A Better Way to Tell a Correction from a Bear Market?

You could go by the usual definition, but dive a little deeper into the market and you might get a better indication of what's going on before making any stock moves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The standard definition of a correction is a 10% market decline, while a bear market is a 20% decline. These are simple definitions … I take a different view.

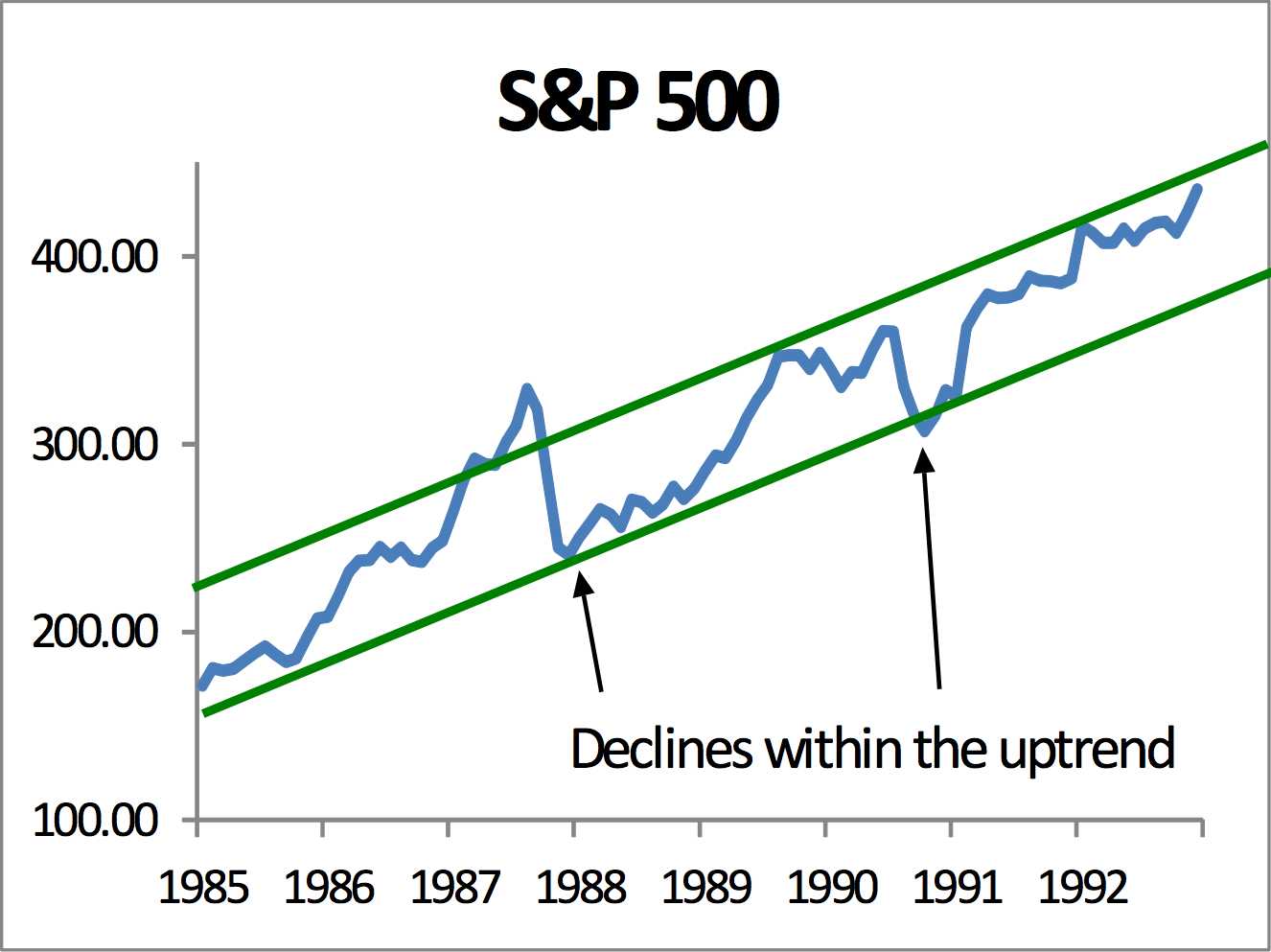

At Cornerstone, we view a correction as a significant decline within an up trend. The key here is that the up trend continues after the correction is over. Two examples are the crash in 1987 and the correction of 1990. In both cases, the market fell 20% or more, yet they recovered quickly and the up trend continued.

As you can see in the chart below, the up trend (green lines) continued upward, but the market, (blue line) vacillated between the two green up trend lines. Since the declines did not reverse the trend, they were only corrections, however, since they were declines of over 20%, by the standard definition, they were called bear markets.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why is that significant? Buying the dip has been a successful strategy for investors over the past nine years. Corrections can be a buying opportunity, since the market is still in an up trend. Current positions do not need to be sold, again since the market is still in an up trend.

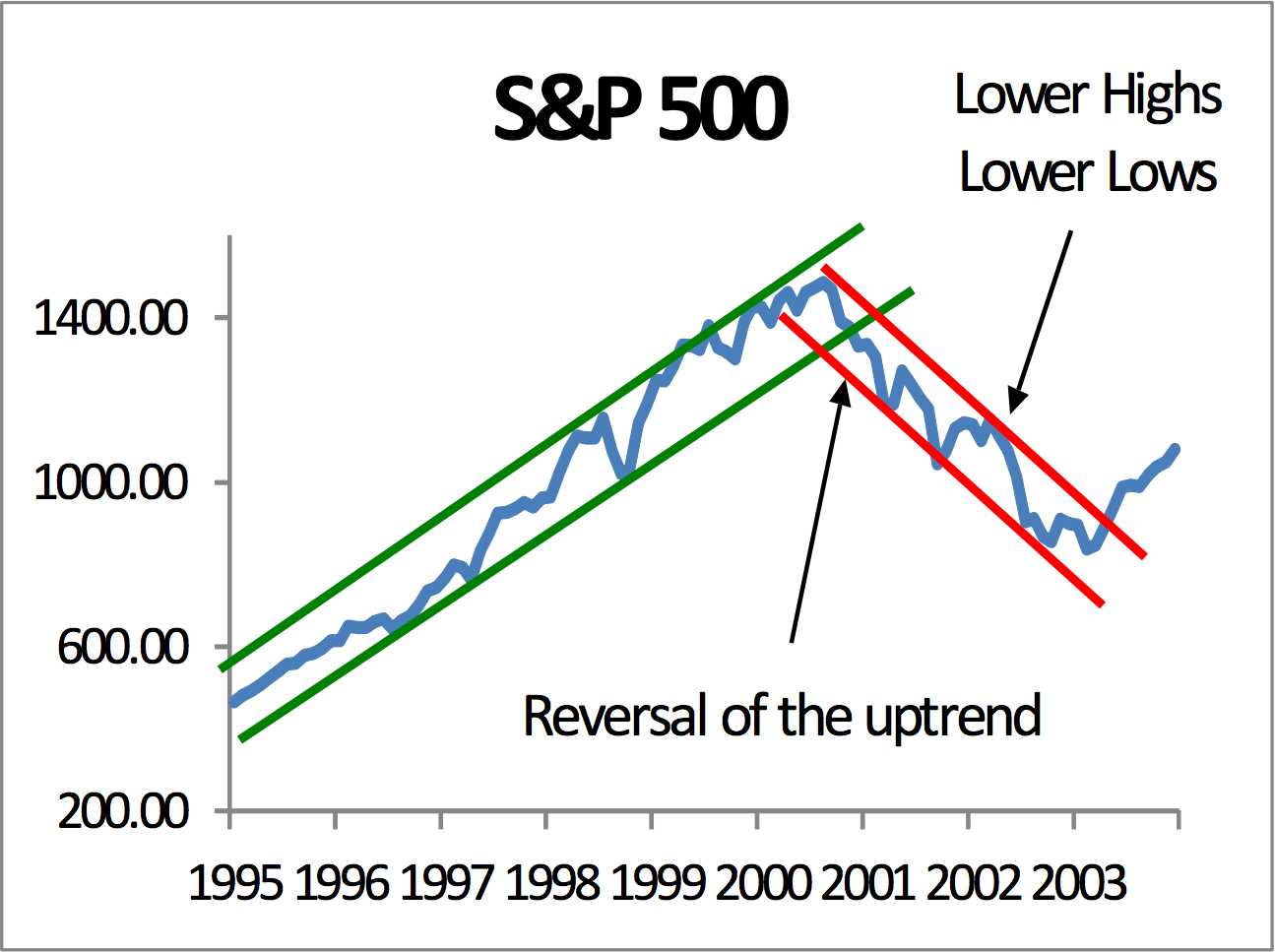

At Cornerstone, we define a bear market as the reversal of an up trend. This can be seen in 2000 and 2007. A reversal of an up trend is usually characterized by a chart with lower lows and lower highs. Since the lows keep going lower, the chart reverses trend, and an up trend starts to head down (red lines).

For investors, what that means is with a bear market, rallies are to be sold, and dips are not bought. As you can see from the chart, buying the dips only leads to lower lows. Selling rallies is the wise move in a bear market.

Once a chart breaks above the down trend and the lows start getting higher and the highs start getting higher, the bear market is over and the market has reversed into a bull market.

Why do markets peak, and how far can a bear market go? Overvaluation makes markets fragile. So the more overvalued, the more vulnerable it is to a correction or a bear market. Historically, bear markets (as defined by Cornerstone) did not bottom until valuations were extremely low. The price-to-earnings ratio of the market has hit single digits in the past at bear market bottoms. Today’s Shiller P/E is over 30.

How can you tell if a correction is on its way to becoming a bear market? You don’t know until the chart tells you. If after a decline, the market fails to return to its up trend, that is a sign that a bear market has begun.

Where are we today? As you can see in the chart below, the market has not made lower lows, which means the first step in a bear market hasn’t happened yet. So, for now, the market is in a correction.

The green lines indicate the long-term up trend. The thin orange line indicates what some call the “Trump rally.” This refers to the market’s rise since President Trump was elected. On the Dow Jones, this Trump rally trend could be broken, and the market could drop a bit further, but it still has a ways to go before it even falls to the level of the top green line that marks the upper limits of the up trend. As long as it holds that trend line, and follows it up, the market would not have fallen into a bear.

The S&P chart above is a little different. The upper end of the up trend channel and the Trump rally are hitting the same spot right now. So a failure of one means the failure of the other. As you can see by the chart, the S&P is currently slightly below each trend line.

Does this mean it’s the start of a bear market? Not yet. The first indicator would be if the low fell below the previous low from the 1st quarter of 2018. And then the subsequent rally would have to fail to make new highs, at least above the upper trendline. Then time will tell.

Watching if the lows go lower and the highs go lower are good signs the market is rolling into a bear. And especially if the market drops below the lower green up trend line.

In the meantime, it’s only a correction within an up trend, and should be treated as such, by holding onto quality investments and adding investments that have become oversold. Will it turn into a bear market? Only time will tell, so we are watching things closely and have strategies — such as selling into rallies, reducing equity exposure, and raising cash among others — for various outcomes.

Third-party posts do not reflect the views of Cantella & Co Inc. or Cornerstone Investment Services, LLC. Any links to third-party sites are believed to be reliable but have not been independently reviewed by Cantella & Co. Inc. or Cornerstone Investment Services, LLC. Securities offered through Cantella & Co., Inc., Member FINRA/SIPC. Advisory Services offered through Cornerstone Investment Services, LLC's RIA.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In 1999, John Riley established Cornerstone Investment Services to offer investors an alternative to Wall Street. He is unique among financial advisers for having passed the Series 86 and 87 exams to become a registered Research Analyst. Since breaking free of the crowd, John has been able to manage clients' money in a way that prepares them for the trends he sees in the markets and the surprises Wall Street misses.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.