Why Stocks Beat Bonds

Rapid economic growth isn't necessary to generate healthy stock-market returns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Granted, it's been a rough decade for stock-market investors. But even if you include the past ten years, the long-term return on stocks has been between 6% and 7% per year after inflation. And that return has dominated all other asset classes. Recently, a few investment gurus -- led by Pimco's Bill Gross and Mohamed El-Erian -- have predicted that future returns on stocks will disappoint investors. They've coined the term new normal to represent the slow-growth economy -- and diminished stock returns -- that they believe investors can expect in the future.

But I would take issue with their assumptions. Rapid economic growth isn't necessary to generate healthy stock-market returns. In fact, based solely on current share prices and the market's current earnings power, stocks should be very rewarding for long-term investors.

Projected returns. Stock investors can project their returns using techniques similar to those that bondholders use. A bond promises to pay a fixed coupon year after year, and the expected return on the bond can be expressed as the coupon divided by the price of the bond. Although stockholders do not have a guaranteed coupon, they do have a claim on a company's earnings. As of February 15, the price-earnings ratio of Standard & Poor's 500-stock index, based on estimated 2010 profits, stood at 14.2. If we take that P/E and stand it on its head, effectively calculating the market's earnings-to-price ratio, we get 7.1%. That figure is known as the market's "earnings yield" and represents the return that investors would receive if the companies in the S&P 500 paid out all of their earnings as dividends. That far exceeds the recent yield of 3.7% on a ten-year Treasury note or even 4.6% on a 30-year bond.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Proponents of bonds will point out that although stocks might be projected to earn 7.1%, the market's current dividend yield -- representing the cold, hard cash actually paid to stockholders -- is only 2.1%. However, earnings that are not paid out can be reinvested by management. That alone has helped dividends grow at a 5% annualized rate over the long term. Even if a company lacks opportunities for growth, management can use the excess cash to increase dividends or buy back shares, which should, at least in theory, prop up a stock's price. Any capital gains should be added to the dividend yield to calculate total stock returns.

Even the three- to four-percentage-point difference between stock and bond yields understates the advantages of stocks. Most government bonds aren't adjusted for inflation, so investors receive the same number of dollars in the future as they do today, even if inflation wipes out a substantial part of their purchasing power. In contrast, stocks are claims on real assets, such as land, factories and equipment, as well as the ideas, patents and all other capital that generate corporate profits and appreciate over time with the general level of prices. So that 7.1% yield on stocks can be considered the expected real, or after-inflation, return.

Of course, you can buy Treasury bonds that are indexed to inflation (see Why You Need TIPS). But the current real yield on ten-year Treasury inflation-protected securities is just 1.4%, and 2.1% on 30-year bonds. The projected returns from stocks, at five to six percentage points above those yields, are generous by historical standards.

Skeptics will point out that earnings estimates may not be realized. But in sharp contrast to the past two years, analysts have been aggressively boosting their estimates for 2010 after a near-record number of firms beat projections for the fourth quarter of 2009. And with prospects poor for juicy returns in the bond market, there are good reasons to believe stocks will outpace bonds in the coming year and over the long haul.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania's Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

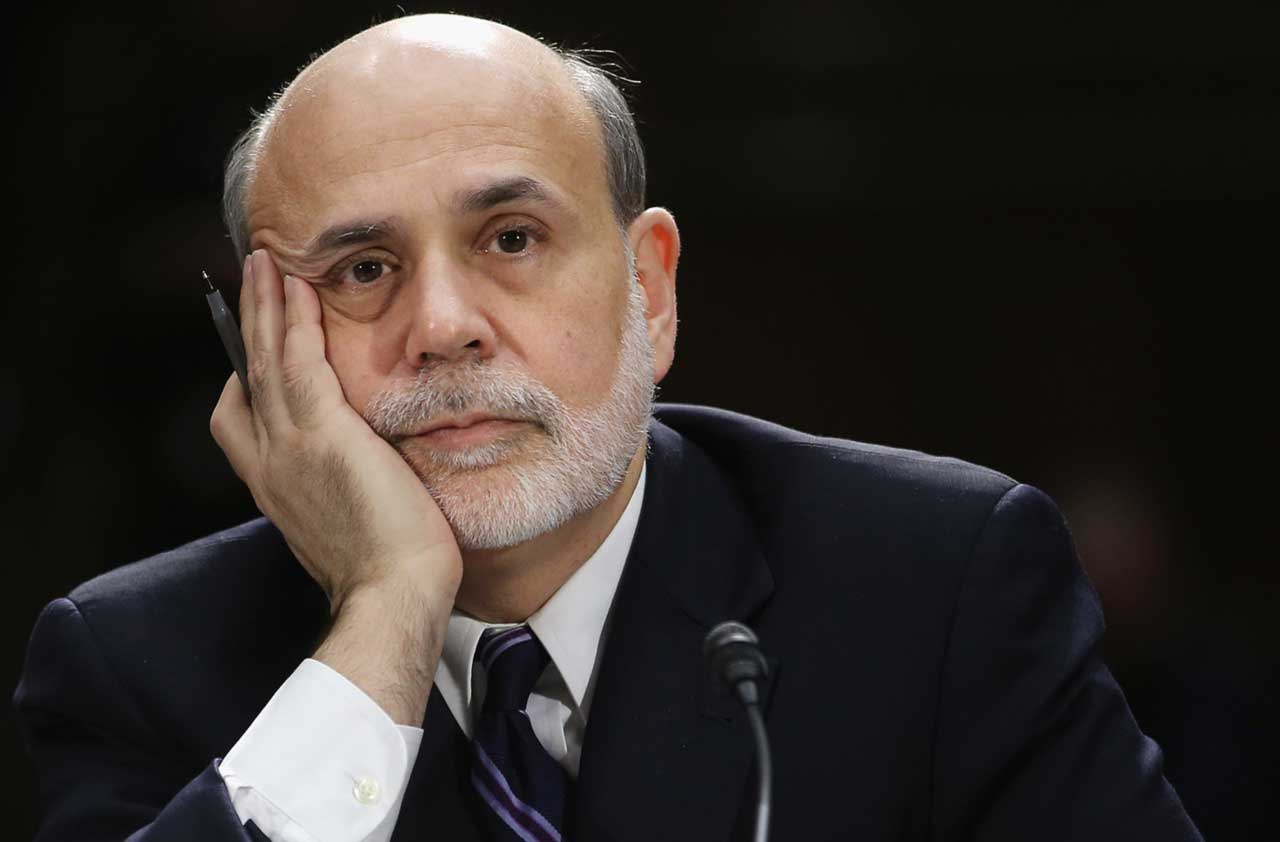

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.