Why Google and Facebook Get No Love from the Big Money

Neither company has been particularly friendly to dividend investors. And managers and activists know their votes hardly matter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Big institutional money managers tend to be the conventional sort, though I’m not talking about their blue power suits or country club memberships. I’m talking about their stock holdings. Managers tend to pile into the same set of large, mega-cap stocks because deviating from the crowd comes with major career risk.

Let me explain. Running a mutual fund is a fantastic, high-paying job, but it is also a precarious one. The fund’s success — and thus the manager’s paycheck — is directly tied to its assets under management. This creates tremendous pressure to conform to a benchmark, which is often the S&P 500.

A manager’s thinking goes like this: If I bet big and beat the benchmark by going outside the mainstream, my investors are happy…for a day or two. But if I bet big and lose, I might be out of a job.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So, the result is that most managers become closet indexers who overweight a handful of stocks and hope to beat the market by a percent or two.

Imagine how surprised I was when I saw this chart in the Financial Times, which tracks institutional ownership of nine major tech companies. (Google makes the list twice, so it’s ten stocks but just nine companies.)

The large overweightings in Expedia (EXPE) and Trip Advisor (TRIP) aren’t that surprising. Expedia and Trip Advisor account for just 0.059% and 0.054% of the S&P 500, respectively, so even a small amount of institutional buying will put these stocks out of proportion to the rest. And the overweighting of Netflix (NFLX) is also pretty understandable given that it is one of the best performing stocks in the S&P 500 this year. It’s near the tail end of the chart that the numbers get interesting.

Two of the biggest names in tech — Facebook (FB) and Google (GOOGL) — are massively underowned by institutional investors relative to what their weightings in the S&P 500. And where it gets even stranger, institutional ownership of the less favorable of Google’s two traded share classes — the non-voting Class C shares (GOOG) — is “where it should be” relative to its weighting in the S&P 500. It’s the A shares (GOOGL), which actually have voting rights, that are underowned.

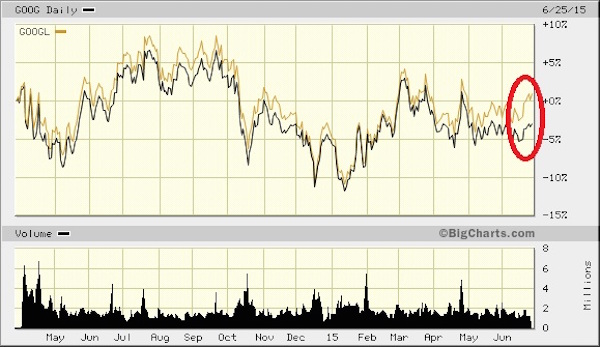

What’s going on here? Why are big money investors shunning Facebook and Google? Let’s look at Google first. There are two issues: The discrepancy between the share classes and the overall underweighting of Google stock by institutional investors. The latter is the easier of the two to explain. Managers don’t care about the lack of voting rights because they know their votes hardly matter. For would-be activists or corporate raiders, Google is an unassailable company. Its founders hold non-traded “super voting” class B shares that make any sort of proxy battle a virtual impossibility. GOOG’s consistent discount to GOOGL, which has actually widened recently, really makes no sense in this context, so it’s perfectly logical for an institutional manager to overweight the cheaper GOOG relative to GOOGL.

As for the issue of Google being underweighted overall… well, it might come back to that point I made about Google being unassailable. Google is not known for being particularly friendly to its shareholders (see my blog post Hey Google, Stop Being Such a Baby and Pay a Dividend.) Google is a profitable company that mints money, yet it has developed a reputation for being the plaything of its founders rather than a profit-maximizing business.

The same goes for Facebook. Zuckerberg is a ruthless competitor and one of the few people that seems to know how to actually make money in social media. Yet, Facebook has also burned through shareholder money on expensive acquisitions of dubious economic value (Oculus, Whatsapp, etc.) and expenses grew at twice the rate of revenues last quarter. Is there a trade here?

Maybe. While I don’t see an immediate catalyst to change big money minds (neither Google nor Facebook will be paying a dividend anytime soon… sigh…), you could view the underownership as a contrarian value signal.

The safest move, however, might be a pair trade. Short GOOGL and go long GOOG, and eke out an arbitrage profit as the discount closes.

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal, and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.