Why Investing Is No Mystery to Me

Just keep your eye on the long-term trends. That's where the investing opportunities lie.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market has literally gone nowhere for about two years now. And for two years pundits and experts alike have tried to offer explanations and predictions on when the market will break out from its' doldrums. The prognosis is mixed, with what seems like an equal split between whether that breakout will be to the upside or the downside.

Stories abound about the crisis of the day: from ISIS to Brexit; the dollar is up, the dollar is down; China's economy is crashing, China's economy is turning around; the Fed will raise interest rates, the Fed will lower interest rates…

But long-term market trends are more likely the result of long-term economic trends. The really big trends. The kind that tweaking monetary policy or changing Presidents won't really impact.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What we know is that the developed world's population is: 1) growing at one of the slowest paces in history and 2) aging. The ramification is huge. Older people buy less stuff. Smaller and older populations mean even less stuff gets bought. The manufacturing of stuff is the key driver to wealth creation through wages and consumption. Growing wealth means higher tax revenue without increasing tax rates. Conversely without the growth of stuff, wealth is stagnant and government deficits rise to meet increasing demands from an aging population and mandatory spending increases.

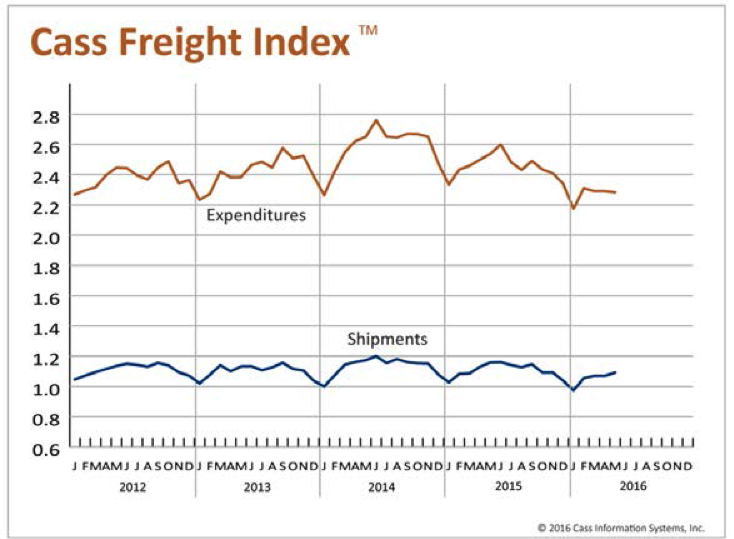

Below is a graph from the May Cass Freight Index Report. The top line is expenditures on freight shipments, which includes price and volume. Actual shipments is below, shown with the blue line.

The takeaway: Shipments have been flat since the beginning of 2012. Currently we are at a three-year low for comparable monthly shipments. Things aren't improving.

In the U.S., we are somewhat buoyed by a stronger, larger and growing service sector. But jobs and wages still require a vibrant manufacturing base for a broad-based economic revival.

The point is this: Until global demand for goods and services turns up, global economies will struggle, deficits will continue to rise and interest rates will remain low. You can knock yourself out following all the economic minutiae and various guesses as to what will affect what. But the simpler alternative is to follow how much product is being moved around the globe. When shipments and transportation indexes hit new highs, I'll be comfortable that any stock rally will be real.

Is There Hope for Change?

Demographically we could be in the economic doldrums for another decade or more, which could mean mediocrity for broad based indexes, such as those represented by the MSCI global indexes.

If not a purely stock picker's market, this could most likely be a sector picker's market. One way to possibly profit is to look at big trends, such as demographics, that are too big to be affected by the turmoil of the day. For example, when I hear people talk about the upcoming election and how they are afraid to invest, I simply ask, "Is anyone really going to stop buying drugs (legal), diapers or toilet paper, whether Trump or Clinton is elected?" So if you're really worried, buy Johnson & Johnson (symbol JNJ), Procter & Gamble Co. (PG) and Walgreen's (WBA). And collect your dividends while you wait for better times.

A new, bigger and hopefully a "not screw up-able" trend is the Internet of things. Some futurists predict everyone will own seven devices that will be connected to the Internet by 2020, in addition to their computer and smart phone. At first, I thought this seemed high. But let's count. In addition to my desktop and phone (I don't have a tablet device), I have two Amazon Kindles. My Garmin fitness/golf watch makes five. Sixth, there's my Amazon Firestick for TV. The other TV is a "smart TV," so that's seven. Two EcoBee Internet-connected thermostats bring me to eight and nine. Then there's my Fitbit scale.

Looks like I'm four years early.

And look at what's also available or coming soon: Samsung is advertising a refrigerator that connects to the Internet to inform you when you need things such as milk or when your broccoli is spoiling. Home security systems, better smart watches, the rest of your kitchen appliances – stoves will be capable of pre-programming to bake the perfect loaf of bread (no more timers or temperature settings).

And that is just in the home. Cars will all be linked (controlled) over the Internet. Every step of manufacturing will be monitored and controlled. Lawyers, medical doctors, virtually all professionals will have more and more data made available and analyzed by artificial intelligence. And all of the above produces data that needs a place to be uploaded and safely stored in the cloud.

By some estimates, this will all add up to a $6 trillion market over the next five years. Will a Brexit stop this trend? A rising (or falling) Yuan? Clinton or Trump? No. This is a trend in its infancy that will play out over the next decade.

Bottom Line

Sometimes we make investing too hard. The global economy and, by extension, stock markets certainly are sailing into a headwind. But that doesn't mean that industries and companies won't change. And where there is change there is opportunity. Global chaos doesn't mean not investing, or for heaven's sake, putting all your money into gold bars. Invest in consumer staple producers such as P&G and JNJ, and collect your dividends. And for growth, invest in the inevitable. Ignore the day-to-day analysis, and follow the big trends. Short-term volatility will make way for a long-term trend when we see the world making, shipping and selling more stuff.

Bill DeShurko started in the financial services industry in 1987. He is the owner of 401 Advisor, LLC, a Registered Investment Advisor.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bill DeShurko started in the financial services industry in 1987 and formed his own practice in 1994. He is the owner of 401 Advisor, LLC a Registered Investment Advisor located in Centerville, Ohio. After following fads, phases, and products of the day for nearly 30 years he hopes that his insights and experience can help today's investors navigate the financial markets.

-

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAATax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.