When You Claim Social Security Can Have Huge Implications for Your Spouse

When you’re gone, your spouse’s income will take a major hit – one that can be worsened significantly if you make the wrong decision about when to claim.

It’s unfortunate, but many people don’t have a basic understanding of how claiming Social Security benefits early can haunt them — and their loved ones. For example, 45% of U.S. adults mistakenly believe they can file early for reduced Social Security benefits and then have them restored to a higher level once they reach their full retirement age, according to a 2021 Nationwide Retirement Institute® survey. This isn’t true. Claiming Social Security early locks you in for reduced benefits for the rest of your life.

Another common — and potentially costly — mistake can occur when married couples fail to consider implications for their partner. If your spouse is depending on your benefits to help make ends meet, it’s important to know that this decision could impact their future financial security if you pass away before them.

The fact is, for married couples when one spouse passes, the survivor’s Social Security income will drop significantly. For most people, this is income they need to meet their basic living expenses. That’s why it’s important to consider taking steps to maximize survivor’s benefits.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

An Example of How Social Security Survivor Benefits Work

Here’s a hypothetical example of how this can play out:

Married couple Bob, age 66, and June, age 62, have just retired and both have decided to start taking Social Security right away. Bob, who is at his full retirement age, will get $3,000 per month, and June will get $1,900, which means their total household Social Security benefit is $4,900 per month.

If Bob died, June’s monthly Social Security retirement income would take an almost 40% hit. While she would still receive her husband’s $3,000 a month check as a survivor’s benefit, her own benefit would disappear. So, at the household level, her Social Security income would drop by $1,900 — from $4,900 to just $3,000 per month.

That reduction in benefits, unfortunately, is unavoidable. However, the decision many couples make to claim Social Security early can make a tough situation even more difficult for surviving spouses. In our hypothetical example, Bob was claiming Social Security at his full retirement age. But let’s change Bob’s age and see how that affects the equation. Instead of retiring at his full retirement age of 66, say Bob retires at 64, and he decides to claim Social Security benefits early. More than half of people do just that, and many don’t realize the potentially devastating impact that claiming early can have on their spouse.

Assuming that Bob’s full retirement age is 66, claiming at 64 would mean that instead of a benefit of $3,000 per month, his benefit is now about $2,625. And what if he retires even earlier? Claiming at 62 would cut his monthly Social Security benefit down to about $2,250. Those reductions are permanent, and they would also reduce June’s survivor benefit. That’s definitely something to think about before you pull the trigger on your own Social Security benefit.

It’s worth noting that if you claim early, your surviving spouse is entitled to either your reduced monthly benefit or 82.5% of what your full retirement age benefit would have been, whichever is higher. Either scenario will translate to reduced benefits for your partner.

That’s why it’s so important to realize that your decision on when to claim Social Security is more than just a decision about your personal benefits. And if your surviving spouse can’t make ends meet, what are the financial implications for other family members who may find themselves in caregiving duties in the future?

How to Maximize Your Spouse’s Survivor Benefit

So, what can you do to maximize your spouse’s Social Security survivor benefit? The answer can be summed up in one word: Wait. For every year past your full retirement age that you wait to claim Social Security, you earn an 8% delayed retirement credit. Those annual increases continue up until age 70, at which point your Social Security benefit is as big as it can possibly get. In our hypothetical example, if Bob waited until age 70 to claim, his Social Security check would jump to $3,960, compared with just $2,250 if he claimed as early as he could. That higher monthly benefit would, in turn, become June’s survivor’s benefit after Bob dies. So, for the rest of her life, June would get an additional $960 per month.

It's important to acknowledge that the decision to delay Social Security benefits comes at a cost, namely the loss of Bob’s Social Security income from age 66 to 70. Foregoing $3,000 of monthly income for those four years comes to $144,000. That’s a significant amount, but it could be worth it if June lives into her 80s or 90s, which is not uncommon for women with good health habits. This trade-off could make a lot of sense for:

- Couples who have the means to delay claiming without depleting their savings to a level that jeopardizes long-term financial goals

- Couples with significant age gaps

- Couples where at least one spouse has exceptional health or a history of longevity in their family

The Bottom Line

If maximizing your spouse’s survivor benefits is something that’s important to you, then you have to figure out a way to generate the income you need to allow you to delay taking Social Security and let your benefit grow. By working with a financial professional, you can map out ways to bridge this gap. That could include solutions like annuities or life insurance, which can provide both guaranteed income and death benefits that can replace lost Social Security income in the future.

Unfortunately, only about half (47%) of the investors Nationwide surveyed said they receive professional guidance on how and when to claim Social Security benefits. There’s no reason to go it alone when trying to figure out the best plan for your family. Building a relationship with a financial professional is a great first step and can make a world of difference, not only for your own confidence, but also the retirement security of those you care about.

NFW-10779AO

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kristi Martin Rodriguez currently serves as Senior Vice President of the Nationwide Retirement Institute® for Nationwide Financial, leading the teams responsible for advocating for and educating members, partners and industry leaders on issues impacting their ability to have a secure financial future. She was a founding member of the Ohio chapter of The National Association of Securities Professionals (NASP), an organization helping people of color and women achieve inclusion in the industry.

-

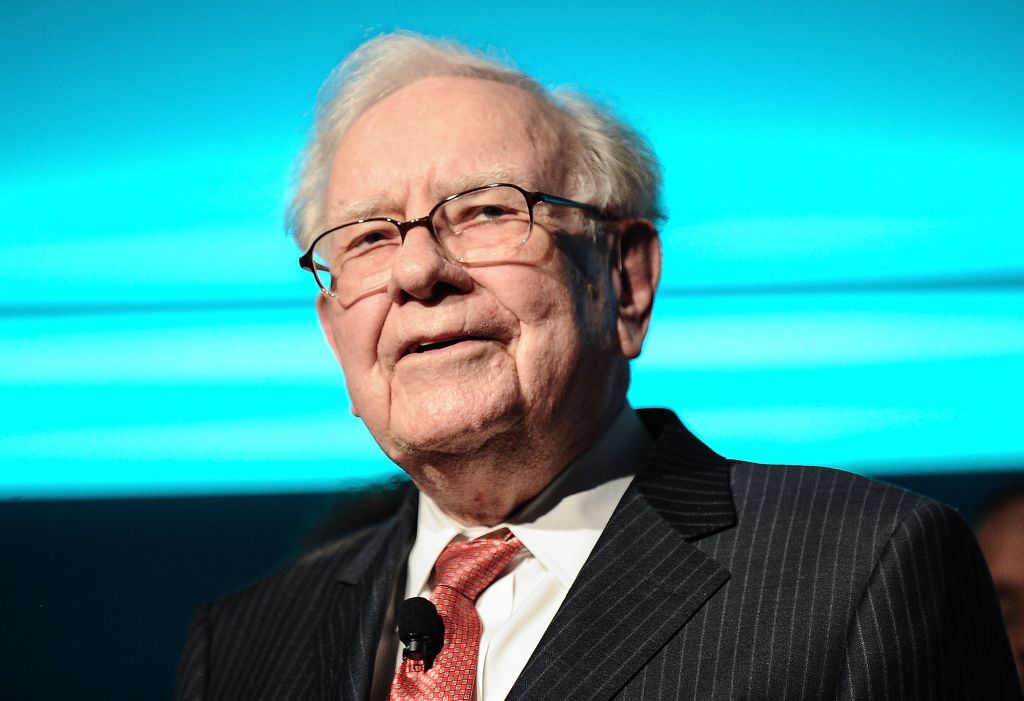

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

Know Your ABDs? A Beginner's Guide to Medicare Basics

Know Your ABDs? A Beginner's Guide to Medicare BasicsMedicare is an alphabet soup — and the rules can be just as confusing as the terminology. Conquer the system with this beginner's guide to Parts A, B and D.

-

I'm an Investment Adviser: Why Playing Defense Can Win the Investing Game

I'm an Investment Adviser: Why Playing Defense Can Win the Investing GameChasing large returns through gold and other alternative investments might be thrilling, but playing defensive 'small ball' with your investments can be a winning formula.

-

Five Big Beautiful Bill Changes and How Wealthy Retirees Can Benefit

Five Big Beautiful Bill Changes and How Wealthy Retirees Can BenefitHere's how wealthy retirees can plan for the changes in the new tax legislation, including what it means for tax rates, the SALT cap, charitable giving, estate taxes and other deductions and credits.

-

Portfolio Manager Busts Five Myths About International Investing

Portfolio Manager Busts Five Myths About International InvestingThese common misconceptions lead many investors to overlook international markets, but embracing global diversification can enhance portfolio resilience and unlock long-term growth.

-

I'm a Financial Planner: Here Are Five Smart Moves for DIY Investors

I'm a Financial Planner: Here Are Five Smart Moves for DIY InvestorsYou'll go further as a DIY investor with a solid game plan. Here are five tips to help you put together a strategy you can rely on over the years to come.

-

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the Summer

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the SummerWorn, underinflated tires and other degraded car parts can fail in extreme heat, causing accidents. If your employer is ignoring needed repairs on company cars, there's something employees can do.

-

'Drivers License': A Wealth Strategist Helps Gen Z Hit the Road

'Drivers License': A Wealth Strategist Helps Gen Z Hit the RoadFrom student loan debt to a changing job market, this generation has some potholes to navigate. But with those challenges come opportunities.