Guide to Medicare Open Enrollment for 2018

Shopping for a new Medicare Part D or Medicare Advantage plan for 2018 could save you money.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Ah, the rituals of fall: The leaves change color. The temperature drops. Sweaters and boots pop out of the closet. And Medicare opens the doors for beneficiaries to shop for Part D and Advantage plans. As you cozy up to the first fire of the season, now is the time to peruse your options to see if you can find a better deal than your current Medicare coverage.

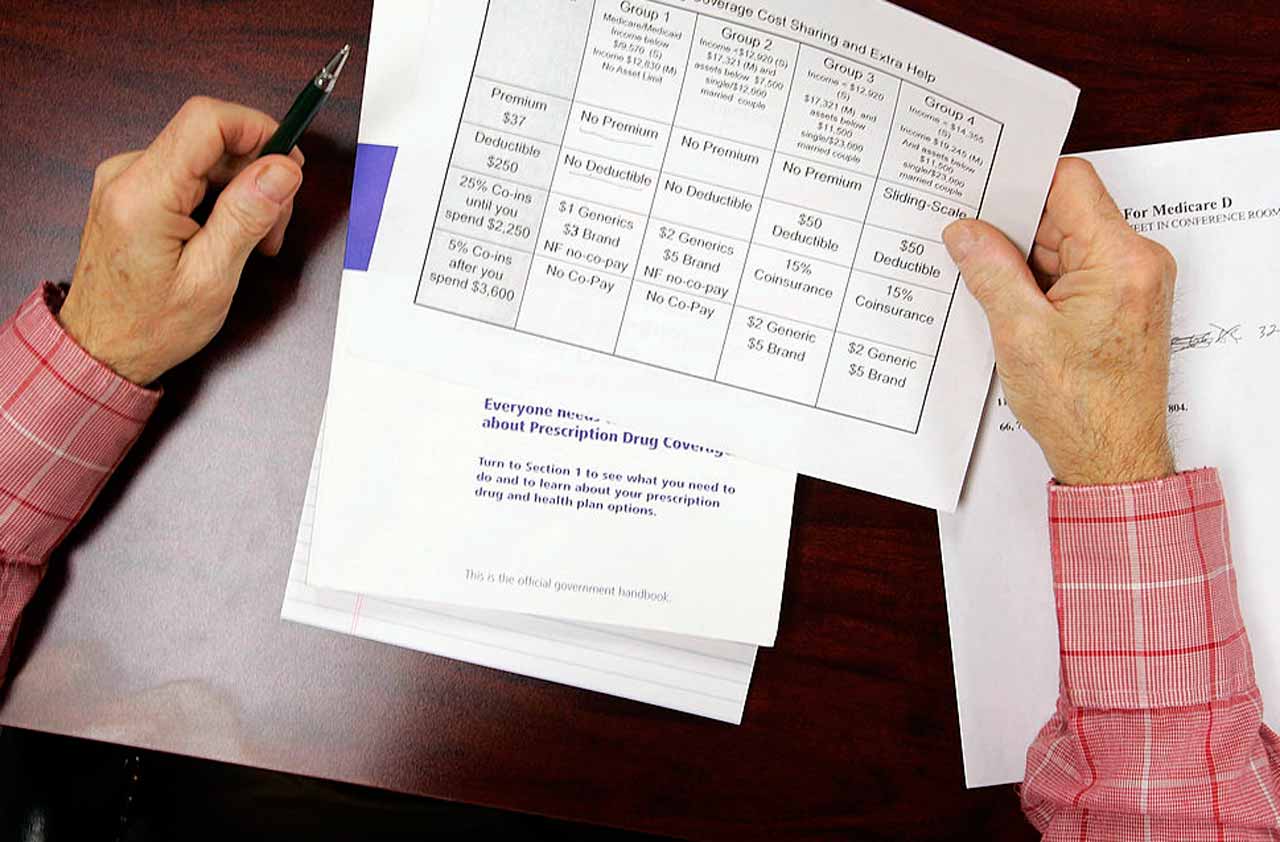

You get about two months to shop. The window opens October 15 and closes December 7. During open enrollment, beneficiaries can choose to switch Part D prescription-drug plans; switch Advantage plans, which offer health coverage through private insurers; or switch from traditional Medicare to Medicare Advantage. New coverage starts January 1, 2018.

Even if you’re happy with your current plan, it can pay to shop around. “Your plan may have been best for 2017, but maybe not for 2018,” says Christina Reeg, director of the Ohio Senior Health Insurance Information Program, based in Columbus, Ohio. Part D and Advantage plans can change their coverage rules from one year to the next, or a change in the prescription drugs you take could make another plan a better deal. A plan better suited to your needs next year could potentially save you hundreds or thousands of dollars.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Your first order of business: Watch your mailbox for your current plan’s Annual Notice of Change. It should have arrived around the end of September and will indicate any 2018 changes to the cost and coverage of your current plan. Pay particular attention to changes to drug formularies, drug tiers and co-pays that affect drugs you take. For instance, “a drug in a lower tier with a $5 co-pay might be shifted to a different tier with a $10 co-pay or $20 co-pay,” says Brandy Bauer, communications manager for the National Council on Aging’s Center for Benefits Access. “Those costs can add up over time.” Use the information about your current plan’s changes to help you compare plans.

By October 1, Medicare releases details about 2018 plans. You can then fire up the Medicare Plan Finder at Medicare.gov to start shopping. Type in your zip code, the drugs you take and the dosages. The online tool will calculate your total costs (premiums plus out-of-pocket costs for your drugs) for each plan in your area.

Keep in mind that choosing a Medicare plan is an individual decision, says Reeg. Married couples don’t have to sign up for the same plan. Two spouses with very different health situations may find traditional Medicare is appropriate for one spouse while the other is better off with a Medicare Advantage plan.

If you need help, contact your state health insurance assistance program, or SHIP. “SHIP helps people navigate the complexities of Medicare,” says Ginny Paulson, director of the SHIP National Technical Assistance Center. Go to Shiptacenter.org or call 877-839-2675 to find local contacts. SHIP’s services are free, and you can get customized help over the phone or make an appointment for in-person assistance. This government-funded program ensures that beneficiaries get objective help in understanding Medicare rules and assistance in navigating Medicare’s online tools.

“Open enrollment is by far the busiest time of year,” says Reeg. “We have 2.2 million beneficiaries [in Ohio] and we encourage all of them to review health and drug plans for 2018.” SHIPs can’t tell you what plan to choose, but they can help you understand your options. Have information about your drugs, pharmacies and doctors handy so SHIP experts can better help you sort through your plan choices.

Shop With Care

When weighing your options, Reeg says the three C’s are critical: costs, coverage and convenience. These three can intertwine. You may prefer to pick up your prescriptions at your local pharmacy, for instance, but getting prescriptions by mail could be cheaper.

You may also run into plans that use step therapy. “You may have to try a generic first before you can go to a brand-name drug,” says Bauer. “If you know you need a brand-name drug, look at plans that don’t have those hoops.” But if you can take generics instead of brand-name drugs, it’s one way to cut costs. Use an online drug costs calculator to compare prices.

Consider out-of-pocket drug costs as well as monthly premiums. “It’s always a trade-off—low premiums versus greater out-of-pocket costs,” says Alan Mittermaier, president of HealthMetrix Research, in Columbus, Ohio. The nitty-gritty of shopping for Part D “comes down to co-pays, particularly for retail pharmacy networks,” he says. “Ninety-day mail order co-pays are pretty close between plans.”

Some good news on the cost front: The Centers for Medicare and Medicaid Services expects the average basic premium for a Part D prescription-drug plan will decline to an estimated $33.50 per month in 2018, down $1.20 from the average 2017 monthly premium of $34.70. And the standard Part D deductible is increasing by only $5, to $405, for 2018.

The limits for falling into the dreaded “doughnut hole” coverage gap also increase for 2018, by $50 both before and after hitting the gap. After the deductible, you pay co-payments or co-insurance until drug costs reach $3,750 (including your share and the insurer’s share). In the gap, you pick up drug costs. After out-of-pocket costs reach $5,000, you pay only 5% of your drug costs.

Under the current health law, the coverage gap continues to shrink in 2018. “There will be less out-of-pocket burden next year,” says Mittermaier. In 2018, the discount on brand-name drugs while in the gap will be 65%, up from 60% in 2017, and the discount on generics will be 56%, up from 49% this year.

If you hit the doughnut hole this year, take a close look at how your drugs are covered, says Bauer. A different plan might help you avoid it next year.

People shopping for Medicare Advantage plans need to pay attention not only to drug costs and coverage but also to provider networks. Unlike traditional Medicare, Advantage plans have limited provider networks—and some networks are narrower than others. If you have certain doctors you like to see, check if their services will be covered—and what your costs would be if they aren’t in a particular plan’s network.

Also, some Advantage plans offer coverage that traditional Medicare doesn’t, such as for vision and dental care or hearing aids. Compare those extras.

Mittermaier’s firm compares costs for Advantage plans. Check out the review of 2018 plans at Medicarenewswatch.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.