Don’t Ignore Small-Company Stocks

Small-cap stocks tend to move in cycles, and we look to be on the rising side of one.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Small-company stocks have a lot going for them. Since 1926, they have returned an annual average of about two percentage points more than shares of large companies. Over time, that two-point difference adds up. A dollar invested in a basket of small caps in 1926 would have returned more than five times as much as a dollar invested in large caps.

Of course, there’s a trade-off. Higher returns are the reward you get for taking on greater risk, and small caps are riskier than large caps. Shares in smaller companies are naturally more volatile because their businesses lack the financial resources of big firms. A new competitor or a failed product can put them out of business.

In recent years, small caps have developed another vulnerability. As index investing has grown more popular, investors have flocked to exchange-traded funds that track Standard & Poor’s 500-stock index, the large-cap index that is often viewed as the market benchmark.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Nevertheless, after trailing the S&P for more than four years, small caps are stirring. Through the first six months of 2018, the Russell 2000, a small-stock yardstick, has beaten the large-cap benchmark by nearly five percentage points, hitting new highs. Is something changing?

The Russell 2000 is composed of stocks on U.S. exchanges roughly ranked 1,001 to 3,000 by market capitalization (price times shares outstanding). The Russell 2000 is weighted by market capitalization, so larger companies affect the index’s performance more than smaller ones. The average stock has a capitalization of $2.3 billion.

The main case for small caps now is that they tend to be focused on the U.S. market, with little exposure to international trade.

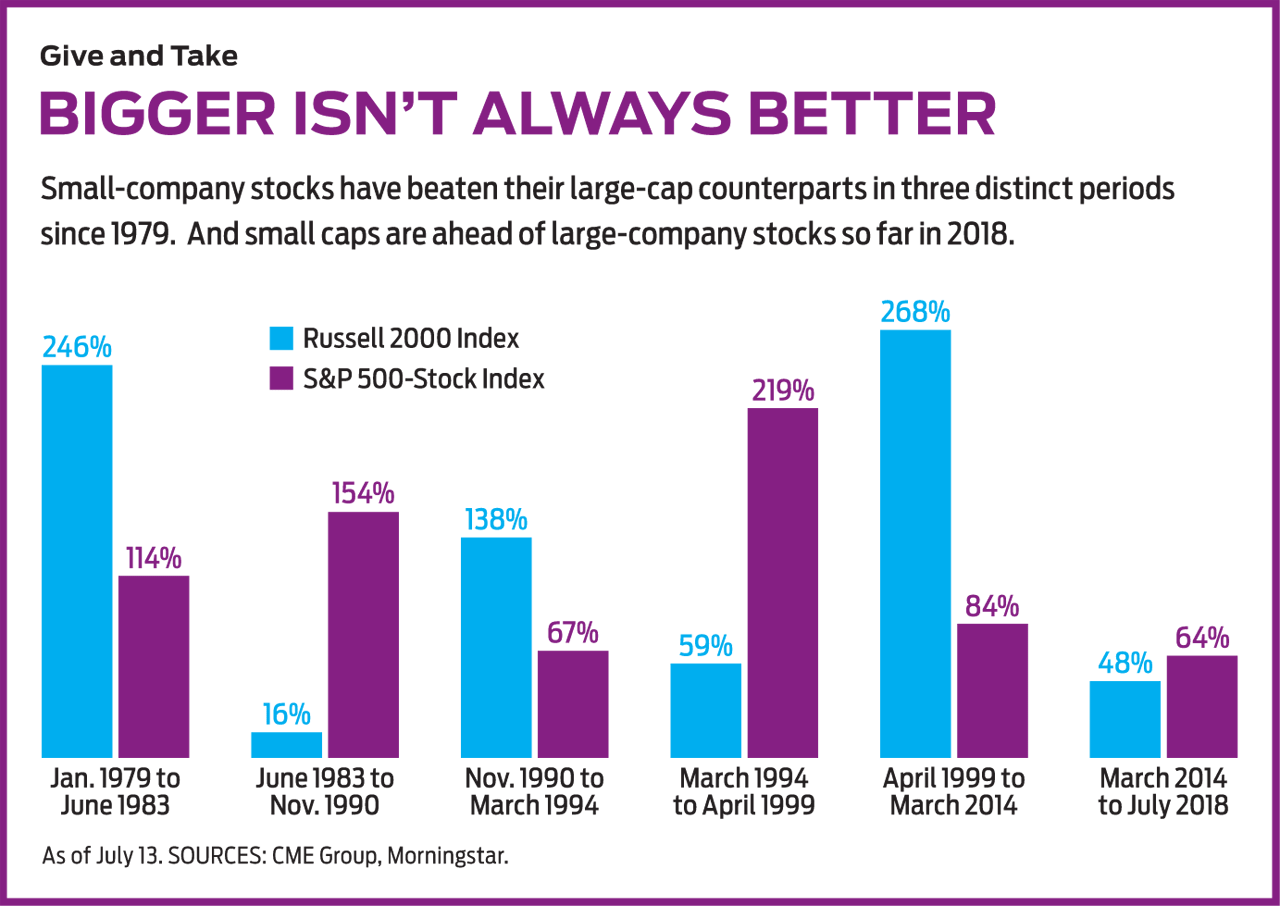

Time to think small? Small caps move up and down in cycles. Studying the data last year, economist Erik Norland, with financial marketplace firm CME Group, found six distinct periods over the past four decades. From 1979 to 1983, the cumulative gain of the Russell 2000 was more than twice the return of the S&P 500. From 1983 to 1990, large caps beat small caps by an even greater margin. Over the next four years, small caps outshone large caps, but they were on the losing end from 1994 to 1999. Small caps whipped large caps from 1999 to 2014, with the Russell up 268% to the S&P 500’s 84%. Since then the S&P has had the edge.

Unfortunately, there seems to be no clear reason why cycles end or begin. Norland believes small caps disproportionately benefit from growth spurts in the economy, but I detect no consistent pattern. The main case for small caps now is that they tend to be focused on the U.S. market, with little exposure to international trade at a time when the Trump administration is imposing tariffs and other countries are retaliating. Perhaps that’s true, but I see these cycles more as prolonged random walks. Once started, a small-cap cycle often gains momentum, and the recent ascendancy of smaller companies could mean that a new trend is beginning after a lull.

The best strategy is not to try to time the market but simply to buy and hold. If you don’t own enough small caps—and I think they should make up 10% to 20% of your portfolio—then get some. The simplest approach is to buy index ETFs, such as iShares Russell 2000 (symbol IWM, $167), with an expense ratio of 0.2%, or Vanguard Russell 2000 (VTWO, $135), with expenses of 0.15%.

Small caps, however, represent a part of the market that is potentially inefficient—that is, many of the stocks are overlooked and could present bargains. For example, Yahoo Finance reports that 31 analysts have made 2019 earnings estimates for Microsoft (MSFT), but only five cover Stamps.com (STMP, $271), which provides internet-based mailing solutions. With a $4.9 billion market cap, it was recently the 17th-largest holding of the Vanguard Russell 2000 ETF.

It can be wise, then, to look for smart stock pickers. There aren’t many, and in recent years, some small-cap funds have larded their portfolios with mid-cap stocks in order to boost returns. Hodges Small Cap (HDPSX), by contrast, is a true small-company fund. Its average annual return over the past five years is 9.4%, with an expense ratio of 1.28%. (If you buy managed small-cap funds, you’ll pay a relatively high price for the stock picking.)

In researching small caps, I identified a powerful current trend: Small-cap value stocks are being trounced by small-cap growth stocks (see Value Vs. Growth Stocks: Which Will Come Out on Top?). I knew this trend prevailed for large caps, and I assumed the reason was the incredible performance of Apple and other tech giants. But look at small caps. The Russell 2000 Value index, composed of companies in the index that have lower ratios of price to book value (book value is a company’s net worth on its balance sheet), has trailed the Russell 2000 Growth index by 2.6 percentage points, on average, for the past five years. Over the past 12 months, Russell Growth has beaten its value counterpart 24.6% to 14.9%.

My conclusion is that small-cap value could start to catch up with growth. These bargain-priced stocks present excellent opportunities right now. Consider iShares Russell 2000 Value (IWN, $134), an ETF with an expense ratio of just 0.24%, whose portfolio mimics the index. Another ETF, iShares S&P Small-Cap 600 Value (IJS, $167), owns the value components of a slightly different small-cap index, with expenses of 0.25%. Both funds own suitably small stocks. The Russell ETF has an average market cap of $1.7 billion; the S&P version, $1.5 billion.

Consider the stock pickers. Again, the managed funds in this sector deserve attention. One of the best is T. Rowe Price Small-Cap Value (PRSVX), with a five-year average annual return of 10.8%, compared with 10.4% for the Russell 2000 Value index. The fund, a member of the Kiplinger 25, the list of our favorite no-load funds, has a portfolio that is currently heavily weighted toward financials, which make up 27% of assets, compared with just 10% in technology. A typical holding is TowneBank (TOWN, $32), which operates in Virginia and North Carolina; it carries a price-earnings ratio of 15, based on a consensus of the 2018 profit forecasts of five analysts. The fund has an expense ratio of 0.91%.

Stocks in the portfolio of Bridgeway Small-Cap Value (BRSVX) have an average market cap that’s smaller than the average for the Russell 2000 Value index. I like that. Smaller means more shunned. The fund, with a veteran management team, has returned an annual average of 9.0% over the past five years, with an expense ratio of 0.94%. Its top holding is SkyWest (SKYW, $55), a regional airline with a P/E of just 12 based on 2018 estimates.

Queens Road Small Cap Value (QRSVX) is a little gem. Its average market cap is about the same as that of the Russell 2000, and it has a low-turnover portfolio of 46 stocks. Its holdings include Oshkosh (OSK, $74), a maker of heavy-duty trucks, with a P/E of 13, and Anixter International (AXE, $65), a distributor of electronic cables and wires, with a P/E of 12. The fund has returned 8.0% annualized over the past five years, and so far in 2018 it’s up 4.1%.

Buying individual small-cap stocks can be challenging because the companies are less scrutinized. A good way to find winners is to examine the holdings of strong managed funds. That is what I have done here (stocks I like are in bold). But you can do well with mutual funds and ETFs alone. Just remember that with small caps, the ups and downs can be extreme, but the rewards—if history is a guide—make the rough trip worth it.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients and owns none of the stocks or funds recommended in this column.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.