6 Great Mutual Funds That Benefit From Small Portfolios

A manageable portfolio holds between 20 and 30 stocks, roughly balanced by sector and weighted fairly equally.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Twenty years ago, in his letter to Berkshire Hathaway shareholders, Warren Buffett quoted Mae West, sex symbol of the 1930s: “Too much of a good thing can be wonderful.” The Oracle of Omaha was alluding to diversification, the benefits of which were overrated, he suggested. Explained Buffett: “I cannot understand why an investor…elects to put money into a business that is his 20th-favorite rather than simply adding that money to his top choices—the businesses he understands best and that present the least risk, along with the greatest profit potential.” Not to mention that when you own too many stocks, it’s hard to keep track of them.

Of course, when you own too few stocks, you run the risk of a huge loss if one of them suffers a calamity. Enron employees learned that lesson the hard way in 2001. If, however, you own everything in Standard & Poor’s 500-stock index, the most widely followed benchmark for the U.S. stock market, you will experience less-volatile performance. If a single company in the index were to vaporize, it would, at most, knock 0.3% off the value of your portfolio.

There’s a happy medium between diversification and what Peter Lynch, the former manager of Fidelity Magellan, once called “diworsification,” and it’s probably a smaller number of stocks than you think. Consider research about long-term stock-market returns by Joel Greenblatt, the Columbia University professor and hedge fund manager. He found that if you owned the U.S. stock market as a whole, two-thirds of the time the range of returns varied from a loss of 8% to a gain of 28%. But if you owned just eight stocks, the range of performance was not that much greater: from a loss of 10% to a gain of 30%. Daniel Burnside, writing in AAII Journal, published by the American Association of Individual Investors, looked at the market over a 41-year period ending in 2001 and concluded that owning 25 stocks reduced “unsystematic” risk (the risk of not diversifying at all) by 80%, while owning 100 stocks reduced that risk by 90%—that is, not much more.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A manageable portfolio holds between 20 and 30 stocks. As long as they are roughly balanced by sector and weighted fairly equally, that number is enough to reduce systematic risk significantly. If you want to eliminate that risk, you can simply buy an exchange-traded fund such as Vanguard Total Stock Market ETF (symbol VTI), which at last report held 3,657 stocks. But if you want to beat the market, you’ll need to accept some risk, and the smartest way to do that is by slimming down your portfolio.

A preference for compactness. The same principle applies to funds. Sure, there are some great funds that own a lot of companies. Fidelity Low-Priced Stock (FLPSX), with 893 stocks, is a good one (the fund is a member of the Kiplinger 25). But I have a soft spot for more-artisanal funds, with small portfolios, low turnover and a founder who has often made the key decisions for decades.

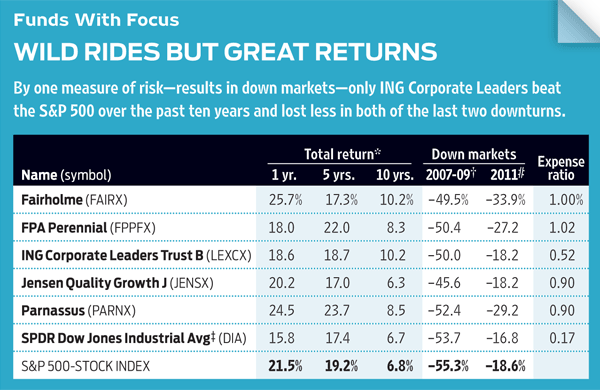

Consider Parnassus (PARNX), launched 29 years ago by Jerome Dodson, a Berkeley political-science major. Dodson is still managing this paragon of socially screened investing. Parnassus owns 46 stocks, or about half the average for a U.S. stock fund, and nearly half of its assets are in just a dozen companies.

In a class by itself is Fairholme (FAIRX), run by founder Bruce Berkowitz, a bargain hunter to the extreme. Fairholme is more hedge fund than standard mutual fund, with only six stocks and a scattering of bonds. Its largest holding, American International Group (AIG), equals a whopping 47% of assets.

Both funds have delivered great long-term results, but they are also highly risky. In 2011, for instance, a year the overall U.S. market earned 2.1%, Fairholme fell 32.4%; the next year, it gained 35.8%, beating the S&P by 20 points. Morningstar gives Parnassus a risk rating of “high”; it is 23% more volatile than the average fund.

[page break]

There are less volatile focused funds. ING Corporate Leaders Trust Series B (LEXCX), which turns 80 next year, holds a nearly unchanging portfolio of 22 stocks, headed by Union Pacific (UNP), at 12% of assets, and ExxonMobil (XOM), at 11%. The fund has beaten the S&P 500 handily over the past ten years, yet the fund’s volatility was lower than the overall market’s. And the annual expense ratio is only 0.52%—about half that of the typical concentrated fund.

Jensen Quality Growth (JENSX) has been even less risky than Corporate Leaders, although its ten-year return is lower. That may be a decent trade-off: In 2008, when the market tumbled 37%, Jensen fell only 29%. It’s a scrupulously structured fund that tries to keep the weightings of its holdings nearly equal. It owns 28 blue-chip stocks, led by PepsiCo (PEP), at just 5.1%

of assets.

A strong concentrated fund that specializes in midsize companies is FPA Perennial (FPPFX). It owns 30 stocks and has an annual turnover rate of a mere 2% (suggesting that, on average, it holds a stock for 50 years). The portfolio favors industrial and consumer cyclical stocks and contains no banks or real estate companies. The risk level is average.

Unfortunately, three of the best concentrated funds closed to new investors at the end of last year. But keep an eye on them; if the market drops and investors bail out of stock funds, they could reopen soon. One is Sequoia (SEQUX), a 43-year-old fund managed by Robert Goldfarb, with 42 stocks and one-third of its $8 billion in assets concentrated in just three companies: Valeant Pharmaceuticals (VRX), a Canadian drug maker; Warren Buffett’s Berkshire Hathaway (BRK.A); and retailer TJX (TJX).

The other two, Yacktman Fund (YACKX) and Yacktman Focused (YAFFX), were founded by Donald Yacktman, who has lately ceded much of the funds’ management responsibilities to his son Stephen. Focused has 37 stocks; Yacktman has 43. The portfolios are similar. Turnover is in the single digits, so if you’re willing to plagiarize, you can simply copy the holdings and own the individual stocks yourself. Top holdings for both funds are PepsiCo, Procter & Gamble (PG) and Twenty-First Century Fox (FOXA).

Finally, don’t forget the best-known concentrated portfolio of them all: the Dow Jones industrial average, which you can buy as a SPDR-sponsored ETF nicknamed Diamonds (DIA). The Dow’s 30 stocks have returned virtually the same as the S&P 500 for the past decade, with very little difference from year to year. That’s proof—if you need it—that 30 stocks is enough.

The question, however, is whether your objective as an investor is merely to replicate the market. If it is, then buy Diamonds or, to be slightly more daring, a fund such as ING Corporate Leaders. But if you really want to try to thump the averages, you have two choices: Do it yourself by assembling your own portfolio of 20 to 30 stocks, or put yourself in the hands of someone like Berkowitz or Dodson, for a fee of about 1% a year. If you select the latter course, don’t put all your eggs in the concentrated-fund basket. But some eggs, certainly.

James K. Glassman is a fellow at the American Enterprise Institute and chairman of the firm Public Affairs Engagement. He owns none of the stocks mentioned.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

What Made Warren Buffett's Career So Remarkable

What Made Warren Buffett's Career So RemarkableWhat made the ‘Oracle of Omaha’ great, and who could be next as king or queen of investing?

-

With Buffett Retiring, Should You Invest in a Berkshire Copycat?

With Buffett Retiring, Should You Invest in a Berkshire Copycat?Warren Buffett will step down at the end of this year. Should you explore one of a handful of Berkshire Hathaway clones or copycat funds?

-

Stocks at New Highs as Shutdown Drags On: Stock Market Today

Stocks at New Highs as Shutdown Drags On: Stock Market TodayThe Nasdaq Composite, S&P 500 and Dow Jones Industrial Average all notched new record closes Thursday as tech stocks gained.

-

9 Warren Buffett Quotes for Investors to Live By

9 Warren Buffett Quotes for Investors to Live ByWarren Buffett transformed Berkshire Hathaway from a struggling textile firm to a sprawling conglomerate and investment vehicle. Here's how he did it.

-

A Timeline of Warren Buffett's Life and Berkshire Hathaway

A Timeline of Warren Buffett's Life and Berkshire HathawayBuffett was the face of Berkshire Hathaway for 60 years. Here's a timeline of how he built the sprawling holding company and its outperforming equity portfolio.

-

Berkshire Buys the Dip on UnitedHealth Group Stock. Should You?

Berkshire Buys the Dip on UnitedHealth Group Stock. Should You?Buffett & Co. picked up UnitedHealth stock on the cheap, with the embattled blue chip one of the newest holdings in the Berkshire Hathaway equity portfolio.