What Drives Stock Returns?

Hint: It’s more than just company profits.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

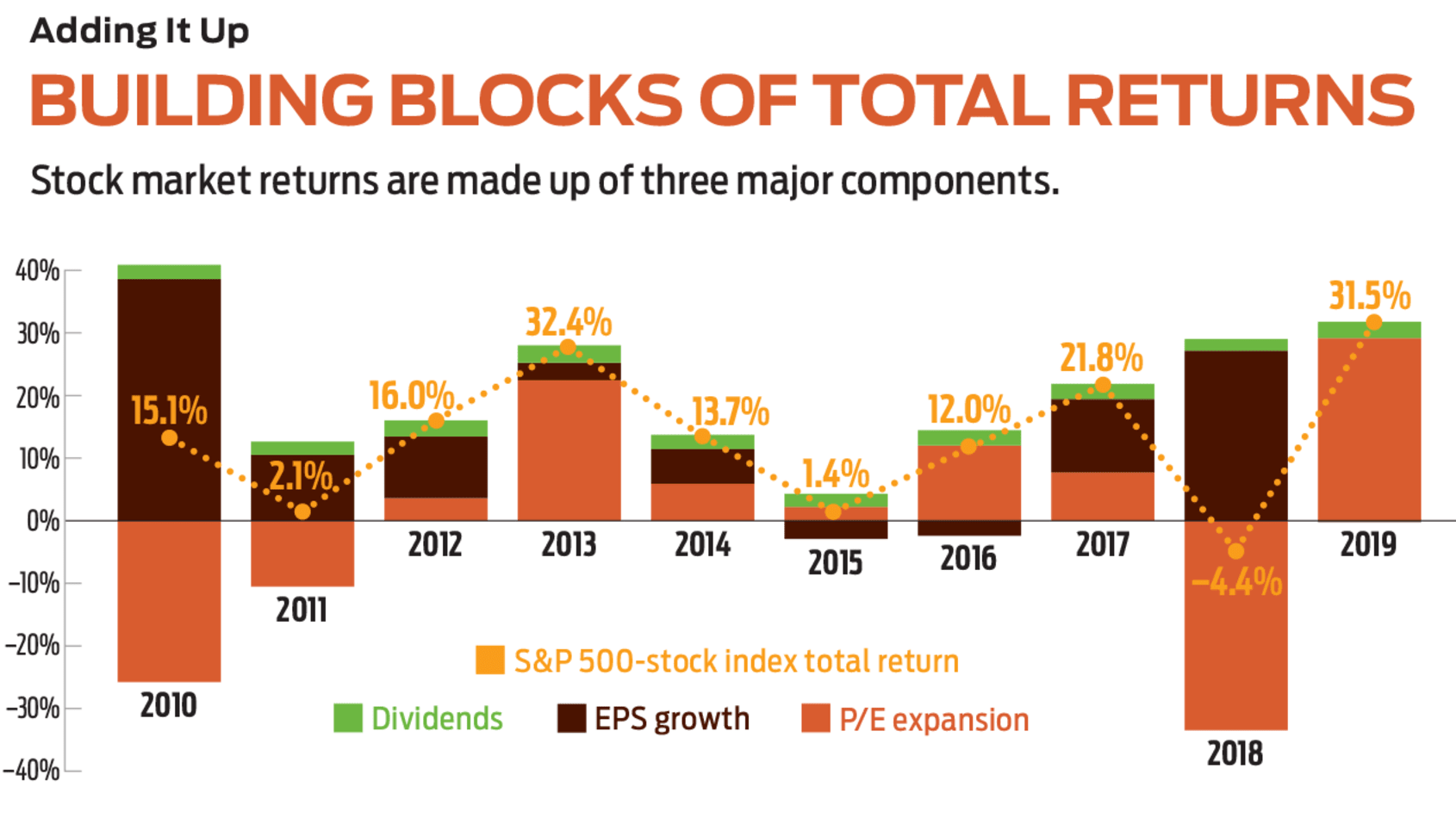

We’re told over and over that growth in corporate earnings drives stock market returns. If that’s the case, what has been going on lately? In 2019, Standard & Poor’s 500-stock index posted a total return of 32%, but corporate earnings barely moved. In 2018, with corporate profits solidly up, the market surrendered 4.4%. The truth is, earnings are only part of the picture when it comes to stock market returns. Understanding the whole mosaic can give you insight on how to manage your portfolio.

You can divide stock returns into three primary drivers, which can work in concert or at odds: earnings growth, valuation and dividends. In a vacuum, earnings growth is the easiest to understand. Say a stock costs $100 per share and posts earnings of $10 per share. If earnings grow by 5%, to $10.50, then the stock price should grow by a commensurate 5%, to $105, producing a 5% return.

But stock prices reflect what investors expect in the future. Their confidence or negativity about a stock’s potential is expressed in its valuation, commonly represented by a measure such as the price-earnings ratio. If investors are bullish on a stock, they’ll bid up the price, thus “expanding” the stock’s price-earnings multiple and boosting return.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Say the $100 stock with $10 in earnings has a P/E of 10. Should confident investors bid the price up to 12 times earnings, the stock would now trade at $120, a 20% return. In 2019, 29 percentage points of the S&P 500’s 32% return came from valuation expansion. “Valuation expansion last year was in anticipation of earnings growth this year,” says analyst Willie Delwiche, at investment firm Baird.

Understanding where the market’s valuation stands compared with historical averages can give investors a sense of market risk, says Delwiche, because valuations tend to revert to mean levels over time. At 18 times expected year-ahead earnings, the S&P 500 trades above the 10-year average of 15. That doesn’t mean prices will come down imminently, Delwiche says, but it could signify that investors should explore less-volatile pockets of the market or consider investing overseas, where stocks are trading closer to historical norms.

Count on dividends. Income investors know the power of the third major driver of total returns: dividends. Since 1955, earnings growth has contributed 63% of the S&P 500’s total annual return, on average, followed by dividend payments (28%) and expansions or contractions in valuation (9%), according to Calamos Wealth Management.

Of those factors, dividends are the least volatile and don’t ever detract from the market’s return. As a result, reinvested dividends have an outsize impact on the market’s return over time. From the end of 1970 through 2019, 78% of the total return of the S&P 500 came from the compound growth of reinvested dividends, according to analysts at the Hartford Funds. The message is clear, says CFRA investment chief Sam Stovall: “Dividends reward the buy-and-hold investor.”

What will drive returns in 2020? Calamos Wealth Management chief investment officer Reed Murphy believes the baseline case is for valuations to hold relatively steady and for earnings growth for companies in the S&P 500 to come in below current estimates of 9%-plus. He suggests the S&P 500 is likely to return 7% to 8% in 2020, including a 1.9% dividend yield.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.