Will You Spend Less in Retirement Than You Think?

It's smart to budget for inflation. But if you're overly conservative, you may be setting yourself up for a less fun retirement or years longer working than necessary, because your retirement spending calculation may be wrong.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

“How much can I spend each year during retirement?” Retirement-planning software and statistics clash on this point.

If you, or your adviser, are using retirement software to determine your recommended spend rate in retirement, it is highly possible that the projections are inaccurate. These miscalculations could put unnecessary limits on the amount you can spend during your early (and healthier) years of retirement. In addition, these potential errors could suggest that your nest-egg needs to be much larger than is needed, forcing you to stay in the workforce longer than you have to.

If you are a retiree, or soon-to-be retiree, understanding these potential inaccuracies could help you better determine when you can comfortably retire, and adjust your spend rate to make the most out of your retirement as you age.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Traditional Planning

Retirement-planning software requires you to input an assumed retirement inflation rate. Most software defaults to 3%, which is roughly the 100-year average in the U.S. That means the software is going to assume that you will need 3% more money every year to buy the same things you bought in the previous year. For example, if you need $60,000 this year to cover your expenses, next year you’ll need $61,800 to buy the same things, and $63,564 the next year and so on.

At that 3% pace, you’ll need $108,367 20 years from now to buy what $60,000 buys today. These projections should work out beautifully if we do, in fact, experience 3% inflation. But life’s not that simple.

The Facts

Even though inflation should always be a consideration in your retirement planning, you shouldn’t let it scare you into unnecessarily overworking and underspending, because research by the U.S. Bureau of Labor Statistics (BLS) suggests that folks actually spend less as we get older, rather than more. While our spending on things like health care increases somewhat during retirement, it is more than offset by a decrease in things like housing, food, clothing, transportation and entertainment.

According to the BLS, there is a spending decrease of 17% between ages 55-65 and ages 65-75, and another decrease of 24% for those over age 75, vs. their age 65-75 counterparts. And that’s more than enough to cover for rising prices, when compared to inflation’s historical average.

So, for someone who is age 55-65 and needs $60,000 to cover their annual living expenses, the BLS numbers suggest that they will likely need 17% less, or $49,800, between age 65-75, and then $37,848 after age 75 (assuming today’s dollars). The BLS numbers don’t suggest that there isn’t inflation experienced during retirement, but rather that we simply buy fewer things.

Comparison

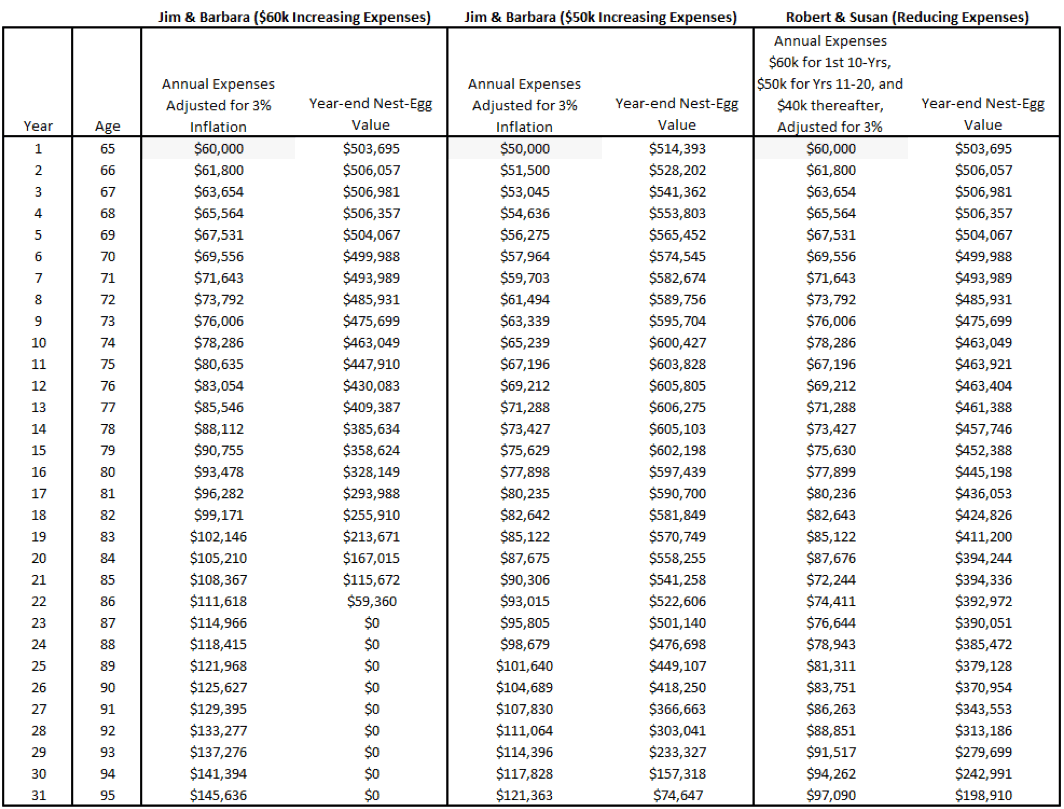

So, let’s look at the difference between someone planning on rising expenses or falling expenses during retirement. Let’s assume we have two couples, both age 65, and both needing $60,000 to cover their retirement expenses (chart below). Both couples receive $36,000 from Social Security, $20,000 from a pension before tax, and the balance of what they need from their $500,000 IRA portfolios. We are also assuming a life expectancy of age 95, a 5% rate of return and an 18% nominal income tax rate.

Constant Rising Expenses (Traditional Projections)

Jim and Barbara are using traditional retirement projections with a 3% inflation assumption. With this conventional wisdom they are assuming they will need 3% more money every year to cover their living expenses. By age 75 they assume they will need $80,635 to cover their expenses and by 85 that will rise to $108,367. Based on these assumptions, Jim and Barbara’s portfolio will be completely depleted at age 87. As their adviser, if I stopped at this point, I’d have to suggest that they continue working and building their portfolio, or decrease their spending to $50,000.

Falling Expenses

Robert and Susan have developed a more detailed analysis and are assuming their expenses will fall at different points during retirement. Using the BLS numbers as their guide, they have determined they will need $60,000 for the first 10 years of retirement, $50,000 for years 11 through 20, and $40,000 thereafter (adjusted for 3% inflation). Using these assumptions, their analysis indicates that they will have $392,972 left at age 86 and $198,910 left at 95. If Robert and Susan wanted to be even more aggressive in their spending, they could spend an additional $5,000 per year for the first 10 years of retirement without running out of money by age 95.

Being Conservative Comes at a Cost

If you take the conventional wisdom, a constant 3% increase per year throughout retirement, you are definitely being conservative. However, you may be being too conservative. The cost of your conservativeness may be an unnecessary reduced spending rate early in retirement when you are healthy and able to enjoy your money. On the flip side, being conservative in your planning will help you handle the unknowns that may arise, like the added cost of a nursing home stay, lower-than-anticipated returns, living much longer than projected, higher-than-projected inflation rates, etc.

The key here is to understand the limitations of retirement calculators in light of spending trends among retirees. The closer you can estimate your actual spending, the better your analysis will be. You don’t want to look back when you are 85 and no longer physically able to do as much as you once could, and wish you would have taken a few more trips when you were younger and more healthy. You also don’t want to spend too much too soon.

I’d suggest running your projections assuming expenses are increasing over time, and also projections assuming your expenses are reducing over time. This will likely take the help of a financial professional who has access to cutting-edge software. Once you’ve run and compared the numbers, you will likely conclude, as I have, that your spending should be somewhere in between the two approaches.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ray LeVitre is an independent fee-only Certified Financial Adviser with over 20 years of financial services experience. In addition he is the founder of Net Worth Advisory Group and the author of "20 Retirement Decisions You Need to Make Right Now."

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.