Aiming for 6 Retirement Goals with Just 3 Simple Buckets

You've saved hard for retirement, and to help that money last, think about pouring it into three buckets, each with a very different purpose.

When it comes to preparing for retirement, people tend to look at the assets in their portfolio as pieces of a puzzle.

However, they don’t necessarily have a plan for how to put those pieces together; in other words, how best to use their various investments or income sources. They often just buy what they like, do what they’re told, accept what they’re given and hope for the best.

From my years working with retirees and pre-retirees, I find that there are typically six things people want their money to do for them during retirement:

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- Supply income

- Access growth

- Provide liquidity

- Avoid paying unnecessary taxes

- Offer safety

- Create a legacy

When I meet with clients and prospective clients, our first step is always to identify and rank these priorities. That way we can build a plan around their specific needs and goals. To accomplish that, we often talk about thinking in terms of three “buckets of money” — with each bucket providing for a different need in retirement:

- Income

- Growth

- Legacy

Using this three-bucket approach can help put you in a better position to make specific investment choices and changes to ensure you have the retirement you have worked all your life to achieve.

The Income Bucket

This bucket can be the most important of the three. It’s the bucket that’s going to pay your bills, so it’s imperative to have a solid accounting of all your income sources — Social Security, maybe a pension, your savings and investments — and to know when you expect to tap into each one. It’s also important to consider how secure these sources are and if they will provide the income your family will need throughout your retirement years.

Those who still have pensions may find their defined-benefit plans aren’t perfect, for example. Many private plans don’t have inflation adjustments, so an amount that looks good today may not look so good 20 years into retirement. And benefits don’t always extend beyond an employee’s lifetime or, in some cases, a spouse's lifetime. That means heirs won’t be able to count on that money unless it’s rerouted to something they can inherit.

Social Security plays an integral role in your retirement and lifestyle. Although Social Security offers cost-of-living adjustments (COLA), they aren’t guaranteed to happen every year. When one spouse dies, the lower of the couple’s two checks goes away. And because your Social Security benefits aren’t part of your estate, they don’t pass on to your children automatically as part of their inheritance (unless they qualify for survivors benefits).

There’s also the chance that Social Security benefits could be reduced in the future. As soon as next year, Social Security’s yearly expenses could exceed its revenue, forcing the program to begin drawing down its trust funds. The projected impact could mean only 80% of promised benefits would actually be paid beginning in 2035, according to the 2019 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds.

The uncertainty of those two income sources — or concerns about a shortfall in what you’ll have in guaranteed income vs. what you’ll need — might mean it’s time to look at annuities as a possible income stream, something that is secure and can provide guaranteed, lifetime income for you and your spouse.

I know there are various opinions about annuities, and I’m not saying they are right for everyone, but when it comes to providing secure, guaranteed income, annuities can be a vital part of your income bucket. I believe in fixed and fixed indexed annuities because of their growth potential and the various ways they can offer lifetime income. Like other investments, most annuities can be passed down to your loved ones/heirs. (Be sure you understand tax and other consequences, when you’re doing your estate planning.)

The Growth Bucket

This bucket focuses on helping your overall retirement assets outpace inflation for the long haul and can help you deal with longevity risk — the scary possibility that you or your spouse could run out of money in the future just because you lived too long.

How much should you put toward growth? One of the basic principles of retirement investing is to gradually reduce risk as you get older, and a common rule of thumb, the “Rule of 100,” can help with that. The Rule of 100 states that investors should hold onto a percentage of stocks equal to 100 minus their age. So, a 60-year-old might have a portfolio with 40% in equities, while the rest of her assets would be placed in safer financial vehicles. A 70-year-old would transition to something closer to 30% in equities, and so on. In retirement, those riskier investments would be in your growth bucket.

Of course, every investor should adjust those numbers to fit their needs and risk tolerance. For some of the families we work with that can mean putting more assets in their growth bucket where we manage their assets in a diversified portfolio that can include stocks, bonds, mutual funds, and other investments. For others who are more risk adverse, we recommend a higher percentage in the income bucket. I use assets under management through different third-party managers (without adding to an investor’s fees).

The Legacy Bucket

This bucket includes the investments and strategies that could help you leave money to your heirs. That typically means purchasing life insurance, but not necessarily for the traditional reasons.

Most people think about buying life insurance to provide for their family in case they suffer an early death. But life insurance can also be used to turn highly taxed assets (including withdrawals from tax-deferred retirement accounts, which are treated as ordinary income) into assets that won’t be taxed. Life insurance lets policyholders save tax-free; it allows their heirs to access their death benefit tax-free; and now that new hybrid products include a long-term care component, it can help retirees cover future health care costs, if need be.

For those clients where life insurance isn’t a great fit; whether they don’t qualify for it or some other reason, we look at other tax-efficient strategies for wealth transfer. This can include Roth conversion strategies and other tax-efficient options.

Many people put a priority on accumulating money — or making their “number” — in the years leading up to retirement. But few seem to put as much effort into how they’ll preserve and distribute that money for decades to come, or how they’ll pass it on to their loved ones later.

Turning all the pieces of this puzzle you’ve collected over the years into the retirement picture you’ve long envisioned takes careful planning. Don’t delay — and don’t hesitate to ask for help from a financial professional who specializes in retirement.

Kim Franke-Folstad contributed to this article.

Investing involves risk, including the potential loss of principal. Any references to protection benefits, safety, security, and lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Journey Wealth Management is not affiliated with the U.S. government or any governmental agency.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Roy Gagaza is president and CEO of Journey Wealth Management LLC (journeywlthmanagement.com/). He has 21 years of experience in the financial services industry, served as an officer in the military for 20 years and has a bachelor's degree from San Jose State University.

-

Callable CDs Have High Rates. We Still Don't Recommend You Get Them

Callable CDs Have High Rates. We Still Don't Recommend You Get ThemInvestors must carefully consider the trade-offs, as falling interest rates could lead to reinvestment at a lower yield and make selling on the secondary market difficult.

-

High Mortgage Rates Are Holding My Retirement Hostage: Can I Still Downsize and Retire?

High Mortgage Rates Are Holding My Retirement Hostage: Can I Still Downsize and Retire?We ask retirement wealth advisers what to do.

-

Five Big Beautiful Bill Changes and How Wealthy Retirees Can Benefit

Five Big Beautiful Bill Changes and How Wealthy Retirees Can BenefitHere's how wealthy retirees can plan for the changes in the new tax legislation, including what it means for tax rates, the SALT cap, charitable giving, estate taxes and other deductions and credits.

-

Portfolio Manager Busts Five Myths About International Investing

Portfolio Manager Busts Five Myths About International InvestingThese common misconceptions lead many investors to overlook international markets, but embracing global diversification can enhance portfolio resilience and unlock long-term growth.

-

I'm a Financial Planner: Here Are Five Smart Moves for DIY Investors

I'm a Financial Planner: Here Are Five Smart Moves for DIY InvestorsYou'll go further as a DIY investor with a solid game plan. Here are five tips to help you put together a strategy you can rely on over the years to come.

-

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the Summer

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the SummerWorn, underinflated tires and other degraded car parts can fail in extreme heat, causing accidents. If your employer is ignoring needed repairs on company cars, there's something employees can do.

-

'Drivers License': A Wealth Strategist Helps Gen Z Hit the Road

'Drivers License': A Wealth Strategist Helps Gen Z Hit the RoadFrom student loan debt to a changing job market, this generation has some potholes to navigate. But with those challenges come opportunities.

-

Financial Pros Provide a Beginner's Guide to Building Wealth in 10 Years

Financial Pros Provide a Beginner's Guide to Building Wealth in 10 YearsBuilding wealth over 10 years requires understanding your current financial situation, budgeting effectively, eliminating high-interest debt and increasing both your income and financial literacy.

-

Five Mistakes to Avoid in Your First Year of Retirement

Five Mistakes to Avoid in Your First Year of RetirementRetirement brings the freedom to choose how to spend your money and time. But choices made in the initial rush of excitement could create problems in the future.

-

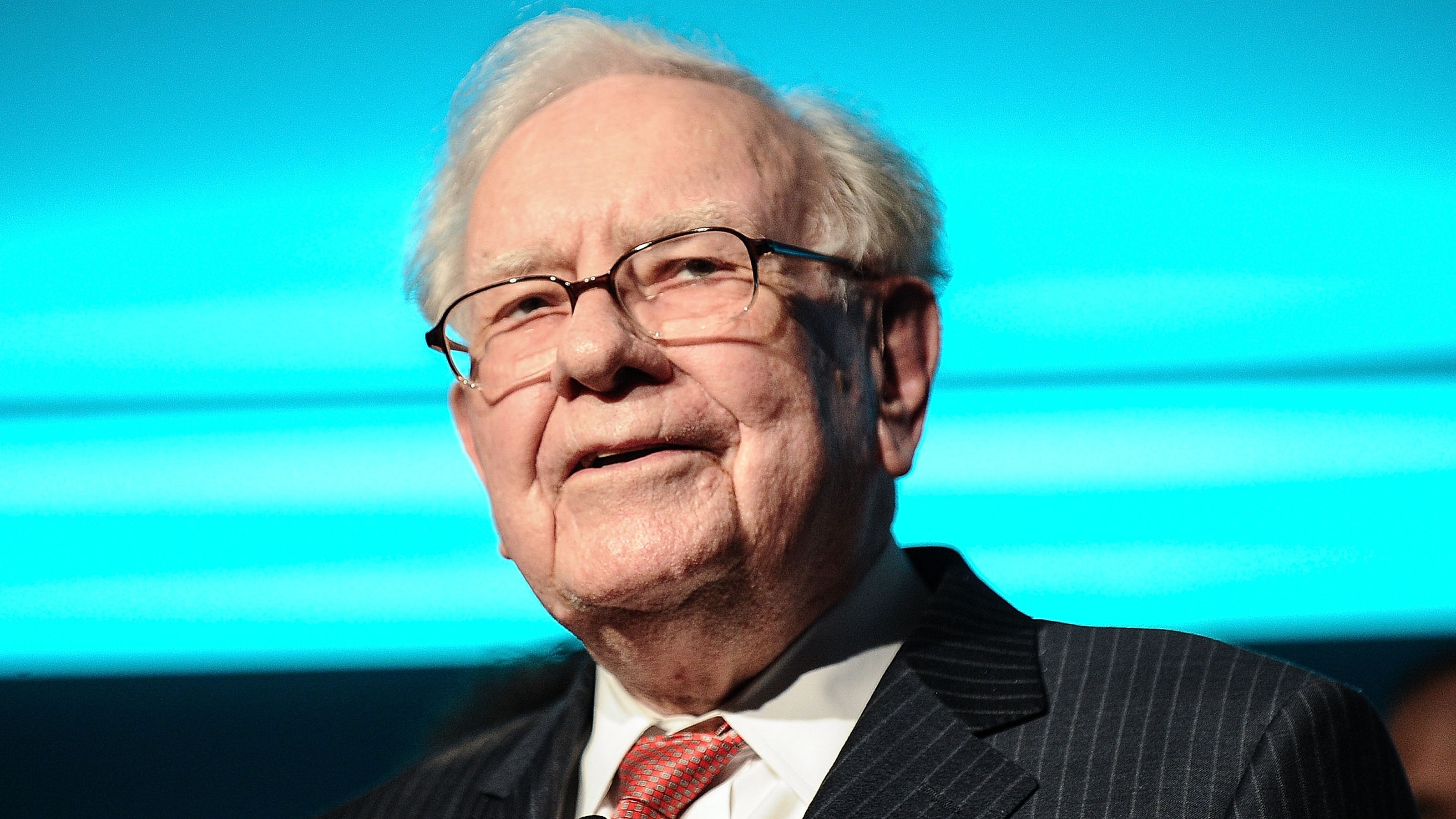

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.