4 Mutual Fund Managers Who Can Help You Beat the Market

Star fund managers are a vanishing breed, but I still think they offer value to the investor.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

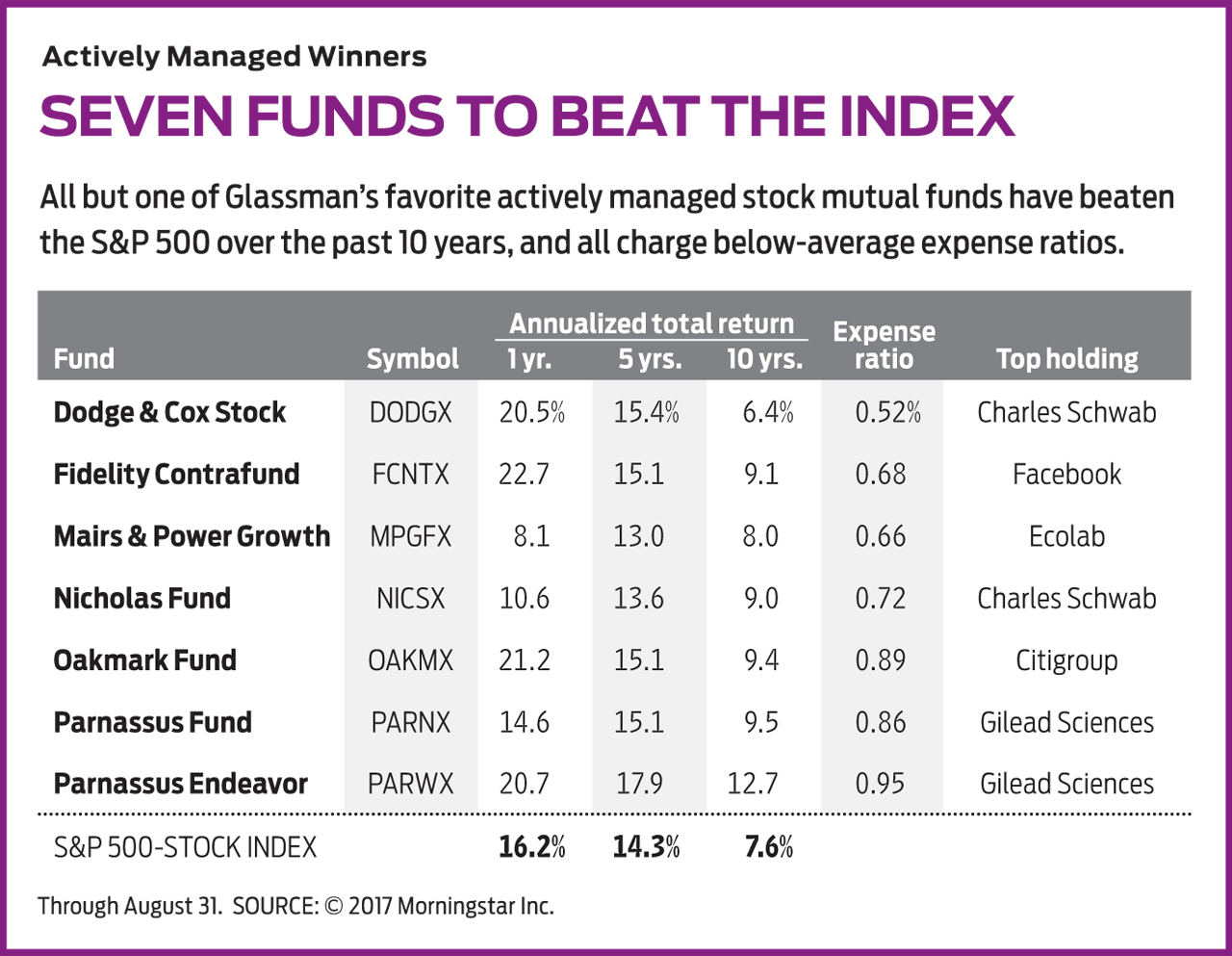

The era of the great mutual fund manager appears to be over. Investors are flocking to index funds, which essentially use computers to assemble portfolios that mimic benchmarks such as Standard & Poor’s 500-stock index. And no wonder. Research shows that over the one-, five- and 10-year periods that ended in June 2016, about nine in 10 actively managed funds failed to beat their benchmarks. In large part, that’s because managed funds charge higher fees than index funds. After all, humans get paid more than computers.

The unkindest cut came in a recent study by Morningstar, which found “no relationship between any type of management change and future returns” for mutual funds. Would Bill Belichick of the New England Patriots make a difference if he moved to coach the Cleveland Browns, the worst team in the NFL? You bet. But apparently, such changes don’t affect fund performance.

The Morningstar study also discovered that 75% of actively managed stock and bond funds are run by teams, compared with 50% just a decade ago. In other words, individual star managers are on the way out. Dodge & Cox Stock (symbol DODGX), one of my longtime favorites (and a member of the Kiplinger 25), lists eight managers. Certainly, in this case collaboration has worked. The fund has compiled a superb record and has grown to $67 billion in assets. (Boldfaced funds are those that I recommend.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Stars of yesteryear. Many of the best-known individual fund managers have left the field—some in ignominy, some in glory, some simply because it was time. After 30 years at the helm of Weitz Value (WVALX), Wally Weitz retired after his namesake fund finished in the bottom half of its category four years in a row. Donald Yacktman last year stepped down from his eponymous fund, now called AMG Yacktman (YACKX), leaving his son Stephen and comanager Jason Subotky in charge. The fund was also faring poorly, having trailed the S&P 500 in seven of the past eight calendar years (including the first eight months of 2017).

Weitz and Yacktman join a pantheon of onetime stars that includes Peter Lynch of Fidelity Magellan, Shelby M.C. Davis of Davis New York Venture, Foster Friess of AMG Managers Brandywine Fund, Marty Whitman of Third Avenue Value and John Neff of Vanguard Windsor, all of whom are still alive. This list also includes the late William Ruane of Sequoia; George Mairs of Mairs & Power Growth (MPGFX), a member of the Kiplinger 25; and, for that matter, John Templeton, T. Rowe Price, and on and on.

Why aren’t new grand masters taking their place? One reason could be that legions of analysts, harnessing the internet, have become more sophisticated and the market more efficient, so the bargains that a Templeton and a Lynch could spot in their time no longer exist in ours. Another reason may be that the best and brightest investment minds have left public mutual funds—whose fees are being ground down by competition from index portfolios—for hedge funds, whose sponsors get paid a percentage of the gains as well as of the assets under management. Or perhaps it was always a delusion that anyone could consistently outperform the market through superior stock-picking skills. With thousands of managers on the scene, the laws of chance would permit a few of them to turn in terrific records for a decade, maybe even two, but then revert to the mean.

Bill Miller is an instructive example. When he was running Legg Mason Value Trust—now called ClearBridge Value—he beat the S&P every calendar year from 1991 to 2005, a record for consistency. He then trailed the index badly in four of the next five calendar years, with a particularly disastrous 55% loss in 2008. Miller retired from that fund in 2012, but he continues to run what is now called Miller Opportunity Trust. Its record has been inconsistent, and, in any case, no fund is worth Opportunity’s annual expenses of 2.13%.

Maybe I am a hopeless romantic, but I still believe it’s worth your time to ferret out great managers who work either alone or with a small team. There aren’t many left. One is Bill Nygren, who has comanaged Oakmark Fund (OAKMX), along with Kevin Grant, since 2000. The pair practice classic value investing in the mold of Benjamin Graham, mentor to Warren Buffett. Over the past decade, Oakmark earned 9.4% annualized, compared with 7.6% for the S&P 500. The fund charges a reasonable 0.89% per year. (All returns are through August 31.)

For the past 27 years, Will Danoff has adeptly managed Fidelity Contrafund (FCNTX), which today has more than $100 billion in assets. The fund, which charges just 0.68% a year, gained 9.1% annualized over the past 10 years, beating the S&P 500 by an average of 1.5 percentage points per year. Moreover, Contra has outpaced its category benchmark (funds that focus on large-cap growth stocks) in seven of the past eight calendar years, including so far in 2017. The fund holds more than 300 stocks, led by Facebook, Berkshire Hathaway and Amazon.com.

Jerome Dodson, whom I praised in my otherwise negative column about socially responsible investing (see Why Socially Responsible Investing Is Not for Me), has led Parnassus Fund (PARNX) for 33 years and launched Parnassus Endeavor (PARWX) in 2005. Both have compact portfolios, charge average fees and have delivered exceptional returns, with Endeavor beating the S&P by an average of five percentage points per year over the past 10 years.

Nicholas Fund (NICSX), a large-cap fund that holds a healthy slug of midsize firms, beat the S&P every year from 2008 through 2014, before slipping behind the index the next two years and so far in 2017. The fund, which is managed in Milwaukee, far from the madding Wall Street crowd, holds such giants as Cisco Systems and Mastercard, as well as some smaller firms in boring businesses, such as Cintas, which rents work uniforms, and can maker Ball. The fund’s expense ratio is just 0.72%. Albert Nicholas, who founded the fund in 1969, died last year at 85. His son, David Nicholas, and a new comanager now run the fund.

I have a fondness for funds with the founder’s name on the door, but staying on top is tough for any manager. Among once-bright stars that have dimmed are Mario Gabelli and Robert Torray. Gabelli Asset Fund (GABAX) failed to beat the S&P in any calendar year from 2011 to 2016. Torray Fund returned just 5.3% annualized over the past 10 years, lagging the S&P 500 by an average of 2.4 percentage points per year.

Another cautionary tale involves Ken Heebner. After producing great returns at CGM Capital Development Fund, he started the wildly risky CGM Focus in 1997. In the 10-year period through 2007, Focus earned a spectacular 26% annualized, crushing the S&P 500 by an average of 20 percentage points a year. Since then, the road has been rocky. Over the past 10 years, the fund gained only 2.3% annualized, trailing the S&P by an average of 5.3 points per year and ranking at the bottom of the large-cap blend category.

But don’t count Heebner out. In a world where investing has been commodified, with index funds’ only competitive edge being their ability to cut hundredths of a point off their fees, it’s refreshing that a few old-school stock pickers are alive and kicking. I would not give managers such as Ken Heebner or even Jerome Dodson more than 5% to 10% of my stock money, but I would not ignore them, either.

James K. Glassman is the author, most recently, of Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks mentioned, he owns Amazon.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.