Betting on Stocks Down Under

With their sound fundamentals and enticing yields, Australian stocks make logical additions to any portfolio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When U.S. investors diversify globally, they typically buy international or regional mutual funds or shares in companies based in Europe, China, Japan, or maybe Mexico or Brazil. But there’s a great big world out there, including countries that have strong and consistent growth, an energetic and imaginative population, thriving businesses, and robust trade unthreatened by tit-for-tat tariff battles.

One of the best of these markets is Australia, which is now in its 29th consecutive year of annual economic growth (the U.S. is in its 11th). On my first and only visit, my reaction was, “Wow, this place is more American than America!” What I meant was that Australia’s robust, free economy was working even better than our own. Australia ranks fifth among 180 countries on the Heritage Foundation’s 2019 Index of Economic Freedom, judged by such criteria as property rights, tax burden and government integrity (the U.S. is 12th). Australia’s budget will show a slight surplus this year, according to an estimate by the Economist Intelligence Unit (the U.S. faces a deficit of 4.7% of gross domestic product). Australia has no estate tax, and its public pension system puts our Social Security system to shame by investing in real assets rather than building up huge liabilities for future generations.

Australia is a major trading nation—the number-one exporter of coal, iron ore and wool, and the number-two exporter of liquefied natural gas and beef. The trade war between the U.S. and China might benefit Australia—for example, as a substitute source of farm goods for Chinese consumers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Australia’s median wealth and GDP per adult are nearly the same as those of the U.S. and far ahead of Germany, France and the U.K. With a population of 25 million (fewer than Texas has), the country’s economy ranks 13th in size globally, with GDP of $1.4 trillion. That’s just behind South Korea, which has more than twice as many people.

Popular destination. Australia is a haven for immigrants, who tend to move to countries where they can get jobs. Some 28% of the country’s population is foreign-born, by far the highest share for any developed nation of more than 10 million people. (The U.S. proportion is 14%.) Australia ranks third, behind Norway and Switzerland, on the United Nations Human Development index, which takes into account life expectancy, years of schooling and income (the U.S. is 13th). Three of Australia’s cities (Melbourne, Sydney and Adelaide) are on the Economist Intelligence Unit’s list of the 10 most livable cities in the world; no U.S. city made the list.

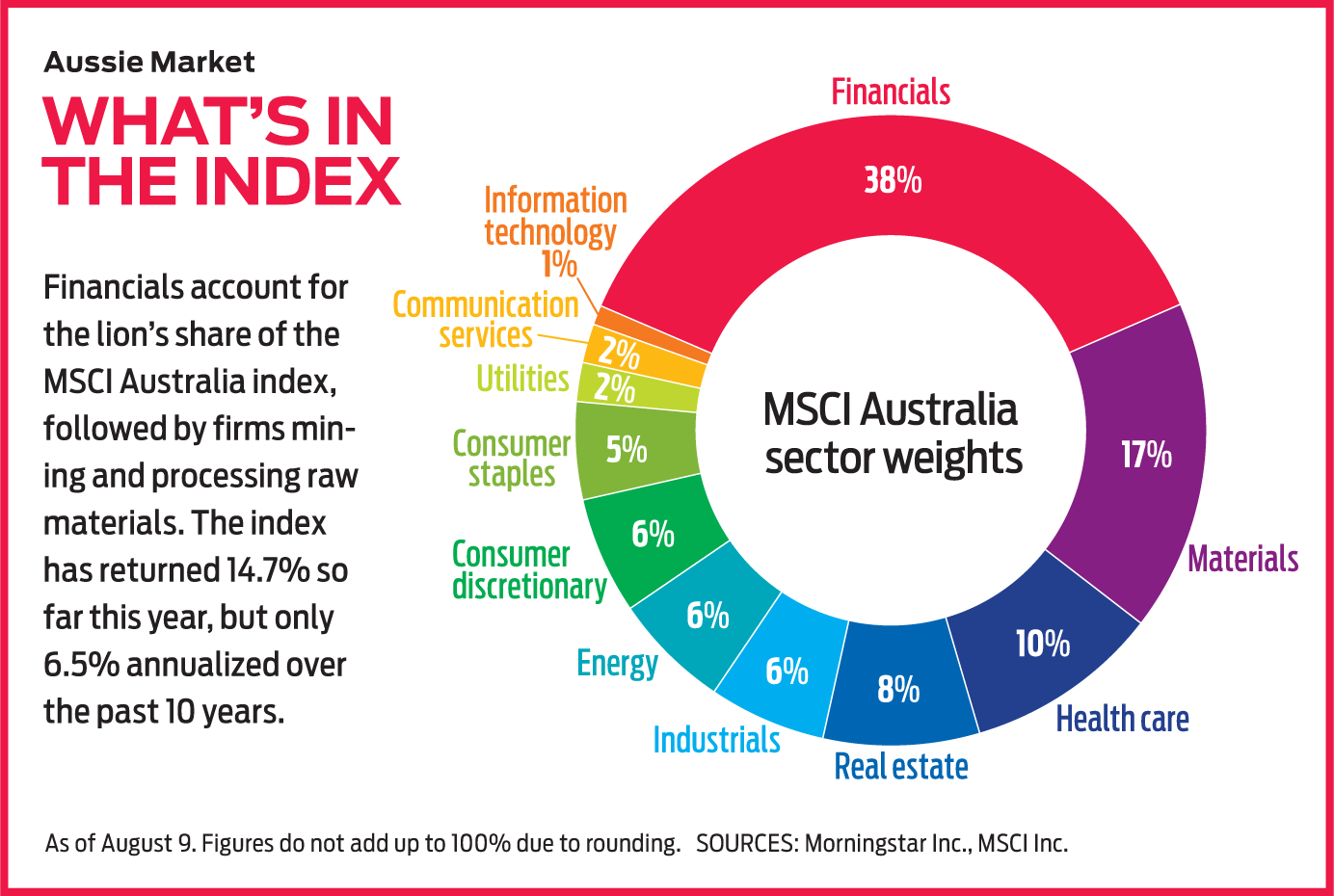

With all this going for it, Australia also has a stock market that looks cheap. Total returns, including dividends, for the MSCI Australia index (roughly the 68 largest Australian stocks by market value) have averaged 6.5% over the past 10 years, compared with 13.5% for Standard & Poor’s 500-stock index, the U.S. benchmark. (Prices and returns are through August 9.)

The current price-earnings ratio for stocks on the MSCI Australia is 16, compared with 17 for the S&P 500. The price-to-book-value ratio for the Australian index is 2.1, compared with 3.5 for U.S. stocks. The dividend yield for the MSCI Australia index is 4.2%; for the S&P 500, it’s 2%.

What Australia does not have is a lot of investment opportunities that can be easily accessed by Americans. But it has enough, if you know where to look.

Start with iShares MSCI Australia (symbol EWA, $21), an exchange-traded fund linked to the index. The fund has performed well in 2019—it has returned 13.9% so far this year—but its average annual return for the past five years is just 1.1%, and it has suffered declines in four of the past eight full calendar years. With an expense ratio of 0.47%, the ETF has a portfolio that is heavily weighted toward financial stocks, which account for 38% of assets, compared with just 13% for the S&P 500.

Banking on financials. Concentration in financials should pay off if Australia’s economy continues on an solid upward course. Although bank profits are influenced by interest rates (especially by the difference between long- and short-term rates), they are also affected by the prosperity of the nation in which the banks are headquartered.

MSCI Australia is flush with excellent banks. I like Westpac Banking (WBK, $19), whose shares trade here as American depositary receipts, with a market value of $66.4 billion. Founded in 1817, Westpac is heavily focused on Australia, but it has branches in China, India, Hong Kong and Singapore. The share price has been stagnant for four years, but the stock yields a whopping 6.9%.

Another 17% of the ETF’s assets reside in basic materials companies, such as the giant BHP Group (BHP, $51), Australia’s largest public company, with a market value of $127.6 billion. BHP mines copper, silver, uranium, gold, coal and iron ore and develops oil and gas. The stock (an ADR) has doubled in the past three years, but the firm is heavily dependent on global commodity prices, and it still trades far below 2014 levels. It yields 4.7%.

A top-10 holding of the fund, Woolworths Group (WOLWF, $24), owns Australia’s largest grocery chain, as well as 1,545 liquor stores, a discount chain and 323 hotels. (The stock trades in the U.S. only as an “other OTC” stock and is bought through specialty brokers.) Woolworths is a great way to buy into the country’s economy as a whole. Unlike most retailers, it pays a nice dividend; it currently yields 3%.

Another fund choice is Aberdeen Australia Equity (IAF, $5), a closed-end fund launched in 1985 and managed by a team in Sydney. It can be bought and sold like a stock or ETF on U.S. exchanges. The fund trades at a 9.1% discount to the market value of the shares it owns—a seeming bargain. But discounts can persist for years.

Most of the fund’s stocks trade in the U.S. as “other OTC” stocks. The portfolio is led by Commonwealth Bank of Australia (CMWAY, $54). With a market cap of $94.6 billion, it yields 5.8%. Other interesting companies in the portfolio include Cochlear (CHEOY, $71), the world’s largest maker of implantable hearing solutions, and Telstra (TLSYY, $14), a telecommunications firm.

Another alternative, First Trust Australia AlphaDEX (FAUS, $31), is a tiny ETF that focuses on smaller stocks in a Nasdaq index. The portfolio includes IDP Education (IEL.AX), which trades only on Australian exchanges. (You can purchase shares through a U.S. broker who deals in international stocks. The recent price of $19 Australian converts to about $13 U.S.) The firm places foreign students in universities—a hot business reflecting Australia’s appeal and its diversity. Australia has become an educational magnet, especially for students from China and India. Foreigners make up 20% of college students in Australia, compared with 5% in the U.S. Shares of IDP have more than tripled in less than two years.

But you don’t have to own IDP as an individual stock. The First Trust ETF itself, despite an expense ratio on the high side at 0.80% and a dispiriting annual average five-year return of 3.4%, is a good bet if you believe in Australia. It’s better balanced—with a higher share of tech, real estate and energy stocks—than the iShares offering, and it has a dividend yield of 4.3%.

Why have Australia’s stocks been so lackluster in a period of impressive economic growth? And more important, will they wake up? There’s no guarantee, but I think they will as investors look for stability in a time of growing economic tension. In the meantime, with their sound fundamentals and enticing yields, they are logical additions to any portfolio.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence..

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.

-

An Urgent Need for Cybersecurity Stocks

An Urgent Need for Cybersecurity Stocksstocks Many cybersecurity stocks are still unprofitable, but what they're selling is an absolute necessity going forward.

-

Why Bonds Belong in Your Portfolio

Why Bonds Belong in Your Portfoliobonds Intermediate rates will probably rise another two or three points in the next few years, making bond yields more attractive.

-

140 Companies That Have Pulled Out of Russia

140 Companies That Have Pulled Out of Russiastocks The list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

-

How to Win With Game Stocks

How to Win With Game Stocksstocks Game stocks are the backbone of the metaverse, the "next big thing" in consumer technology.