Federal Deficit in the Danger Zone

As federal spending continues to rise, a crushing mountain of debt looms.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

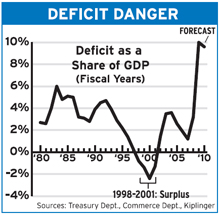

Time is running out for attacking the deficit. The danger, once distant, is now close. Soaring deficits are jacking up the national debt, resulting in higher interest rates and raising the odds of an even weaker dollar, which would stunt economic growth and lower Americans’ future standard of living.

Spending is out of control. For years it has averaged about 20% of GDP. This year, it’ll be about 25%. Some of that is due to spending on war in the Middle East as well as efforts to cushion the effects of the recession through higher unemployment benefits, aid to banks and state governments, spending on roads and highways, and more. Plus, tax receipts diminished as the economy shrank.

But even after the economy fully recovers, outlays won’t ebb. The growing ranks of retirees mean that Medicare and Medicaid costs will keep soaring, even if health care reform successfully curbs increases in the cost of care -- an iffy proposition at best.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Such entitlement programs -- those that lawmakers don’t control on a year-to-year basis but that run on a sort of autopilot -- account for 54% of federal spending. And they’ve climbed 6.4% on average a year since 2000. When it comes to spending that it can control annually, Congress has shown little restraint. Discretionary spending, which includes defense and an array of domestic programs from national parks to the FBI, has risen over the past decade at an average of 7.5% a year.

The result is an annual deficit that in fiscal 2009 was equal to nearly 10% of GDP, the largest since it hit 21.5% in 1945 at the end of World War II. What’s worse is that a mountain of debt will continue to pile up even if the politicians in Washington manage to keep a rein on spending and trim the yearly deficit. In fiscal 2009, federal debt held by the public jumped by a third, to $7.8 trillion. At the end of fiscal 2008, debt held by the public measured 41% of GDP. By 2014, it’ll equal a whopping two-thirds of GDP.

The interest payments on the debt will be staggering. They could soar to as much as $800 billion a year by the end of this decade, gobbling up 16% of the total budget. Indeed, servicing the debt may become the single biggest item in the federal budget, surpassing Medicare, defense and Social Security.

That will raise the cost of borrowing for everyone -- households and businesses alike. And it threatens to derail the U.S. economic engine. A jump in the debt from 40% of GDP to 60% would boost the rate on Treasury bonds by a full percentage point. Other interest rates, such as those for mortgages and corporate bonds, would follow. And if the U.S. loses its top credit rating -- until recently, an unimaginable event -- interest rates will increase even more. China, Saudi Arabia and other cash-rich nations would insist on higher returns to keep buying U.S. Treasuries at auctions.

Foreign nations, which own about half of the $7.8 trillion public debt, don’t need to sell to make waves. They could simply slow their rate of buying. That might tempt the Federal Reserve to buy debt in order to stave off a rise in interest rates. But that’s no way out. “Countries have tried that and seen double-digit inflation,” says Rudy Penner, former director of the Congressional Budget Office, now with the Urban Institute. “Even the tiniest probability of that has to be avoided.”

There are no easy fixes. Diane Swonk, chief economist with Mesirow Financial, says, “We’re going to have to cut overall spending and raise overall taxes.” In fact, solving the problem will take unparalleled restraint, and determination by elected officials of all stripes.

For weekly updates on topics to improve your business decisionmaking, click here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

How AI Chatbots Can Secretly Give Biased Advice

How AI Chatbots Can Secretly Give Biased AdviceThe Kiplinger Letter “Poisoned” artificial intelligence can give untrustworthy advice about finance, health and lots more. Here’s how to fend off the growing threat.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

A Scary Emerging AI Threat

A Scary Emerging AI ThreatThe Kiplinger Letter An emerging public health issue caused by artificial intelligence poses a new national security threat. Expect AI-induced psychosis to gain far more attention.

-

An Inflection Point for the Entertainment Industry

An Inflection Point for the Entertainment IndustryThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Humanoid Robots Are About to be Put to the Test

Humanoid Robots Are About to be Put to the TestThe Kiplinger Letter Robot makers are in a full-on sprint to take over factories, warehouses and homes, but lofty visions of rapid adoption are outpacing the technology’s reality.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.