on her business income. Still, “one big contract could throw that out the window,” she says.

Lower your income. Amid this uncertainty, there are steps you can take that will increase your eligibility for the tax break. If you’re close to the cut-off, contributing to a tax-deferred retirement plan will reduce your taxable income. Self-employed people can contribute up to 20% of their net income to a SEP IRA, up to $55,000 in 2018. Another tax-saving option is a solo 401(k)—also known as an individual 401(k)—which is a retirement plan designed for self-employed people who have no employees other than a spouse. In 2018, you can contribute up to $55,000, or $61,000 if you’re 50 or older.

The tax law nearly doubled the standard deduction, but if you have a lot of deductible expenses, you may still end up itemizing. In that case, increasing your charitable contributions could also lower your taxable income below the thresholds, says Trevor McCandless, CEO of Fusion CPA, an Atlanta-based accounting firm that advises small businesses and entrepreneurs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Nvidia Earnings: Live Updates and Commentary February 2026

Nvidia Earnings: Live Updates and Commentary February 2026Nvidia's earnings event is just days away and Wall Street's attention is zeroed in on the AI bellwether's fourth-quarter results.

-

I Thought My Retirement Was Set — Until I Answered These 3 Questions

I Thought My Retirement Was Set — Until I Answered These 3 QuestionsI'm a retirement writer. Three deceptively simple questions helped me focus my retirement and life priorities.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By Much

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By MuchFood Prices Arkansas and Illinois are the most recent states to repeal sales tax on groceries. Will it really help shoppers with their food bills?

-

New Bill Would Eliminate Taxes on Restored Social Security Benefits

New Bill Would Eliminate Taxes on Restored Social Security BenefitsSocial Security Taxes on Social Security benefits are stirring debate again, as recent changes could affect how some retirees file their returns this tax season.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Tax Season 2026 Is Here: 8 Big Changes to Know Before You File

Tax Season 2026 Is Here: 8 Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.

-

3 Major Changes to the 2026 Charitable Deduction

3 Major Changes to the 2026 Charitable DeductionTax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?