How the Rich Can Save $100,000 Tax-Free for Retirement Every Year

Pensions are dead, right? Not if you are self-employed with cash to sock away.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Let me start by saying that I love the 401(k) plan. It’s the single best wealth accumulation vehicle available to the vast majority of Americans. At today’s contribution limits, you can defer up to $18,000 of income — and $24,000 if you’re 50 or older — tax free. And many companies offer corporate matches dollar for dollar (most companies match the first 20-60% you save.)

That’s great for middle-class Americans, and many can contribute the maximum allowed with a little bit of discipline. But if you have an annual income of $500,000 or more, that amounts to a paltry savings rate of less than 4%. Any savings above that amount would be subject to punishingly high taxes…and even the dreaded Obamacare surcharge.

Well, I have good news. If you earn a high income and own your own business (or are paid as a 1099 contractor), you have vastly superior savings options at your disposal. If done right, you can save well over $100,000 per year in tax-sheltered accounts.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This strategy is designed for the self-employed, but it can also work if you get a paycheck but also earn additional income from a side business or additional contract income. A lot of doctors and consultants would fall under this umbrella.

We all know that the traditional defined-benefit pension is dead. The days when your employer guaranteed you an income for life are now something we read about mostly in history books.

Well, that might be true for corporate plans. But there is nothing stopping you from starting your pension for yourself and your spouse.

The One-Man Pension

The best retirement savings strategy is actually a combination of two separate vehicles:

1. An Individual 401(k) plan, which consists of regular salary deferral and additional profit sharing based on your company’s profit for the year.

2. A cash-balance, defined-benefit pension plan.

I’ll tackle the Individual (“Solo”) 401(k) plan first. Most investors consider a Solo 401(k) plan to be more or less interchangeable with a SEP IRA.

They’re wrong.

While both plans max out at $53,000 per year in contributions, the Solo 401(k) allows for front loading. Let’s look at an example. Let’s say your business earns $100,000 in net income. With a SEP IRA, you can contribute 20%, or $20,000, tax deferred. This is a profit-sharing contribution made on your behalf by your employer…which happens to be you.

With the Solo 401(k), you can make that same profit-sharing contribution of $20,000. But you can also defer $18,000 of salary, for a total of $38,000.

Of course, we’re talking about high-income earners, and both the Solo 401(k) and the SEP IRA max out at $53,000 on incomes of $265,000.

So, if you earn $265,000 or more, the SEP IRA and Solo 401(k) are interchangeable, right?

Wrong!

If you save via a Solo 401(k), you are also eligible to contribute to a defined-benefit plan. If you save via a SEP IRA, you cannot.

This brings me to the second prong of the retirement plan, the single-person defined-benefit plan.

Yes, you can actually make a traditional pension plan…for yourself. There are administrative fees involved, and you’ll want to hire a professional to draft the plan documents and monitor compliance. But doing all of this opens the door to massively increasing your retirement savings if you can afford it.

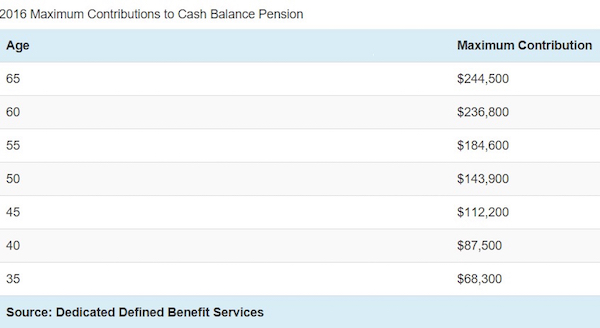

Annual contribution levels here depend on your age and other actuarial assumptions, but the chart below shows how they shake out. The contribution limits depend on two main variables: age and income. That’s very different from IRAs/401(k)s, so it takes some getting used to. These are sometimes (though not always -- see a list of exceptions here) insured by the Pension Benefit Guaranty Corporation.

Putting It All Together

Combining the Solo 401(k) with the cash-balance, defined-benefit plan is complicated, so I can’t stress enough the importance of hiring a knowledgeable pro to set it up correctly. But here are the basics.

Normally, you can contribute $18,000 in salary deferral and 20% of profits to a Solo 401(k) plan, up to a maximum of $53,000. But if you also contribute to a cash-balance pension plan, your profit-sharing percentage gets bumped from 20% to 6%. That effectively drops your $53,000 contribution to $33,900 if you’re under 50 and $39,900 if you’re 50 or older.

But here’s where it gets fun. If you’re 65 years old, your combined contribution to the Solo 401(k) and cash-balance pension is a whopping $284,400 ($244,500 cash balance + $39,900 401(k) plan). The numbers get smaller the younger you are, but at age 35 you can still contribute a not-too-shabby $102,200. (Breaking out the math, this is $18,000 in salary deferral, $15,900 in salary deferral at the maximum 6% rate, and $68,300 in defined-benefit contributions.)

Is There a Downside?

So, stashing away hundreds of thousands of dollars per year sounds pretty great, right? What’s the catch?

Believe it or not, there really isn’t one, assuming you earn a high enough income. This isn’t for everyone. You have to own your own business (or earn significant contract income), and you need to have a high income for this to make sense. If the business has any employees, contributions must also be made for them, which can be very expensive. And there are other costs. Expect to pay $2,000 to $3,000 in administrative expenses. But if you fall under this umbrella -- and if you’re eager to shield some of your savings from the tax man -- this is the best combination I’ve seen.

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal, and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.

-

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash Flow

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash FlowDividing funds into a safety bucket, an income bucket and a growth bucket can help to cover immediate expenses, manage cash flow and promote growth.

-

Your Most Overlooked Retirement Investment: Luxuriating in Doing Nothing

Your Most Overlooked Retirement Investment: Luxuriating in Doing NothingWhen you take the time to rest and breathe, your brain starts to focus on what matters most in your new stage of life.