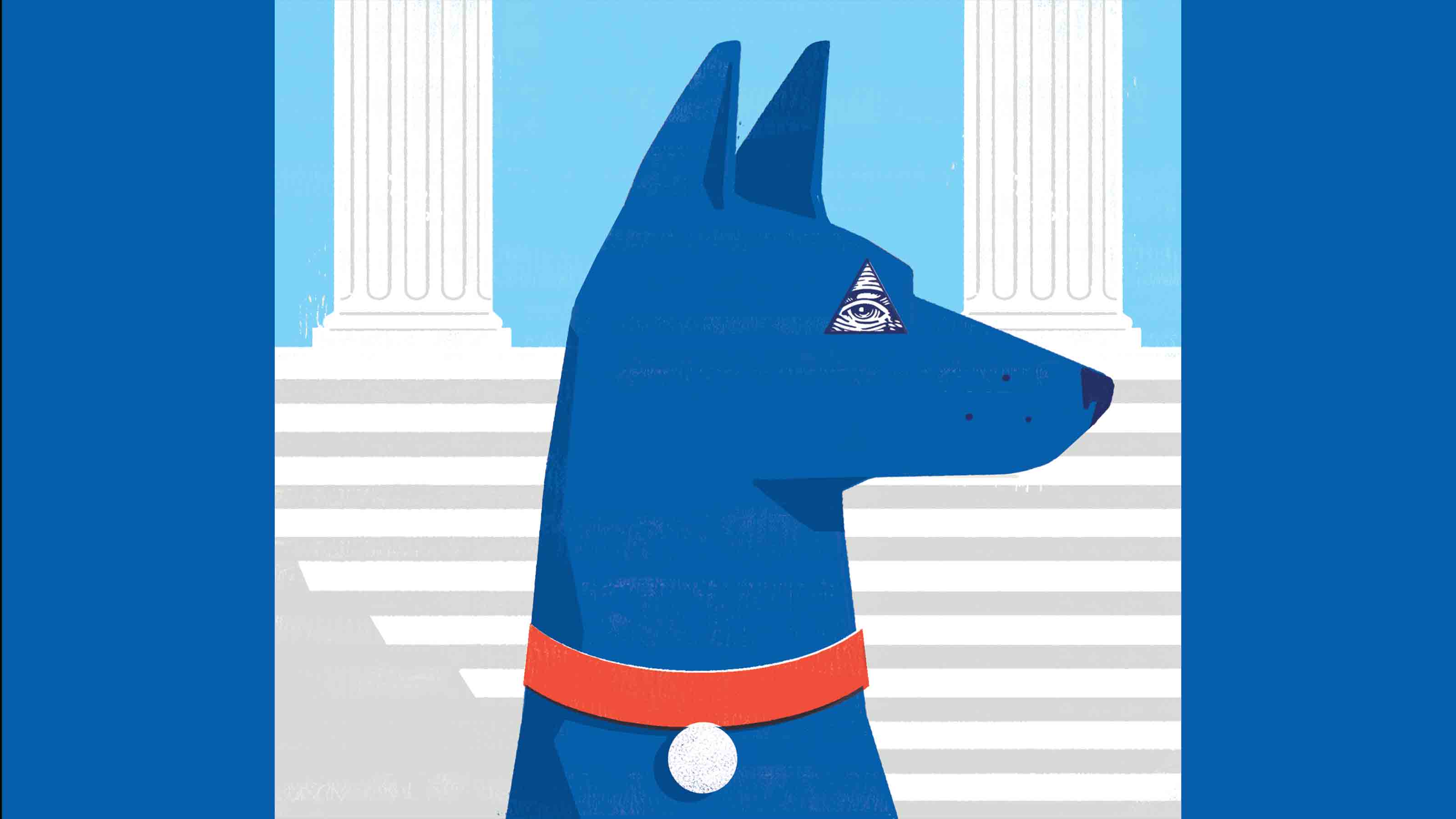

Should Rich Immigrants Be Able to "Buy" Permanent Visas?

U.S. immigration policy should tilt toward admitting people who actually want to work in this country. An immigrant's wealth shouldn't by itself confer priority for citizenship.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Q. I hear that thousands of wealthy foreign families, mostly Chinese, are allowed to gain permanent residency in the U.S. each year by investing $500,000 each in a new American business venture that creates at least 10 new jobs. Do you think this is ethical?

A. I have deep misgivings about the EB-5 visa program you’re referring to, and not just because it has attracted fraudulent promoters.

U.S. immigration policy, which is flawed in many ways, should tilt toward admitting people who actually want to work in this country, at jobs with shortages at both the low and high ends of the labor market, ranging from agriculture to high tech. An immigrant’s wealth shouldn’t by itself confer priority for citizenship.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Supporters of the EB-5 program argue that the foreign capital it attracts—an estimated $1.8 billion annually in recent years, $6.8 billion total since 1992—has created 49,000 new jobs in rural and high-unemployment urban communities, which are the intended beneficiaries of the program.

But claims of robust job creation have been disputed by impartial studies, and the dynamic American economy attracts plenty of foreign investors even without the offer of permanent residency.

What’s more, most of the EB-5 investment has been made in just one business sector: commercial real estate, such as hotels, offices and stores. And loopholes in the definition of an economically distressed place have led to EB-5 certification of ritzy realty projects in affluent areas of Los Angeles, New York City and Washington, D.C., which have no trouble attracting conventional capital. (Investors of $1 million don’t have to meet the depressed-locale requirement that applies to $500,000 investors.)

Of the 10,000-plus wealthy visa applicants approved in 2014 (including their spouses and unmarried children under 21), about 85% were from China. It appears that these immigrants are much less interested in an investment return—which is often very meager—than in the prospect that their children can legally remain in the U.S., not just for college but forever after.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Knight came to Kiplinger in 1983, after 13 years in daily newspaper journalism, the last six as Washington bureau chief of the Ottaway Newspapers division of Dow Jones. A frequent speaker before business audiences, he has appeared on NPR, CNN, Fox and CNBC, among other networks. Knight contributes to the weekly Kiplinger Letter.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

What Will Happen With Health Costs in 2023

What Will Happen With Health Costs in 2023Business Costs & Regulation Higher drug costs are likely to accelerate health insurance premium increases.

-

Biden Puts New Cops on the Money Beat

Biden Puts New Cops on the Money BeatBusiness Costs & Regulation President Biden has nominated well-known watchdogs to head agencies that regulate the financial sector.

-

SEC Dings Robinhood for Trading Charges

Business Costs & Regulation The complaints are a reminder to investors who pay low or no commissions to investigate more-opaque costs.

-

Retirees, Create An Emergency Fund for Rental Property

Retirees, Create An Emergency Fund for Rental PropertyBusiness Costs & Regulation Build a cushion to protect your income from an unforeseen crisis.

-

What Corporate Profits Really Tell You

What Corporate Profits Really Tell Youstocks You need to go beyond the headlines to interpret a company’s earnings.

-

4 Myths about the ADA that Could Cost You a Lot of Money

4 Myths about the ADA that Could Cost You a Lot of MoneyBusiness Costs & Regulation You probably didn't open your business or become a landlord because you love rules and regulations, so you might not grasp the intricacies of the Americans with Disabilities Act. Here are four ADA myths you can't afford to believe.

-

How Can the Approval Process for New Drugs Be Speeded Up?

How Can the Approval Process for New Drugs Be Speeded Up?investing There are many reform proposals, including some from free-market think tanks.

-

Honoring Deceased Parents’ Wishes

spending Your siblings are under no legal obligation to help if your parents’ will is silent on a subject.