What the New Tax Overhaul Means for You

Here are some important changes that it could pay to anticipate.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Over the past several weeks as the House and Senate tax overhaul bills worked their way through Congress — the final version passed on Wednesday, Dec. 20, 2017 — I've heard from several clients with questions about how they might be affected. Here's what I tell them: Overall, this tax package is helpful, not detrimental, to American families. Although wealthy individuals and entrepreneurs stand to benefit the most from it, the average household still gets a tax cut of approximately $1,600 in 2018. Here are some important changes you should anticipate.

Standard vs. Itemized Deduction

The standard deduction will jump from $12,700 now to $24,000 in 2018 for married couples filing jointly, and rise from $6,350 now to $12,000 in 2018 for single filers. The deduction for state, local and property taxes will be capped at $10,000 annually starting in 2018. The mortgage interest deduction on primary and secondary residences will be reduced, applying to loans under $750,000 rather than $1 million. The medical expense deduction will temporarily kick in at a lower point, becoming deductible to the extent expenses exceed 7.5% of income, rather than 10% of income as it is now.

What this means to you: There’s a good chance you may no longer want to itemize. Taxpayers who historically itemized deductions on Schedule A may find it more advantageous to take the higher standard deduction in 2018. For example, assume you are a married couple, and your state, local and property tax deduction in 2017 is $15,000. Other itemized deductions total $5,000. You’d itemize deductions in 2017, reducing your income by $20,000. In 2018, there is a cap on state and local taxes in addition to the higher standard deduction. You are better off taking the $24,000 standard deduction rather than claiming $15,000 of itemized deductions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Personal Exemption & Child Tax Credit

The current personal exemption of $4,050 per person will be eliminated in 2018. Although families have long relied on personal exemptions to reduce their taxable incomes, this move isn’t terrible for working families with dependent children. That’s because the child tax credit will be enhanced. It currently starts at $1,000 per child and is phased out for married couples earning over $110,000. Going forward, the credit doubles to $2,000 ($1,400 of which is a refundable tax credit), and income phase-outs apply to married couples earning over $400,000. This distinction between refundable and non-refundable tax credits is important. Non-refundable tax credits cannot reduce your tax liability beyond zero, while refundable tax credits can give you an additional refund — even if your tax liability was zero before the credit.

New rules also include a $500 non-refundable tax credit for dependents who don’t qualify for the child tax credit (i.e., dependents over age 17, whether a college-aged child or a dependent parent). This $500 credit follows the same income limitations as the enhanced child tax credit.

What this means to you: If you are a married couple earning less than $400,000 with two children under age 17, expect a $4,000 tax credit that will directly reduce your tax liability. If you don’t have any dependents, you won’t benefit from this enhanced child tax credit but may still appreciate the higher standard deduction and lower tax rate.

Tax Rates

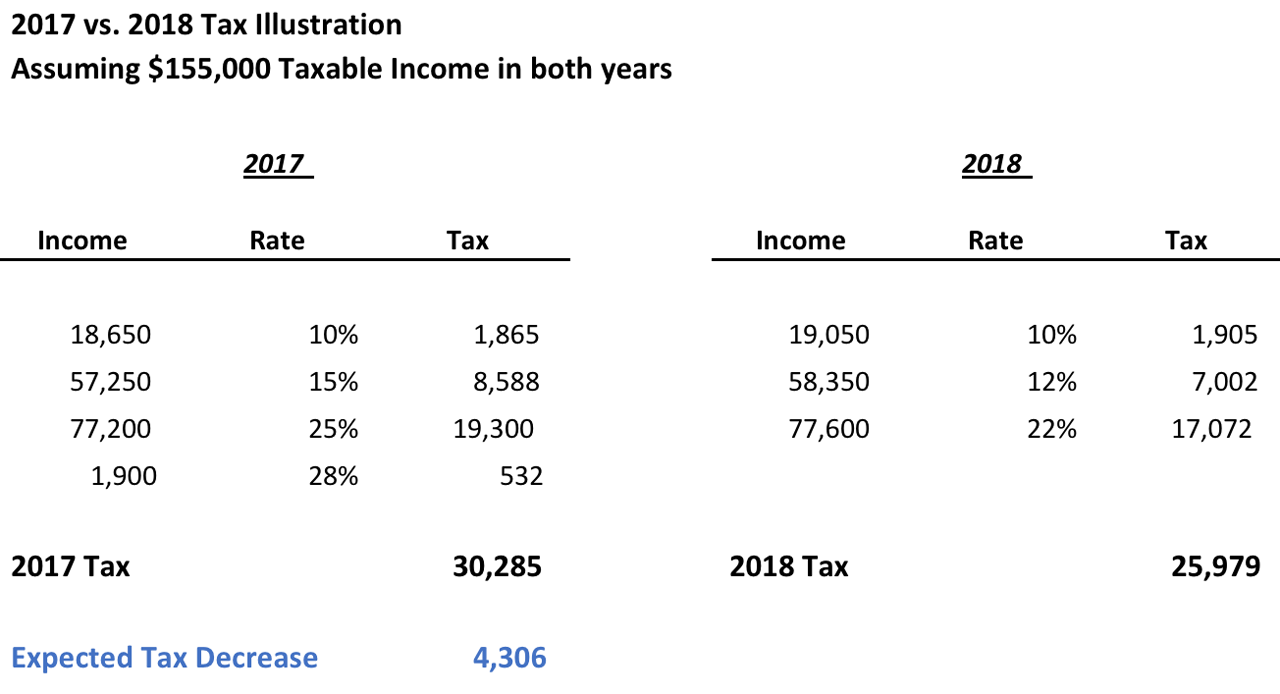

President Trump originally intended to reduce the number of individual tax brackets and simplify the tax code. Although the number of brackets remains unchanged at seven, the top tax rate falls slightly to 37% (down from 39.6%) and most tax brackets are generally more favorable. In 2017, the tax brackets are: 10%, 15%, 25%, 28%, 33%, 35% and 39.6%. The new rates are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Let’s suppose you’re a married couple with taxable income of $155,000. Your 2017 expected tax is $30,285, and you’re in the 28% bracket. If you have that same level of taxable income in 2018, your tax bracket decreases to 22% and your expected tax would be $25,979, a decline of over $4,300. Details for this calculation are provided in the example below.

What this means to you: It’s more likely than not that your tax rate will go down (at least a little) in 2018, particularly if you’re a married couple filing jointly. On the other hand, individual taxpayers with taxable incomes between $157,500 and $416,700 may be harmed by the new tax rates.

Preserves Popular Tax Breaks

Earlier versions of the bill considered repealing small tax breaks centered around student loan interest, teachers’ supplies (up to $250 is deductible), and medical expenses. Luckily, the final bill retains these popular deductions.

What this means for you: While every little bit helps, these tax breaks are minimal and only impact a select few. High earners with large amounts of student loan debt often phase-out of the $2,500 student loan interest deduction anyway.

Coverdell ESAs

Coverdell Education Savings Accounts (ESAs) are a tool currently used by some families to save for private elementary and high school expenses. The new tax law allows families to save for private school AND college expenses in a single, tax-advantaged account — a 529 plan. Historically, college expenses were the only “qualified” withdrawals of 529 plans. (FYI: Home-schooling expenses were included in the bill at one point, but last-minute wrangling in the Senate caused it to be stripped from the final version.)

What this means to you: Parents paying for their children’s education expenses should consider funding a 529 saving plan. Beginning in 2018, you can withdraw up to $10,000 annually per student from the 529 plan for private elementary or high school expenses. Qualified withdrawals for higher-education expenses at the college or university level will not be capped; rather, they correlate to the actual expenses incurred.

Affordable Care Act

The penalty is now waived for families that do not have health insurance.

What this means to you: Healthy people who were previously forced under the Affordable Care Act to have coverage may drop it. That could mean premiums are likely to rise for families still seeking coverage on individual exchanges.

Corporations

Now that we’ve discussed the implications of tax reform on individuals, let’s shift gears. The maximum corporate tax rate will be slashed from 35% down to 21%, favoring companies classified as C Corporations. This tax cut will be permanent (unlike the tax cut that individual taxpayers are receiving, which would end in 2025). In addition, large, multinational corporations often accumulate wealth overseas through tax haven subsidiaries, such as Ireland and the Netherlands. Tax legislation aims to entice these companies to bring that income back to the U.S. through lower rates, ranging from 8% to 15.5%.

What this means for you: It seems the original intent of this tax overhaul was to help American families. Lower corporate taxes would help companies’ bottom lines and could spur economic development through job creation. Yet it is unclear if this will truly happen. Large corporations with already strong balance sheets could use the tax savings for hiring OR simply return more cash to their investors through bigger dividends.

Pass-Through Entities

Like corporations, owners of pass-through entities, such as Limited Liability Companies (LLCs), S Corporations and partnerships, will benefit as well. There will be a 20% deduction to these owners who are required to report business income on personal tax returns. One exception is this: taxable income of service providers must be below $157,500 for single filers and $315,000 for married couples to take full advantage of the deduction.

What this means for you: If you are considering entrepreneurship, this may be the perfect time to get started. But do your homework first. Pamela Slim’s Escape from Cubicle Nation offers both practical advice and emotional encouragement to would-be entrepreneurs. Michael Gerber’s book, The E-Myth Revisited, is one of the five top-selling business books of all time.

Favoring the Rich?

Although these changes on the surface are helpful to every American, there are plenty of skeptics. Many middle-class families feel that these changes disproportionately favor the rich. And they’re right, to an extent.

- First, the individual tax cuts expire in 2025. Corporate tax cuts remain permanent, and corporations are not required, only encouraged, to stimulate the economy through job creation.

- Second, the estate tax exemption doubles to $11.2 million for individuals. Only 0.2% of estates are currently subject to estate tax, even at today’s levels. This provision means even fewer wealthy families will be required to pay an estate tax when a loved one passes away.

- Finally, a last-minute change to the bill helps affluent real estate investors with taxable income over $157,500 still benefit from the pass-through deduction through a special calculation.

Proactive Steps Now

Whether you are happy with the final version of the tax law or not, there are proactive steps you should consider before year’s end.

- Accelerate deductions, particularly if you’re a business owner. You will likely pay lower taxes in 2018 than 2017 on the same level of income. Work diligently to take as many deductions as possible in 2017, including personal charitable contributions. Consider maxing out your retirement contribution if you haven’t already.

- Defer income. If your employer is paying a year-end bonus to you, request that they wait and pay it in January 2018, when you’ll likely have a lower tax rate. On the other extreme, small-business owners on a cash basis method of accounting should postpone December 2017 billings to January if possible.

- Prepay property taxes, especially if you’re in a high-income tax state. There are two exceptions, though. First, find out if you’re subject to Alternative Minimum Tax, or AMT. The property tax deduction is allowed for regular tax purposes but not for AMT. Second, not every state will allow you to prepay 2018 property taxes. Please note that you will not benefit from prepaying state or local income tax in December 2017 for the 2018 tax year.

This list isn’t exhaustive. If you have a trusted tax adviser, ask him or her about the impact of these changes on your specific situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Deborah L. Meyer, CFP®, CPA/PFS, CEPA and AFCPE® Member, is the award-winning author of Redefining Family Wealth: A Parent’s Guide to Purposeful Living. Deb is the CEO of WorthyNest®, a fee-only, fiduciary wealth management firm that helps Christian parents and Christian entrepreneurs across the U.S. integrate faith and family into financial decision-making. She also provides accounting, exit planning and tax strategies to family-owned businesses through SV CPA Services.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.