The Power of Index Funds

Index funds benefit investors in other ways besides low fees. Trading expenses and tax consequences are minimal.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

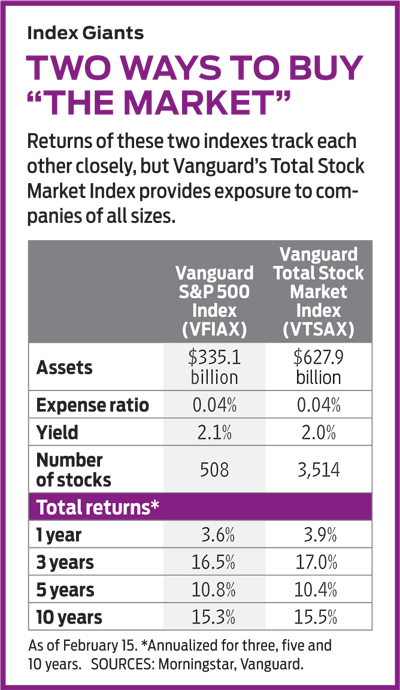

John Bogle used to joke that investing in managed mutual funds was like a second marriage: “It’s the triumph of hope over experience.” Bogle, an investment industry legend who died in January at 89, could have said the same about his own life. He survived at least six heart attacks and lived long enough to see the low-cost index fund—which he championed for 43 years at Vanguard, the firm he founded—go from an obscurity to a sensation. Moody’s predicts that index funds will claim more than half of the assets in the investment-management business in the next two to four years. All by itself, Vanguard 500 Index (symbol VFIAX), which is linked to Standard & Poor’s 500-stock index, has a portfolio valued at $335 billion. (For more on Bogle, see The Legacy of John Bogle.)

The rationale for the stock market index fund rests in the efficient-market hypothesis, the notion that the value of a stock reflects everything that’s known about it at the time. Under this theory, the future course of a stock’s price cannot be predicted. Rather, it moves in what Princeton economics professor emeritus Burton Malkiel called a “random walk,” which was the subject of his influential book A Random Walk Down Wall Street, first published in 1973. If markets are efficient, it is a waste of time and money to invest in a mutual fund run by a human being who picks stocks and bonds and charges you a significant fee for the effort. In the long term, a fund that reflects the whole market will beat managed funds because of two advantages: lower fees and immunity to the panic buying and selling of crowds.

Indexing works. The record of index funds validates this theory. In the 15-year period through June 30, 2018, Standard & Poor’s found that its S&P 500 index, composed of roughly the 500 largest companies on U.S. exchanges, beat 92.4% of large-cap funds. According to Morningstar, Vanguard 500 Index has done better than the majority of funds in its category (large-cap blend, a mix of growth and value stocks) in each of the nine calendar years through 2018. In the five years ending February 15, Vanguard 500 Index returned an annual average of 10.8%, nearly two percentage points a year more than large-cap blend funds, which returned an annualized 9.1%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Index funds benefit investors in other ways, too. Only a handful of companies in the S&P 500 change each year, so trading expenses and tax consequences are minor.

The competition for index investors has become intense. Last year, Fidelity launched a new series of funds with no fees at all, including ZERO Large Cap Index (FNILX), which is linked to Fidelity’s own index of 504 stocks that are nearly the same as those in the S&P 500. Vanguard charges just 0.04% for its 500 Index fund. (The firm recently closed the more expensive Investor share class of the fund to new investors, allowing Investor share class owners to convert to Admiral shares with just a $3,000 minimum investment.) Expenses are also 0.04% for shares of Vanguard S&P 500 (VOO), the firm’s exchange-traded fund, and 0.09% for SPDR S&P 500 (SPY), the most popular index ETF. A growing number of ETFs now trade commission-free.

The average managed large-cap fund has an expense ratio of 0.65%, according to Morningstar, so to beat an index fund that charges 0.04%, a typical active manager would need to outperform by 0.61 percentage point. That’s not easy.

ISO excellence. The question, however, is not whether a fund that will beat the index over the next five years exists. Of course it does. The question is whether you can find it. As analyst Mark Hulbert has written, “I’m not aware of any way of identifying in advance the select funds that will be able to beat the market over the long term.” One method that seems bound to fail is betting on funds that are doing well today. A study by S&P found that “out of 550 domestic equity funds that were in the top quartile [that is, the best-performing 25% of funds] as of September 2016, only 7.1% managed to stay in the top quartile at the end of September 2018.”

Still, some active managers seem to have a golden touch. Fidelity Contrafund (FCNTX), run by Will Danoff since 1990 and carrying an expense ratio of 0.74%, has returned an annual average of 10.5% for the past 15 years, compared with 8.3% for Vanguard 500 Index—and with similar risk. And there’s Warren Buffett, of course. The chairman of Berkshire Hathaway (BRK.A) has had enormous success by finding inefficiencies in the pricing of individual companies. “I’d be a bum on the street with a tin cup if the markets were always efficient,” he once said.

Trying to find funds—or putting together your own portfolio of individual stocks, for that matter—that can beat the indexes can be exciting, an intellectual challenge. And you certainly won’t beat the index with an index fund. But even Buffett is an index fund advocate. In the 2013 Berkshire Hathaway annual report, he said he would give this advice to a trustee for his own children: “Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors—whether pension funds, institutions or individuals—who employ high-fee managers.”

The S&P 500 is not the only index that reflects the stock market as a whole. You can get even broader exposure through funds such as Vanguard Total Stock Market Index (VTSAX), which reflects the performance of every exchange-listed U.S. stock and charges 0.04%. Although the S&P 500 index itself has about 10% of its assets in mid-cap stocks, the Total Stock Market fund has 17% in mid-cap stocks and 6% in small caps. Like the 500 Index fund, Total Stock Market is capitalization weighted, so the smallest companies have little impact on the price of the fund and the largest dominate—but not quite as much as with an S&P 500 fund. The three top holdings at the end of 2018 for the two funds were, naturally, the same—Microsoft (MSFT), Apple (AAPL) and Amazon.com (AMZN)—but they represented 10% of the assets of 500 Index and 8.3% of Total Stock Market.

Over the past 15 years, Total Stock Market has beaten Vanguard 500 Index by an annual average of three-tenths of a percentage point. The broader fund, with its mid and small caps, is slightly riskier—and more risk should yield greater rewards.

With about 2,500 holdings (Vanguard Total Stock Market has 3,500), Fidelity ZERO Total Market Index (FZROX) does the same job and charges no expenses. The only catch with these zero-fee funds is that you have to open a Fidelity brokerage account. If you prefer an ETF, good choices are Vanguard Total Stock Market (VTI), charging 0.04%, and iShares Core S&P Total U.S. Stock Market (ITOT), holding about 3,400 stocks and charging 0.03%.

How do you choose between an S&P 500 and a total-market fund? Over the past 10 years, the widest annual variance between the two Vanguard funds has been just two percentage points. But last year, in an attempt at streamlining, Vanguard removed the 500 fund as a selection for its employees’ 401(k) plan. “We believe the Total Stock Market Index fund is the best proxy for the U.S. market, offering exposure to large-, mid- and small-cap stocks,” said a spokesperson. My own view is that it makes no difference. Just bear in mind Bogle’s bon mot (attributed originally to Samuel Johnson), and pick experience over hope.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

Vanguard Cuts Fund Fees Again. Here's Why That's Important for You

Vanguard Cuts Fund Fees Again. Here's Why That's Important for YouVanguard recently cut fees on dozens of ETFs and mutual funds, which is great news for investors. Here's why.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.