The Seven Deadly Taxpayer Sins

Wrath.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wrath. Greed. Sloth. Pride. Lust. Envy. Gluttony. Who among us hasn’t fallen victim to temptation? After all, no one is perfect. Of course, there’s a moral penalty to pay. But when you exhibit one of these vices in the tax arena, you also have to answer to another higher authority…the IRS. As these real-life battles with the IRS illustrate, the results of these seven sins generally are not favorable, to say the least. Take a look.

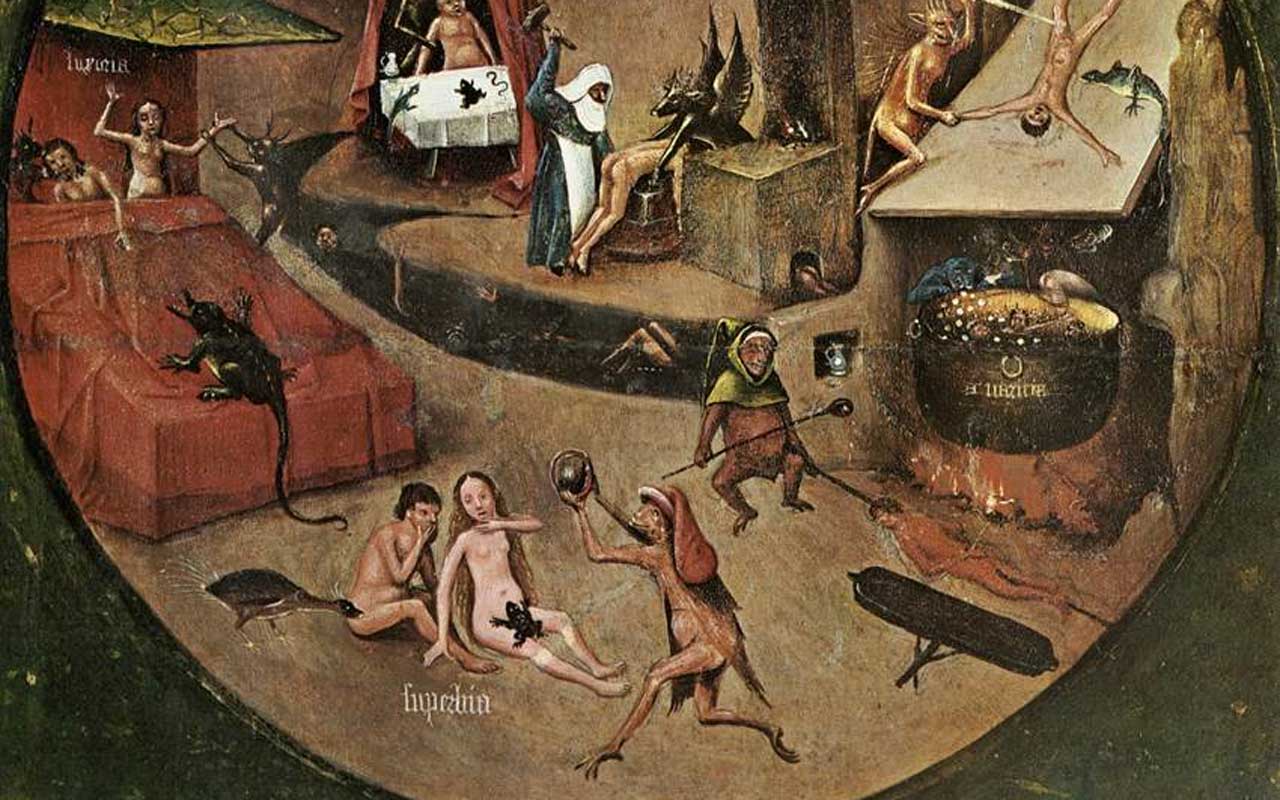

Images are from Hieronymus Bosch's "The Seven Deadly Sins and the Four Last Things."

Wrath

After a job transfer, a worker relocated his family to a new state. But his wife didn’t like living there and returned to their old home with the kids. When he visited over a holiday weekend, he discovered another man had been living there with his wife. When his wife left the house after a quarrel, he piled some of her clothes on the stove and set them on fire. The fire spread and burned down the house. At tax time, he claimed he was entitled to a casualty loss deduction. But the Tax Court said no, reasoning that allowing him to deduct a loss from a fire he deliberately set would be a bad policy.

Greed

There’s a saying that while pigs get fat, hogs get slaughtered. A taxpayer who tried to hide a $15 million stock sale from IRS found out that the adage was true. The tax man uncovered the hidden sale on audit, and the seller refused to provide any information on what he paid for the shares. A federal court ruled that his tax basis in the stock was zero, meaning he had to pay capital gains tax on the entire proceeds. So as a result of his greed, and his foolish refusal to substantiate his tax basis, the total of the extra taxes, penalties and interest he owed came to $7.5 million.

Sloth

A busy tax preparer ran her business out of her home. During tax season, she tired of after-hours phone calls from clients and occasionally booked a room at a local hotel to duck their calls. On her own return, she deducted the cost of her rest and relaxation as a business expense. Unfortunately for her, the Tax Court ruled that the cost of her escape from clients was a nondeductible personal expense.

Pride

A husband foolishly began chatting up a revenue agent who had begun an examination of his return. His bragging alerted the auditor to a home sale that occurred in the year prior to the one under audit. The agent ended up expanding the audit to include the previous year, and found that the sale didn’t qualify for the break that makes most home sale profits tax-free. So as a result of the taxpayer’s loose lips, he had to fork over more than $150,000 in tax, penalty and interest.

Lust

A tax lawyer spent more than $65,000 in a year on prostitutes and pornographic materials. He deducted the total as a medical expense, making a novel argument about the positive health effects of sex therapy. However, the Tax Court red-lighted his write-off, saying that his conduct not only was illegal, but also wasn’t for the treatment of a medical condition.

Envy

Coveting thy neighbor’s wife isn’t a good idea, and it can have tax consequences, as this case shows. After a police officer discovered his wife was having an affair with her doctor, he confronted the physician and threatened a lawsuit. The doctor agreed to pay $25,000 to cover his indiscretions. The police officer claimed the $25,000 was a tax-free gift, but the Tax Court said that the payment is taxed as income because it was offered to settle the doctor’s misconduct.

Gluttony

A car collector purchased a rare and expensive McLaren F1 sports car from a German seller and imported it to the U.S. He didn’t pay the gas-guzzler tax, which applies to a manufacturer’s sale or an importer’s use of an automobile with low fuel economy, or a luxury tax on cars that was in effect at the time. IRS sniffed out the import transaction and sent a bill for more than $75,000 in taxes, penalties and interest. The car owner tried to put on the brakes, but a federal court sided with the IRS.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAATax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Ten States with the Lowest Sales Tax in 2025

Ten States with the Lowest Sales Tax in 2025Sales Tax Living in one of the lowest sales tax states doesn't always mean you'll pay less.

-

10 Least Tax-Friendly States for Middle-Class Families

10 Least Tax-Friendly States for Middle-Class FamiliesState Tax Here’s what living in one of the least tax-friendly states for middle-class families costs residents.

-

Low-Tax States for 'Middle-Class' Families in 2026

Low-Tax States for 'Middle-Class' Families in 2026State Tax Here are the best states for families with middle incomes (due to low tax burdens).

-

15 States That Tax Military Retirement Pay (and Other States That Don't)

15 States That Tax Military Retirement Pay (and Other States That Don't)retirement Taxes on military retirement pay vary from state-to-state. How generous is your state when it comes to helping retired veterans at tax time?

-

5 Tax Deadlines for October 17

5 Tax Deadlines for October 17tax deadline Many taxpayers know that October 17 is the due date for filing an extended tax return, but there are other tax deadlines on this date.

-

Penalties for Filing Your Tax Return Late

Penalties for Filing Your Tax Return Latetax deadline Stiff penalties await those who didn't file their return (or pay any tax owed) by the tax filing deadline.

-

9 Tax Deadlines for April 18

9 Tax Deadlines for April 18tax deadline Between requesting a tax extension, making IRA or HSA contributions, and meeting other tax deadlines, there's more to do on Tax Day than just filing your federal income tax return.