This Socially Responsible Mutual Fund Offers Low Fees, Low Minimums, Big Returns

A young fund that practices socially responsible investing climbs the one-year chart.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

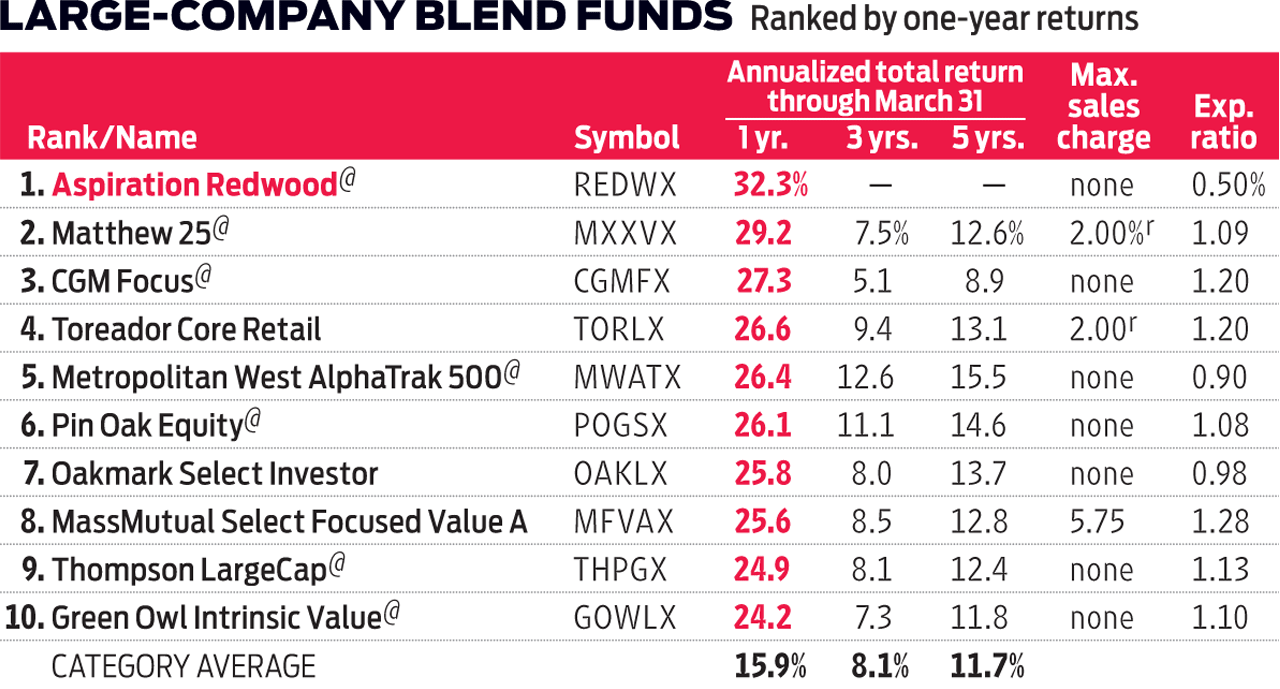

When an unfamiliar name pops up as a top performer, we’ll often take a closer look. It turns out that the fund in question, Aspiration Redwood (symbol REDWX), features a couple of investor-friendly benefits. Despite a tiny asset base of $16 million, the fund’s annual expense ratio is just 0.50%. And it requires just $100 to start.

Aspiration CEO Andrei Cherny says his firm is seeking to bring socially responsible investing to a wider audience. This power-to-the-people attitude explains the bite-size minimum, but what about the low fees? The fund’s costs are substantially greater than 0.50%, but for now Aspiration is capping the fees it charges shareholders at that level.

Bruno Bertocci and Thomas Digenan, of UBS Asset Management, run Redwood. To be considered, a firm must score high marks among its peers for its environmental, social and governance practices (one thing the fund looks for is diverse leadership). For the most part, the fund won’t invest in companies involved in fossil fuels, nor those in other blemished sectors, such as tobacco, alcohol and firearms. Beyond that, the managers seek firms with competitive advantages, talented executives and cheap share prices. The fund held 26 stocks at last word, with consumer-goods firm Newell Brands, drugmaker Eli Lilly and insurer Allstate holding the top slots.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

UBS Global's Solita Marcelli: It's a Green Light for U.S. Stocks in 2025

UBS Global's Solita Marcelli: It's a Green Light for U.S. Stocks in 2025A strong economy, rate cuts and continued AI spending should support stocks in the new year, says UBS Global's chief investment officer, Americas.

-

Stock Market Today: Stocks Rise Ahead of Fed

Stock Market Today: Stocks Rise Ahead of FedBank headlines dominated another choppy day of trading on Wall Street.

-

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank Concerns

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank ConcernsChaos in the financial sector stole the spotlight from this morning's inflation and retail sales updates.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Inflation Reduction Act a Blessing in Disguise for Drug Stocks?

Inflation Reduction Act a Blessing in Disguise for Drug Stocks?investing Coming limits on drug pricing may not be bad news for drug makers after all.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.