Are Capital Gains Taxes Keeping You From Selling Property?

A structured installment sale could help defer or reduce long-term capital gains when you sell real estate.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Homeowners around the country are finding themselves with large amounts of equity in their homes as a result of the recent double-digit increases in real estate values, following more than a decade of growth in many areas. A common reason many are hesitant to sell is the potential capital gains taxes, but a structured installment sale could help with that.

As a financial planner in the San Francisco Bay Area, I frequently hear from clients, friends and associates around the state who are considering unlocking their trapped real estate wealth. Some are empty nesters who want to downsize. Some are done being landlords, while others are considering moving to a more affordable city or state. I also see seniors who — due to age — are looking at selling their home in order to move to an assisted-living community.

This article examines ways to legally reduce your capital gains taxes on the sale of highly appreciated real estate, excluding the more commonly known Internal Revenue Code Section 1031 exchange option for investment properties. Instead, we analyze an option that involves the outright sale of appreciated property, known as the structured installment sale.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How Appreciated Property Sales Are Taxed

In general terms, the difference between what is known as the cost basis and the net sales price is considered your profit and, for tax purposes, your capital gains. To compute your cost basis, add any improvement costs to your purchase price. To arrive at your taxable gain, subtract your cost basis from the purchase price and the tax exclusion. That number equals your capital gain from the sale of your property.

If you have lived in the home for at least two of the last five years, you will have an exclusion, an amount which is not taxable. For an individual, the exclusion amount is $250,000, and for a married couple, it is $500,000.

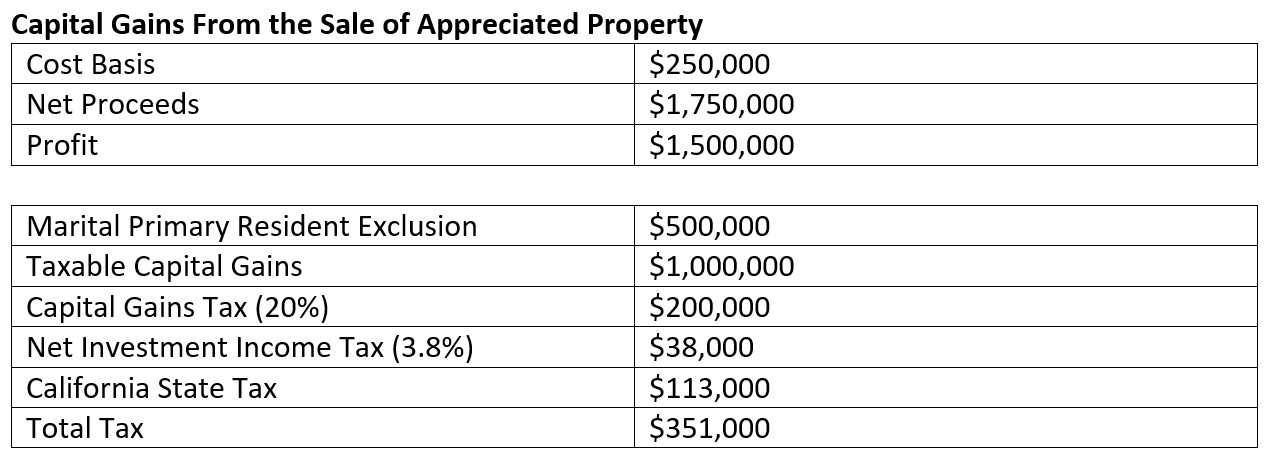

To understand how the sales of highly appreciated real estate are taxed, let’s look at an example. John and Beth purchased their home 25 years ago for $200,000 and spent $50,000 to upgrade their bathroom and kitchen. Their cost basis is $250,000.

Because they live in the San Francisco Bay Area, where real estate has appreciated significantly since they bought their home, the net proceeds from the sale are $1,750,000. Their profit is $1.5 million; however, since this was their primary home, they do not pay taxes on the first $500,000 of the profits due to the capital gains exclusion, leaving them with $1 million in taxable capital gains.

The federal capital gains tax rates range from 0%, 15% to 20%. The rate you pay depends on your adjusted gross income and filing status. In John and Beth’s case, the capital gains tax will be 20%, or $200,000. An additional federal net investment income tax (NIIT) of 3.8% also applies on adjusted gross income in excess of $250,000 for a married couple filing jointly, so John and Beth must pay an additional $38,000.

Since John and Beth are California residents, they are also subject to California state tax. For Beth and John, the California state tax is an additional $113,000.

The ABCs of Structured Installment Sales

“When the right set of circumstances presents itself, there may be no simpler way to defer, reduce or completely eliminate long-term capital gains when selling real estate, businesses or certain other appreciated assets than a structured installment sale,” according to the CPA Journal in December 2021.

A structured installment sale is a vehicle long sanctioned by the Internal Revenue Service Code 453. Under this vehicle, sellers of appreciated personal, business or investment property can gain the benefits of an installment sale without the risk of buyer default. Before a structured installment sale can take place, the asset must be deemed eligible for installment sale tax treatment.

If you’re interested in exploring whether a structured installment sale would be beneficial, it’s a good idea to consult with a financial adviser and a CPA experienced with this type of sale. You’ll also want to find a highly rated insurance company that offers qualified structured installment products to administer the installment payments that provide the tax benefits you’re seeking.

Structured Installment Sale Scenario No. 1

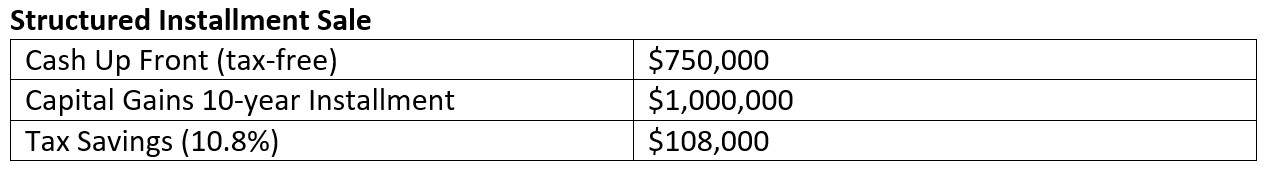

Beth and John work with their CPA and financial planner to implement a structured installment sales plan that gives them $750,000 up front, which they will use for their new home. The $750,000 is tax-free due to their cost basis and tax exclusion. They take the $1,000,000 of capital gains as an installment sale over a 10-year period. This strategy allows them to save 10.8% on their taxes (federal, state and NIIT), a total of $108,000. Depending on the actual needs for cash or cash flow and the structure of the installment sale, the tax burden can be reduced even further in many cases.

In addition to the tax savings, the structured installment sale offers a less obvious additional financial benefit. With a traditional sale, the $351,000 John and Beth pay in taxes is gone forever. With the installment sale, you pay taxes only on each year’s taxable installment amount. In other words, the remaining untaxed balance will continue to receive an investment rate of return, until actually paid out over the term of the installment. Using a 4% return example on the $351,000 paid out over 10 years, John and Beth would receive over $100,000 of additional income from the tax dollars they would have otherwise paid when selling the house.

Structured Installment Sale Scenario No. 2

John and Beth retired at 63. They believe they can live on $80,000 annually after using the $750,000 to pay for their new home. They decide to use the annual payments from the structured installment sale as their primary source of income for the next seven years in addition to some interest, dividends and savings. This allows them to defer taking their Social Security benefits until the maximum payout at age 70. They also plan on leaving their retirement accounts alone until their required minimum distribution ages. They now structure the installment sale over a 20-year period, which enables them to stay at a 0% federal estate tax rate for several years, ultimately reducing the total amount of capital gains taxes even further.

Depending on a taxpayer’s total income, the potential tax bill could be further reduced. In some cases, this type of structure may result in some years of no tax obligation within the installment sale period. This is why it is critical to work with an experienced financial adviser and tax professional in structuring this type of sale.

A Final Word

Best practices for a structured installment sale include:

- Preparing for a structured installment sale before you put your appreciated property on the market.

- Setting up a structured installment agreement with a life insurance company specializing in these arrangements.

- Disclosing the structured installment sale in your real estate contract because the buyer must agree.

The potential disadvantages of a structured installment sale include the complexity of the product and the time it takes to set up.

Structured installment sales are a potential way that you can mitigate the taxes paid in the sale of highly appreciated personal, business or investment property. It can also be utilized when selling a traditional business not related to real estate. Before you proceed with such a sale, consult with qualified professionals to decide whether this vehicle is right for you.

Amy Buttell contributed to this article.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Since 2003, Lars Larsen has been committed to providing a personalized, caring approach with his clients, providing stability, promoting financial well-being and protecting their legacies. Born and raised in Denmark, a highly taxed country with a social safety net, he realized early on the concerns of so many Americans regarding their retirement income. This helped shape the focus and philosophy of Heritage Financial North.

Advisory Services Offered Through CreativeOne Wealth, LLC a Registered Investment Advisor. Heritage Financial North, Heritage Financial North Insurance Services and CreativeOne Wealth, LLC are not affiliated. CA Insurance License # 0E02803

This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This information is not sponsored or endorsed by the Social Security Administration or any governmental agency.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.