China A-Shares: 6 Reasons Why Investors Should Consider Them

It's not just about a Chinese recovery. It's about where that recovery should be most fruitful.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

China A-shares – domestic stocks traded in Shenzhen and Shanghai – have performed relatively well during this crisis. That fact might surprise many investors given that Asia's largest economy was home to the COVID-19 coronavirus outbreak that has claimed so many lives and brought the global economy to a virtual halt.

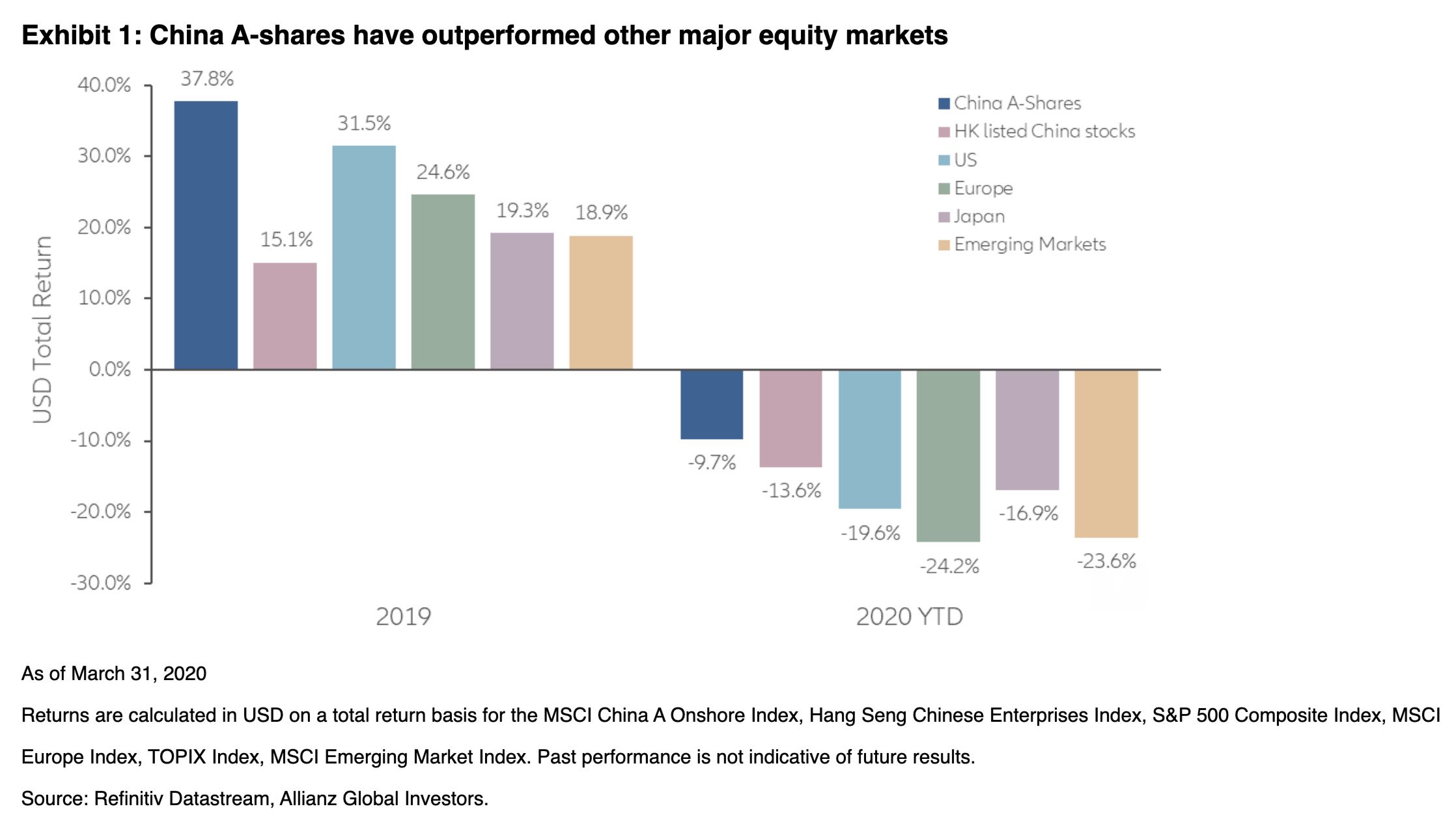

The comparative resilience of China A-shares is borne out in the data. While the MSCI China A Onshore Index, a key benchmark for the asset class, was down through the end of March, A-shares have shown relative strength compared to the S&P 500 and MSCI Europe indices (Exhibit 1). They also have outperformed "offshore" China companies (H-shares, traded in Hong Kong, and American Depositary Receipts traded in the U.S.).

The question now: Can investors expect this outperformance to be sustainable over the long-run and is an allocation to A-shares still a good opportunity today?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Six Reasons Why the Answer Might Be Yes

- China A-shares have historically been uncorrelated to other major equity indices. The correlation of A-shares with world equities was around 0.2 over the past decade, while the correlation with U.S. and European equities was even lower, according to Bloomberg data from the end of January 2020. That means including A-shares in a global portfolio might enhance optimization by generating a potentially better risk-return profile. Crucially, these low correlations have held up during the current crisis.

- China is getting back to work. The coronavirus appears to be contained in China after strict quarantine measures. Most of China's large companies and around two-thirds of its small- to medium-size companies have resumed work, according to China's Ministry of Industry and Information Technology. We held a large number of company calls in late March and were positively surprised about the pace of recovery, with most companies indicating they are operating at more than 75% capacity. This bodes particularly well for the recovery of China's domestic economy and for local consumption.

- China A-shares are largely shielded from global economic woes. As the domestic Chinese economy gets back to full speed, that is especially beneficial for A-share firms. That's because these companies typically generate 90% or more of their revenues domestically and engage in little foreign trade, therefore shielding them from economic weakness elsewhere.

- Chinese economic growth should rebound. Although the country is not yet out of danger, assuming China does not suffer a massive second wave of COVID-19 infection, we expect its economy will recover in the second half of this year. To be sure, it has been a particularly challenging year – before COVID-19, there was the African swine fever, the U.S. trade war and protests in Hong Kong. Nevertheless, currency and bond markets have been remarkably stable and, as noted earlier, Chinese equity markets have outperformed. It seems unlikely that China is facing the same sort of solvency stress as the rest of the world. Additionally, while firms reliant on trade may struggle as U.S. and European demand ebbs, we expect a pick-up in earnings from A-share companies as the domestic economy gets back to work. Also, Beijing has signaled it stands ready to use fiscal stimulus to achieve full-year economic targets.

- Technical factors support China A-shares. Domestic investors in China can typically only purchase bonds, property and A-shares. Low yields on domestic bonds coupled with high property prices support the trend of domestic investors continuing to demand A-shares. Domestic investors, employees and management of A-share firms have increased their ownership in the past two years: a trend we expect will continue. Foreign inflows to China A-shares should also persist as MSCI remains on track on its plan to gradually increase A-share weightings in their indices.

- Monetary policy is supportive. We are also optimistic because The People's Bank of China (PBoC) has higher interest rates than the U.S., Europe and Japan, giving it flexibility to cut rates further if economic growth falters. That said, we expect Chinese rates would remain higher than other regions even in the event of some easing by the central bank. Higher rates – the seven-day reverse repurchase rate is 2.2% after a March 30 cut – bode well for attracting capital inflows.

Among the best-performing sectors during the recent relative outperformance of A-shares have been industrials and capital goods. A-shares also have a heavy weighting toward consumer staples – a sector that is expected to perform well in the current environment.

Another reason to expect A-shares to perform well relative to U.S. equities is that whereas corporate stock buybacks were pervasive in the United States in recent years (and now are being cut back), in 2019, A-share firms only bought back 0.25% of their outstanding shares.

We have consistently contended that investors should diversify their portfolios for the long run with an allocation to A-shares. While many investors are understandably cautious about taking risk amid so much uncertainty, we nevertheless believe that this is a good time to consider A-shares, especially in light of currently discounted prices.

Anthony Wong, CFA is a lead manager responsible for China A-share equity portfolios and Shannon Zheng is a product specialist covering regional and China equity strategies, both for Allianz Global Investors based in Hong Kong.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.