Bonds: Time to Pull Back

With corporate and municipal bond yields down and interest rates likely to rise, the best buying opportunities are abroad.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

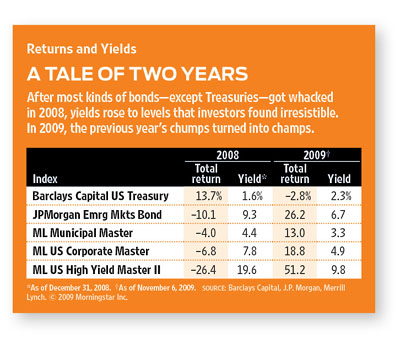

Bond investors are sitting pretty as we ring in 2010. They’ve erased all of their 2008 losses, thanks to a dramatic rebound in prices following the collapse of most types of bonds during the financial crisis. The bad news is that with prices for corporate and municipal bonds up (and yields, which move inversely with prices, down), the opportunity for further gains is limited. So, expect to earn what a bond or bond fund currently yields over the coming year and little more.

Treasuries, which were stars during the financial crisis, performed poorly during the past year as their yields rose from the panic-induced record lows of late ‘08. The yield on the ten-year Treasury, 3.5% in early November, should pass 4% in 2010, suggesting further price declines for government bonds (the longer-term outlook is also negative). As for short-term yields, Kiplinger’s expects the Federal Reserve Board to start raising the federal funds rate this summer, a move that savers will welcome because money-market-fund and other short-term yields key off the Fed’s benchmark rate.

In the meantime, you should start trimming bond holdings that have grown into unusually large positions because of the 2009 recovery. Snip first at holdings that rallied the most -- probably any high-yield fund you own (see the table below for how different bond classes performed in 2008 and 2009). Matt Freund, manager of USAA High-Yield Opportunities, says that the past year’s recovery in junk bonds made sense because “default expectations were cut almost in half” as credit markets thawed and even weak companies were able to borrow once again. But from here on, the performance of junk bonds depends on the course of the economy. “We need to see more evidence that the recovery is stable” before putting new money into junk bonds, says Kathleen Gaffney, co-manager of Loomis Sayles Bond (symbol LSBRX), a member of the Kiplinger 25.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors in all kinds of high-quality debt -- government, corporate and municipal -- are faced with a conundrum: These securities tend to be more sensitive to interest-rate movements than are low-quality, high-coupon bonds. Some experts think that with the economy still sluggish, it’s too early to begin positioning for an interest-rate rise -- a stance that argues for buying long-maturity bonds, which offer higher yields than short-term issues. But, as Tom Atteberry, manager of FPA New Income fund, notes, “How will you know when it’s the right time to exit? When everyone else is trying to sell at the same time as you?”

To minimize rate risk, switch longer-maturity bonds to issues with shorter maturities. For example, investors in tax-free bonds could trim some holdings in Fidelity Intermediate Municipal Income (FLTMX) and move the proceeds to Fidelity Short-Intermediate Municipal Income (FSTFX).

If you haven’t already diversified into bonds denominated in foreign currencies, do it now. But check first to see whether your core bond fund already holds some foreign bonds. For example, Loomis Sayles Bond has 13% of its assets in bonds denominated in Canadian dollars -- a play on the country’s energy and commodity resources -- and another 15% in other foreign debt. For additional exposure, check out T. Rowe Price International Bond (RPIBX), which holds developed-market government IOUs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

How to Use 1031 Exchanges to Build Your Real Estate Empire

How to Use 1031 Exchanges to Build Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Where's the Best Place to Save for a House Down Payment?

Where's the Best Place to Save for a House Down Payment?Learn how timing matters when it comes to choosing the right account.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.