Value Vs. Growth Stocks -- Which Will Come Out on Top?

Investors have shunned bargain-priced stocks in favor of fast growers for years. Is value due for a comeback?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

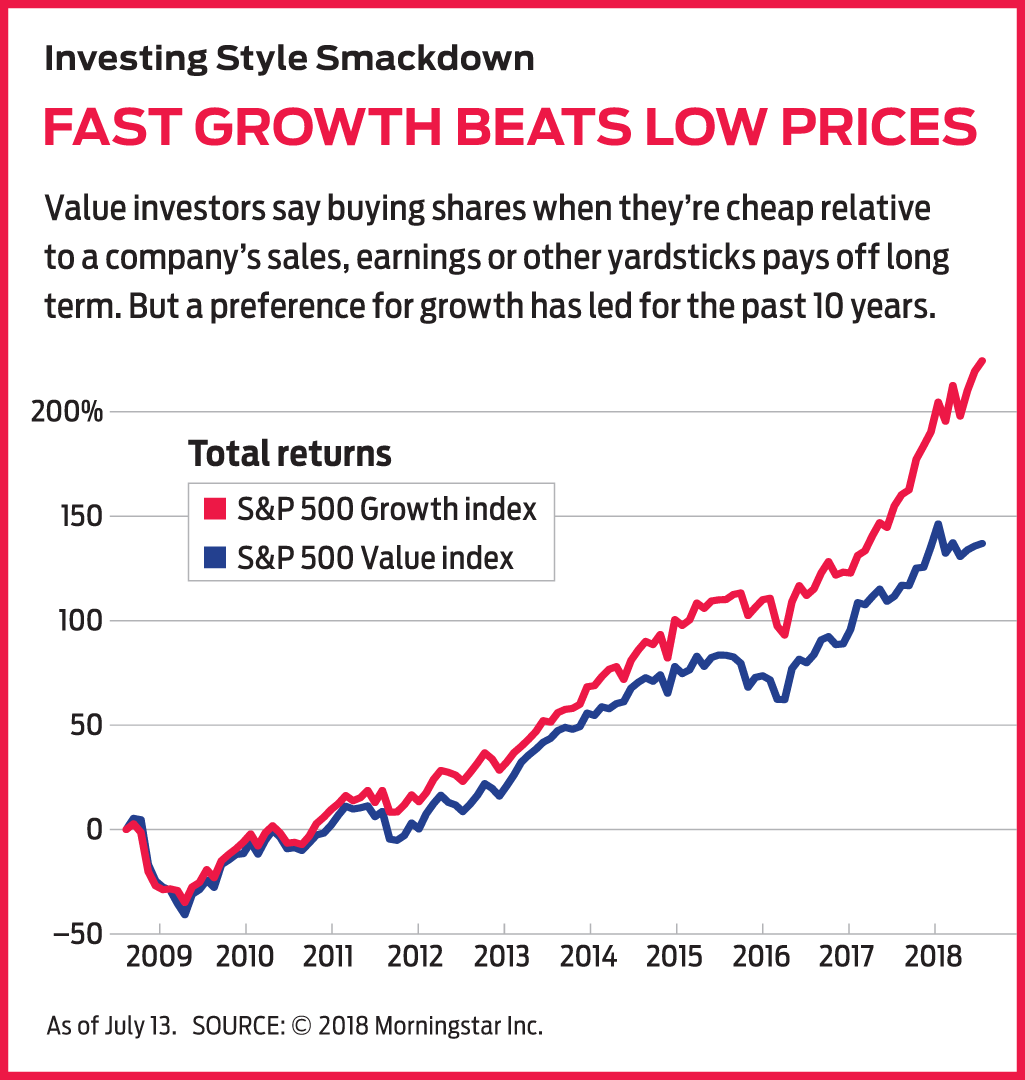

Legends of investing, including Benjamin Graham and his disciple Warren Buffett, have long touted the advantages of value investing. Value stocks trade inexpensively compared with corporate measures such as sales, earnings and book value (assets minus liabilities). Historically, they have outperformed growth stocks, which boost earnings and sales faster than their peers. The thinking behind the value strategy is simple: Investors tend to bid up exciting, fast-growing companies to bloated levels and shun boring companies or those going through temporary problems.

When the market eventually comes to its senses and stock prices normalize, value wins. From July 1926 through May 2018, value stocks traded on U.S. stock markets outpaced growth stocks by an annualized 3.9 percentage points.

But for more than a decade, growth stocks have pummeled their bargain-priced counterparts. Since the beginning of the last bear market in 2007, Standard & Poor’s 500 Value index, which tracks value-oriented components of the broad market barometer, has returned a cumulative 77%, compared with a 179% return in the corresponding growth-stock yardstick. The walloping hasn’t been consistent; value outpaced growth in 2012 and 2016. Led by a still-booming tech sector, growth stocks in the S&P 500 have returned 11.6% so far in 2018, compared with 0.2% for value stocks. (Prices and other data are through July 13.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Growth stocks usually sparkle in bull markets, but value shares tend to shine in down markets. At least that was the case between 1970 and 2006. When the stock market dropped 55% in the financial crisis and associated bear market of 2007–09, value should have shone. Except that value-oriented financial firms were at the heart of the mess, and lost 82% over the period. From June 2014 to January 2016, energy stocks, also value stalwarts, lost 42% as oil prices plummeted.

At 11 years, value’s current slump is the longest ever—“an extreme outlier,” says Scott Opsal, research director at the Leuthold Group, a market research and money management firm in Minneapolis. So investors are right to ask: Is value investing down for the count? Or is now the time to seize opportunities in a group of stocks poised to get off the mat?

Rebound Ready

The trends favoring growth have shown few signs of slowing down this year. But today’s environment favors a rebound in value stocks, say many analysts. For starters, whereas stocks of fast-growing companies are most attractive when profits and economic growth are scarce, bargains present better prospects when overall growth accelerates. Today, Wall Street analysts expect corporate profits to rise an average of 22% in 2018, up from 12% last year; Kiplinger estimates 2.9% gross domestic product growth this year, up from 2.3% in 2017.

And although value stocks nearly always look cheaper than growth stocks, the discount today is particularly steep. Despite forecasts of similar levels of earnings gains for growth and value stocks, the S&P 500 Growth index trades at 21 times investment research firm S&P Capital IQ’s estimated 2018 earnings, on average, compared with a price-earnings ratio of 14.5 for the Value index. The 45% premium is well above the post-technology-bubble average of 28%.

Finally, rising short-term interest rates are also thought to benefit value stocks—particularly financial firms, which can reap more on their investments. Although today’s still-low long-term rates offer limited lending profits for the group, continued deregulation is in their favor. With these factors in mind, John Lynch, chief strategist at investment firm LPL Financial, says value is poised for a comeback.

Timing such cycles is difficult. But it’s a good idea to diversify your portfolio with the complementary styles of growth and value. Investors who already do this might find now an opportune time to rebalance. Consider: Someone who started with an equal amount invested in the S&P 500 Growth and Value indexes 10 years ago would now have 58% of assets in growth and 42% in value.

Great Values

Low-cost ETFs are an inexpensive, easy way to add value stocks to your portfolio. The SPDR S&P 500 Value ETF (symbol SPYV, $30) tracks its namesake index. The fund holds 384 stocks and charges an expense ratio of 0.04%. Top holdings include Berkshire Hathaway, JPMorgan Chase and ExxonMobil. Invesco S&P 500 Pure Value ETF (RPV, $67), with an expense ratio of 0.35%, tracks a limited version of the index featuring only stocks that rank in the bottom third of the S&P 500 by market size and that score high marks for value. Top holdings include CenturyLink and Kohl’s.

For a more targeted approach, consider Kiplinger ETF 20 member Invesco Dynamic Large-Cap Value (PWV, $36). The ETF charges 0.56% of assets and screens holdings for 10 factors, including quality and favorable share-price and earnings trends. The resulting 50-stock portfolio is full of blue chips, such as Procter & Gamble, Coca-Cola and Walt Disney.

Among actively managed funds, consider Dodge & Cox Stock (DODGX), a member of the Kiplinger 25, the list of our favorite no-load funds. The fund’s contrarian managers buy into fundamentally strong businesses whose shares are underpriced because of negative investor sentiment or unfavorable market environments. T. Rowe Price Value (TRVLX) invests in stocks that trade at a discount to historical averages, shares of their peers or the broad market. Both funds sport 15-year returns that place them among the top 13% of large-company value funds over that period.

Comanagers Stephen Yacktman and Jason Subotky at AMG Yacktman Focused Fund (YAFFX) home in on high-quality stocks trading on the cheap, favoring firms with robust free cash flow (cash profits left over after capital outlays) and little exposure to swings in the economy. An insistence on quality has bolstered returns during down markets. The fund, which at last check held only 22 stocks, lost 11.3% in the 2011 stock market correction, compared with an 18.6% decline in the broad market. Top holding: 21st Century Fox, Class B.

Boston Partners All Cap Value (BPAVX) has also proved its mettle during down markets. Manager Duilio Ramallo’s decision to lighten up on financial stocks paid off in 2008. The fund’s 27.6% loss that year beat the S&P 500 by 9.4 percentage points and placed it among the top 4% of large-company value funds. Today, financial stocks are back in the fund’s good graces: JPMorgan Chase, Bank of America and Citigroup are three of the fund’s top four holdings. The fund is also bullish on old-school tech, including Cisco Systems and Oracle.

Successful value investors share a common trait: patience. For those who can wait long enough, the strategy will pay off, says Leuthold’s Opsal. “At some point, the great growth winners of this bull market are going to run out of gas and people are going to get tired of overlooking consumer staples, financials and energy shares. The timing is not something you can put your finger on,” he says, “but there are a lot of ways for value to win.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.