Retirees, Maximize Returns on Your Cash Stash

Smart ways to spread out your savings and earn more interest from your bank.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

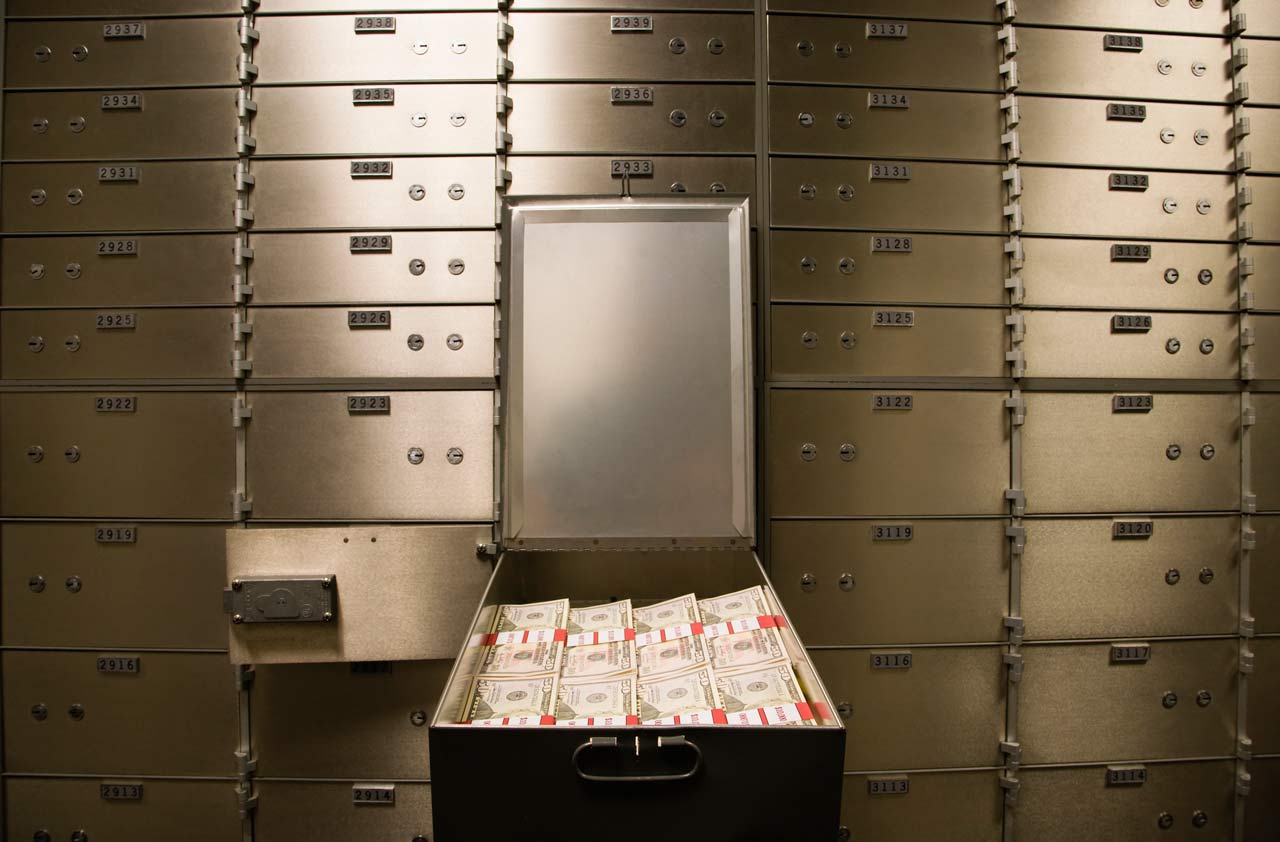

Savers with high cash balances face a conundrum: How can they earn competitive yields without sacrificing federal deposit insurance coverage?

As the Federal Reserve raises interest rates, the question takes on greater urgency. Some banks are now offering yields north of 2%, which is the Fed’s inflation target, “so for the first time in more than a decade, savers are in a position where they can have a positive after-inflation return without giving up federal deposit insurance protection,” says Greg McBride, chief financial analyst for Bankrate.com.

The issue for savers with sizable cash balances — including many retirees — is that federal deposit insurance typically covers only $250,000 for each account type that you hold at a single bank. So keeping all of your cash in the highest-yielding account you can find may not be an option.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There are ways to earn decent yields while maintaining full insurance coverage, including titling accounts in different ways at a single bank, opening accounts at multiple banks, and taking advantage of online services that will spread your money among several banks while optimizing your yield. For someone with a substantial cash hoard, “a difference of a quarter percentage point makes a big difference in interest income and could well justify doing a little additional legwork,” McBride says.

Despite the low rates of recent years, wealthy savers clearly don’t see cash as trash. In 2017, the average high net worth individual stashed about 21% of assets in cash and cash equivalents, according to the Capgemini World Wealth Report. But those who aren’t hunting for the best yields may pay a hefty price. Although some online banks have offered more-generous yields as the Fed raises rates, many brick-and-mortar banks have been slow to pass on higher rates to depositors.

One of the best ways to earn juicy yields at the bank — a rewards checking account — does little to help high-balance savers. These accounts are offering yields of up to 5%, but those generous rates apply only up to a certain balance — often $10,000 or $15,000. What’s more, savers who want to earn the highest yields in these accounts typically must jump through some hoops, such as completing 15 debit card transactions per month. So maintaining multiple accounts may be too much work.

A simpler option: Consider an online service that will spread your cash among high-yield accounts at multiple banks. MaxMyInterest, launched in 2014, allocates customers’ money among online savings accounts offered by Barclays, Ally Bank, American Express, Goldman Sachs and UFB Direct. The service, which has no minimum balance requirement, keeps the amount in each account under the Federal Deposit Insurance Corp. limit, and it allows an individual saver using all five banks to easily insure up to $1.25 million. At least once a month, or as often as the customer requests, MaxMyInterest reallocates the cash to take advantage of the highest rates.

To get started, customers link a checking account to MaxMyInterest and indicate how much they’d like to keep in that account. The service optimizes the yield on the excess amount by spreading it among the online savings accounts. The average customer is earning a yield of more than 1.6%, says chief executive officer Gary Zimmerman. But the service comes at a price: Annual fees total 0.08% of the amount optimized.

High-balance savers willing to do their own homework can avoid the fees — but getting a decent yield requires some effort. Websites such as Bankrate.com and DepositAccounts.com can help you find banks offering the best rates.

Boost FDIC Coverage at One Bank

If you want to keep all your cash under one roof, you can boost your FDIC coverage at a single bank by maintaining multiple accounts that are titled differently. For example, a married couple could have a joint account insured up to $500,000, two individual accounts each insured up to $250,000, and two retirement accounts each covered up to $250,000, bringing their total FDIC coverage to $1.5 million.

Another approach: Set up a “payable on death” account — one that will transfer funds to your named beneficiaries upon your death — and designate multiple beneficiaries. Generally, deposits in such accounts are insured up to $250,000 for each beneficiary. You can name up to five beneficiaries and get up to $1.25 million in coverage. Note that “each of the five beneficiaries doesn’t have to receive an equal amount of the deposit,” says Ken Tumin, editor of DepositAccounts.com. “You could have the vast majority going to one beneficiary,” and the FDIC still provides up to $1.25 million in coverage, he says. (If you have more than five beneficiaries, the rules get more complicated.) To calculate how much FDIC coverage you might get with different account types, use the FDIC’s electronic deposit insurance estimator.

While keeping all your cash in one place is convenient, “it very likely means you’re not getting the best yield,” McBride says.

Some savers aim to boost their yield — and their FDIC coverage — by buying brokered certificates of deposit issued by various banks. These CDs, available through brokerage firms such as Vanguard and Fidelity, are traded on a secondary market and may respond more quickly than direct CDs to interest-rate changes — giving savers higher yields as rates rise.

But they come with several caveats. FDIC coverage on secondary-market brokered CDs applies only to the par value — if you purchase these CDs at a premium, the amount above par won’t be covered. Avoid callable CDs, which allow the bank to terminate the CD early. And only buy brokered CDs when you’re certain you’re going to hold them to maturity. If you try to sell early in a rising-rate environment, “you could take a bath,” McBride says.

As rates rise, savers should also look at options beyond the bank. Yields on Treasury bills and notes have climbed substantially and “are very competitive with CD rates and Internet banks,” Tumin says — and they’re backed by the full faith and credit of the U.S. government. The six-month Treasury bill, for example, yielded 2.13% in early June, compared with 2.05% for the top-yielding six-month CD listed on Bankrate.com. You can buy Treasury bills directly from the federal government.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Where's the Best Place to Save for a House Down Payment?

Where's the Best Place to Save for a House Down Payment?Learn how timing matters when it comes to choosing the right account.

-

We want our RMDs to fund a vacation with our kids and grandkids.

We want our RMDs to fund a vacation with our kids and grandkids.An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

The Roth Conversion Bandwagon is Rolling: Should You Jump On?

The Roth Conversion Bandwagon is Rolling: Should You Jump On?Roth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.