State Tax

News, insights and expert analysis on state tax from the team at Kiplinger.

Latest

-

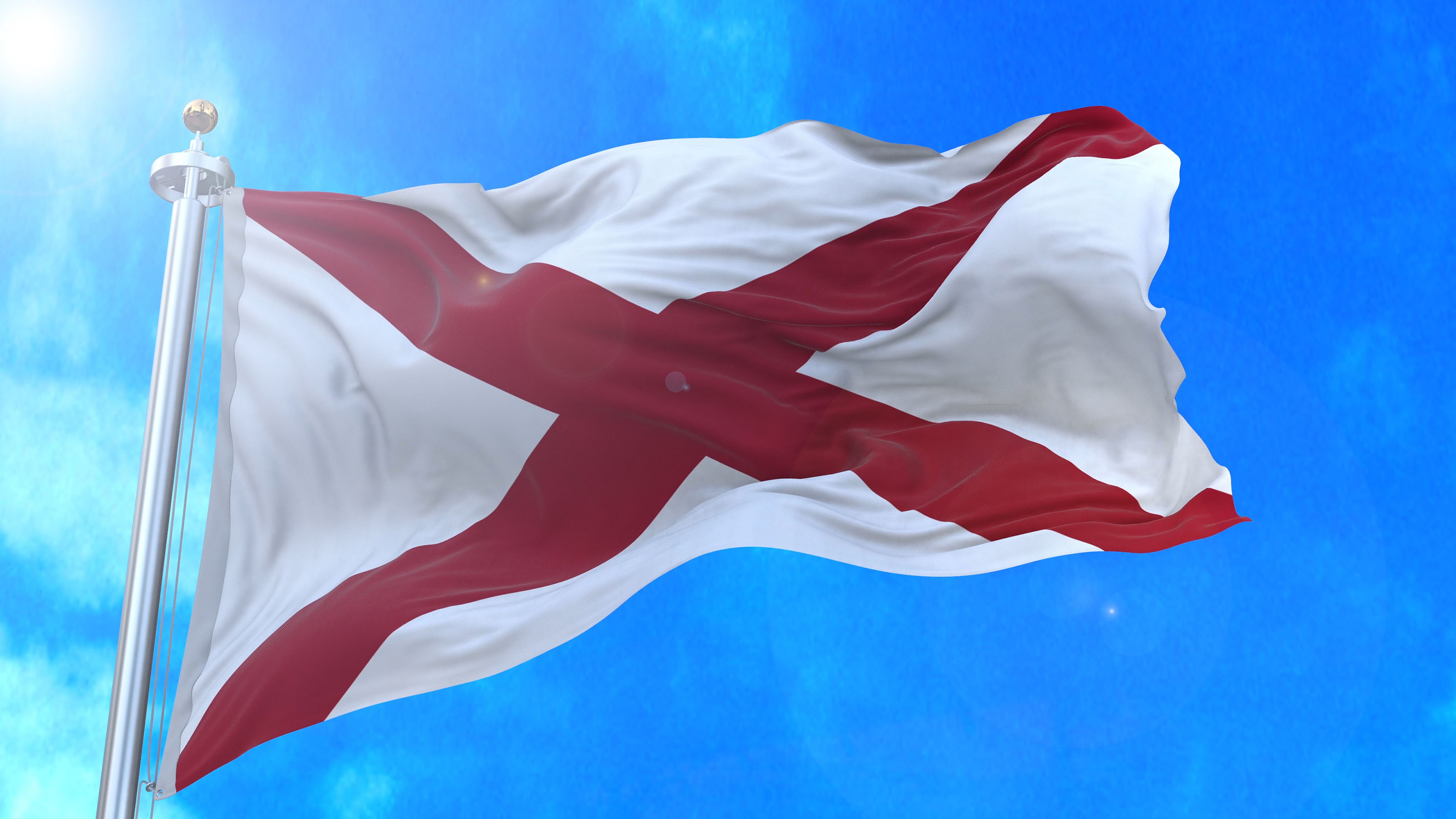

Alabama Tax Guide 2025

State Tax Explore Alabama's 2025 state tax rates for income, sales, property, retirement, and more. Learn how Alabama compares nationwide.

By Katelyn Washington Last updated

State Tax -

Don’t Miss Alabama Tax-Free Weekend 2025

Tax Holiday Ready to save? Here’s everything you need to know about the 2025 back-to-school Alabama sales tax holiday.

By Kate Schubel Published

Tax Holiday -

Oregon Tax Guide 2025

State Tax Explore Oregon's 2025 state tax rates for income, sales, property, retirement, and more. Learn how Oregon compares nationwide.

By Katelyn Washington Last updated

State Tax -

Could Your State End Tax on Overtime This Year?

State Taxes Key states are considering ending taxes on overtime — find out if yours makes the cut

By Kate Schubel Last updated

State Taxes -

Idaho Tax Guide 2025

State Tax Explore Idaho's 2025 state tax rates for income, sales, property, retirement, and more. Learn how Idaho compares nationwide.

By Katelyn Washington Last updated

State Tax -

Will Tax on Tips End for Your State This Year?

State Tax While the 'Big Beautiful Bill' spearheads federal talk on tips, several key states are considering ending taxes on tip income.

By Kate Schubel Last updated

State Tax -

States With 2025 IRS Tax Deadline Extensions

Tax Deadlines The IRS has extended tax deadlines in several states due to severe storms, fires, hurricanes, and other natural disasters.

By Kate Schubel Last updated

Tax Deadlines -

Florida Changes Homestead Exemption Property Tax Break

State Tax Property taxes have skyrocketed nearly 60% within the last five years in Florida, and constituents did something about it.

By Gabriella Cruz-Martínez Last updated

State Tax -

Powerball Jackpot Winner Will Get a Hefty Tax Bill for 2025

Lottery Taxes Whenever someone wins Powerball, the federal government gets a chunk of the prize from taxes.

By Kelley R. Taylor Last updated

Lottery Taxes