These Services Alert You to Identity Theft. Are They Worth It?

A number of services promise to notify you if you are a victim of credit fraud. But you'll pay a hefty fee.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The problem with identity theft is that you probably won't know when your personal data has been stolen–or even whether you've been a victim. A recent study by Javelin Strategy & Research found that the number of identity-fraud victims in the U.S. totaled 16.7 million in 2017. But that's only the tip of the iceberg, because the data of many millions more Americans has been exposed and may be used in the future to open fraudulent accounts. Last year's Equifax breach alone exposed addresses, birth dates, Social Security numbers and other sensitive data for nearly 146 million people, launching them into ID fraud limbo.

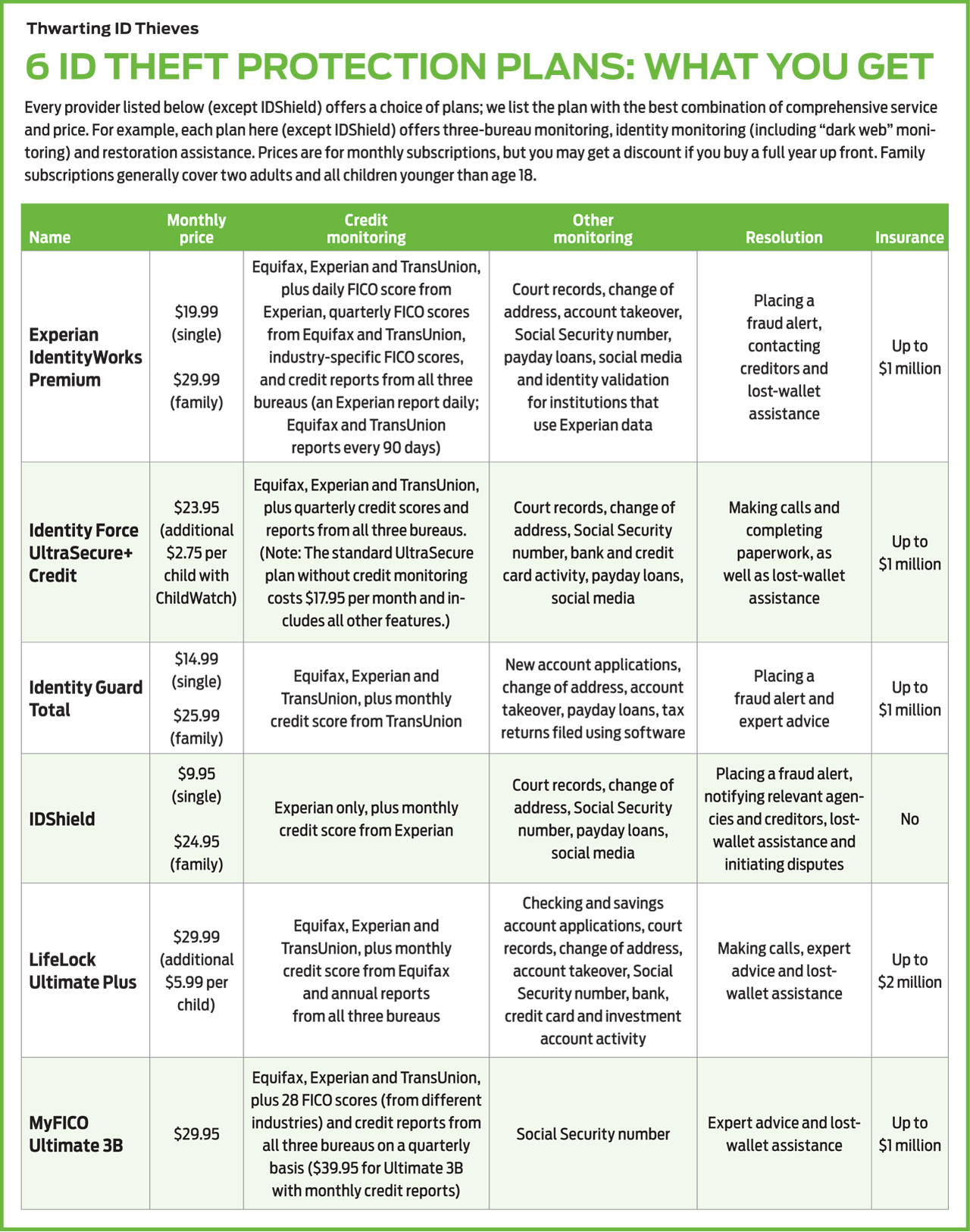

Enter ID theft protection services. For $10 to $30 a month, they will alert you via text, e-mail or mobile app if they detect (or suspect) misuse of your data or accounts–perhaps sooner than you'd notice on your own–and to walk you through repairs.

Do you need an ID theft protection service? That depends on how much you're willing and able to do by yourself. Most paid plans offer at least one tier that watches over all three credit bureaus at once and can flag changes to your reports–such as the appearance of a new credit account–more quickly than you might detect by ordering your once-a-year freebies from www.annualcreditreport.com. Moreover, a good service will sweep online databases to see if your personal details pop up in court records, payday loans, sex offender registries or applications for new financial accounts. The service will also keep an eye out for address changes that could suggest a criminal is trying to reroute your mail, and it might look out for unfamiliar names or addresses linked to your SSN, too.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

ID theft protection services often scour the secret chat rooms and black-market websites of the "dark web" for evidence that your SSN, e-mail address, driver's license number, passport number, mother's maiden name and other identifying info are up for grabs. "Some of this monitoring is challenging or dangerous to do on your own without the technical know-how," says Eva Velasquez, president of the Identity Theft Resource Center. And although freezing your accounts is an important preventive step, it won't stop a crook from fiddling with your existing accounts.

Monitor to the max. A comprehensive package includes four main services: monitoring your credit report, monitoring other data tied to your identity, dealing with the aftermath of ID theft, and covering certain costs to restore your identity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Seven Things You Should Do Now if You Think Your Identity Was Stolen

Seven Things You Should Do Now if You Think Your Identity Was StolenIf you suspect your identity was stolen, there are several steps you can take to protect yourself, but make sure you take action fast.

-

The 8 Financial Documents You Should Always Shred

The 8 Financial Documents You Should Always ShredIdentity Theft The financial documents piling up at home put you at risk of fraud. Learn the eight types of financial documents you should always shred to protect yourself.

-

How to Guard Against the New Generation of Fraud and Identity Theft

How to Guard Against the New Generation of Fraud and Identity TheftIdentity Theft Fraud and identity theft are getting more sophisticated and harder to spot. Stay ahead of the scammers with our advice.

-

12 Ways to Protect Yourself From Fraud and Scams

12 Ways to Protect Yourself From Fraud and ScamsIdentity Theft Think you can spot the telltale signs of frauds and scams? Follow these 12 tips to stay safe from evolving threats and prevent others from falling victim.

-

Watch Out for These Travel Scams This Summer

Watch Out for These Travel Scams This SummerIdentity Theft These travel scams are easy to fall for and could wreck your summer. Take a moment to read up on the warning signs and simple ways to protect yourself.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

How to Guard Against Identity Theft in 2025

How to Guard Against Identity Theft in 2025Scammers are getting better at impersonating legitimate businesses.