What Keeps Me Awake

The European financial crisis is likely to cause some countries to default on their debt.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Everyone knows that I am a long-term bull on the stock markets and that I believe stocks will deliver excellent returns for investors. Yet I'm often asked what keeps me up at night and could change my bullish outlook.

There are a number of scary scenarios, starting with another debt crisis, originating either in commercial real estate, sovereign countries (particularly in Europe) or the municipal-bond market. I am no longer worried about a real estate-induced crisis. The decline in the price of residential and commercial real estate has already been reflected in the price of bank stocks, even though some banks have not fully written down the price of nonperforming assets. We know this is true because bank stocks are extremely cheap relative to their book value (assets minus liabilities) on a historical basis.

The European financial crisis is likely to cause some countries to default on their debt, and it could even cause a breakup of the euro currency area. I have consistently doubted the sustainability of the European Economic and Monetary Union, which includes far too many countries with disparate fiscal policies to form a successful common currency. Defaults or an exchange breakdown would cause some severe short-term disruptions. Nevertheless, European stocks are selling at a price-earnings ratio that's 20% less than the P/E of comparable stocks in the U.S., so any market slide is apt to be short-lived.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Excessive state- and local-government debt is also a concern. Mutual funds hold more than $850 billion in municipal debt, with $350 billion concentrated in money-market funds. If municipal defaults started a run on these funds, it could give the stock market fits. But the Fed would likely offer guarantees to fund investors, and the federal government would likely rescue states in peril. Does anyone doubt that President Obama would pressure Congress to bail out California, the state that gave him the most electoral votes (see Golden Opportunities in the Golden State)?

Of course, many investors worry more about our enormous federal deficit than our state and local obligations. But most of our current federal deficit is due to the recession and will shrink significantly when the economy recovers. In the long run, Medicare is the huge budget buster. Fixing it will require a fundamental reworking of our entitlement programs, but that won't threaten stocks in the near future.

If there's one thing that keeps me up at night, it's the threat of a terrorist attack -- particularly one that involves nuclear material in a city such as New York or a major European or Asian capital. A nuclear strike would be catastrophic not only because of the loss of lives and property but also because of the extraordinary security measures that would be taken to avoid a future attack. Those measures would restrict freedom and increase government regulation, neither of which would be good for stocks or private enterprise.

No backlash. But let me leave investors on a cheerier note. In the aftermath of the recent financial crisis, there was the real possibility of a strong reaction against capitalism. Fortunately, such a backlash didn't materialize. In fact, elections in the U.S. and around the world indicated a swing to the right as the public rejected the thesis that government could replace private enterprise in running the economy.

That doesn't mean the American public is happy with the state of affairs in the U.S. But despite anger directed at the investment banks that sold subprime mortgage-backed securities, most Americans aren't blaming our free-enterprise system for our current woes. The U.S. has faced many crises that have disturbed the sleep of numerous investors. Yet we've always surmounted them and rewarded those who stuck with stocks. I see no reason the future should be any different.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania's Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

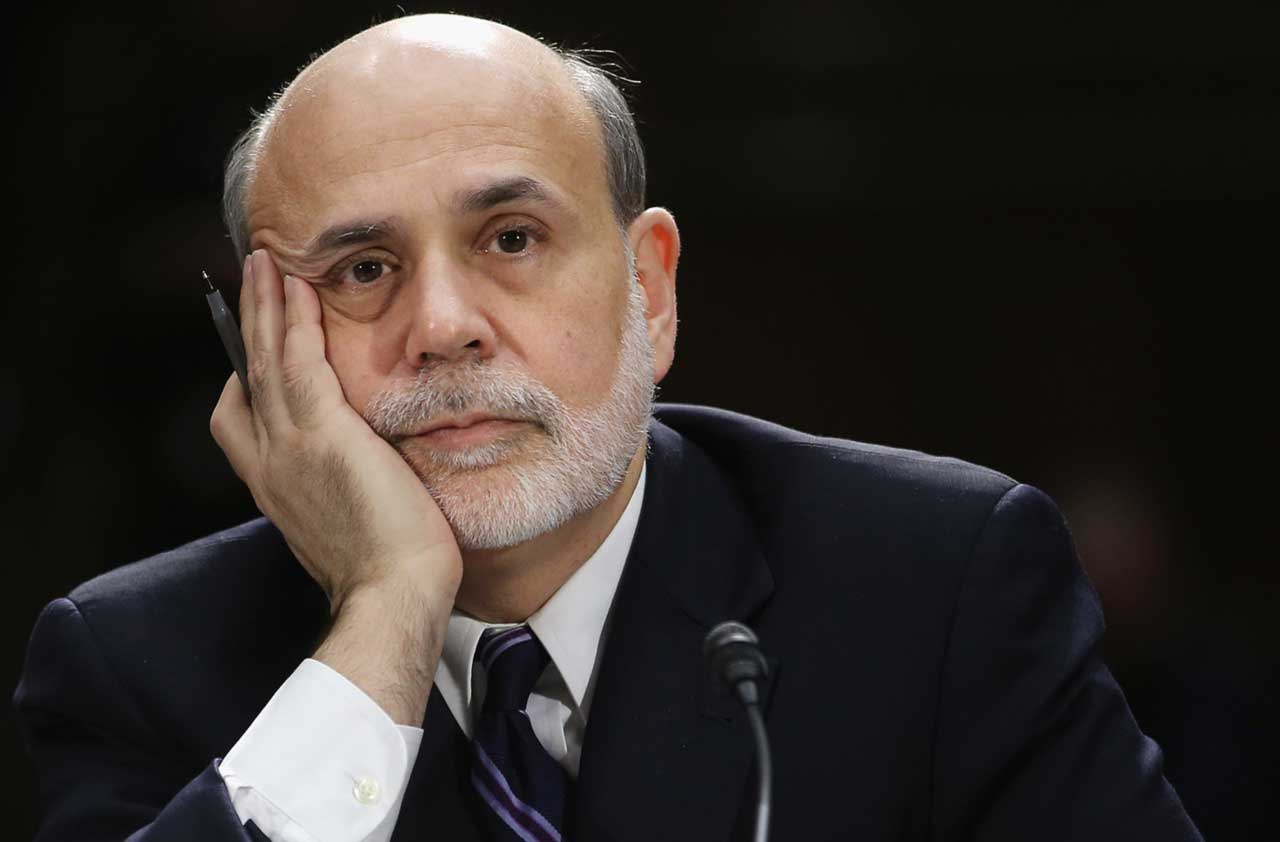

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.