TOP 10 TAX-FRIENDLY CITIES

It's not what you earn, it's what you keep that often dictates your standard of living.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's not what you earn, it's what you keep that often dictates your standard of living. With that in mind, take this quick tour of the ten cities in the nation that have the lowest overall tax burden. These cities came out on top (er, at the bottom, really) of the 2007-2008 District of Columbia Tax Rates and Tax Burdens Survey for the largest city in each state, plus D.C.

Tax rankings are based on 2007 tax return computations for a two-income couple earning $75,000 with one school age child. The real property tax is a function of housing values, real estate tax rates, assessment levels, homeowner exemptions and credits. The auto tax figure assumes the couple owns two cars and is based on the estimated registration fees, state and local gasoline taxes, and personal property taxes, if any.

No. 1 Anchorage, Alaska

Income tax: $0

Property tax: $2,572

Sales tax: $0

Auto tax: $165

STATE & LOCAL TAX BURDEN: 3.6%

(National median tax burden: 8.5%)

Urban Facts: Taxes? Residents of Anchorage actually receive an annual "dividend" payment derived from levies on state oil drilling operations.

In sheer geographic size, the city of Anchorage is larger than the state of Rhode Island. It is home to 42% of all Alaskan residents.

No. 4 Seattle, Washington

Income tax: $0

Property tax: $1,698

Sales tax: $1,561

Auto tax: $457

STATE & LOCAL TAX BURDEN: 5.0%

Urban Facts: Seattle may be a tax-friendly city, but it also has a high cost of living, well above the national average.

The median home sales price was $375,000 for last quarter of 2008, compared to $200,000 at the national level.

No. 5 Las Vegas, Nevada

Income tax: $0

Property tax: $2,251

Sales tax: $1,072

Auto tax: $486

STATE & LOCAL TAX BURDEN: 5.1%

Urban Facts: Gaming taxes account for 27% of the state's general revenue funds.

The city's rapid growth a few years ago that drew more than 5,000 new residents every month was propped up on subprime lending. Now Las Vegas has the highest foreclosure rate among U.S. cities.

No. 6 Jacksonville, Florida

Income tax: $0

Property tax: $2,456

Sales tax: $1,284

Auto tax: $195

STATE & LOCAL TAX BURDEN: 5.2%

Urban Facts: The state intangibles tax on certain investments was repealed in 2007.

Jacksonville is the third-most populous city on the East Coast, after New York City and Philadelphia. (Other cities such as Boston, Washington, D.C., and Miami have larger metropolitan area populations.)

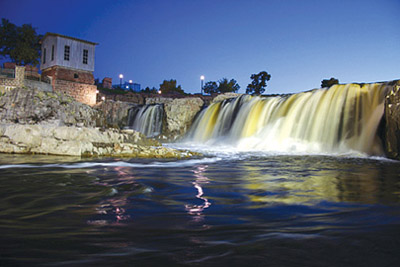

No. 7 Sioux Falls, South Dakota

Income tax: $0

Property tax: $2,760

Sales tax: $1,518

Auto tax: $294

STATE & LOCAL TAX BURDEN: 6.1%

Urban Facts: In fiscal year 2007, lottery gaming put $110 million in the state till to provide a 30% property-tax relief.

Sioux Falls has the largest shopping center between Minneapolis and Denver.

No. 8 Phoenix, Arizona

Income tax: $1,241

Property tax: $1,401

Sales tax: $1,849

Auto tax: $588

STATE & LOCAL TAX BURDEN: 6.8%

Urban Facts: Tax information for Phoenix includes the entire metropolitan area which extends to cities of Scottsdale, Mesa, Tempe, Mesa, Chandler, Gilbert, Glendale and Peoria. But housing prices and local tax can vary significantly from locality to locality.

No. 9 Billings, Montana

Income tax: $2,559

Property tax: $1,865

Sales tax: $0

Auto tax: $689

STATE & LOCAL TAX BURDEN: 6.8%

Urban Facts: Billings taxpayers with adjusted gross incomes of less than $30,000 can exclude up to $3,600 of their pension income from state taxes.

Dubbed locally as the "Magic City," Billings is supporting growth by dunning its energy, agriculture, and transportation industries.

No. 10 Chicago, Illinois

Income tax: $2,019

Property tax: $1,023

Sales tax: $1,624

Auto tax: $478

STATE & LOCAL TAX BURDEN: 6.9%

Urban Facts: Chicago's effective real-estate tax rate of .70% and various exemption programs keep real property tax low. Just keep in mind that this surprisingly tax-friendly city doesn't offer the same breaks for other cost-of-living expenses.

SOURCE: 2007-2008 District of Columbia Tax Rates and Tax Burdens Survey

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By Much

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By MuchFood Prices Arkansas and Illinois are the most recent states to repeal sales tax on groceries. Will it really help shoppers with their food bills?

-

New Plan Could End Surprise Taxes on Social Security 'Back Pay'

New Plan Could End Surprise Taxes on Social Security 'Back Pay'Social Security Taxes on Social Security benefits are stirring debate again, as recent changes could affect how some retirees file their returns this tax season.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Tax Season 2026 Is Here: 8 Big Changes to Know Before You File

Tax Season 2026 Is Here: 8 Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

3 Major Changes to the Charitable Deduction for 2026

3 Major Changes to the Charitable Deduction for 2026Tax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?