The Dimensions of Wealth: Influencing Your Financial Path

Generalized financial advice and rules of thumb aren’t good enough. Unless your financial plan takes into account all of the special things that make you “you,” it could steer you off course.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A nuanced and thoughtful approach to financial planning is like peering into a kaleidoscope. Each kaleidoscope design comprises a unique set of pieces and patterns, and those specific dimensions come together to create a one-of-a-kind mosaic. With each slight turn or shift, the pattern rearranges to reveal a new image.

This same concept applies to the decisions we make about our finances. The circumstances impacting your financial decisions are not the same as those of your friends or colleagues. Why then, do many of us take advice from friends and family, or rely on financial advice created for the masses?

Many DIY investors and robo-advisers underestimate the number of facets in a person’s life — and possible combinations of those facets — that should be considered when making financial decisions. With these models, the scope of what is considered in the financial decision-making process is limited. At times, generic advice is delivered without considering a person’s unique financial needs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

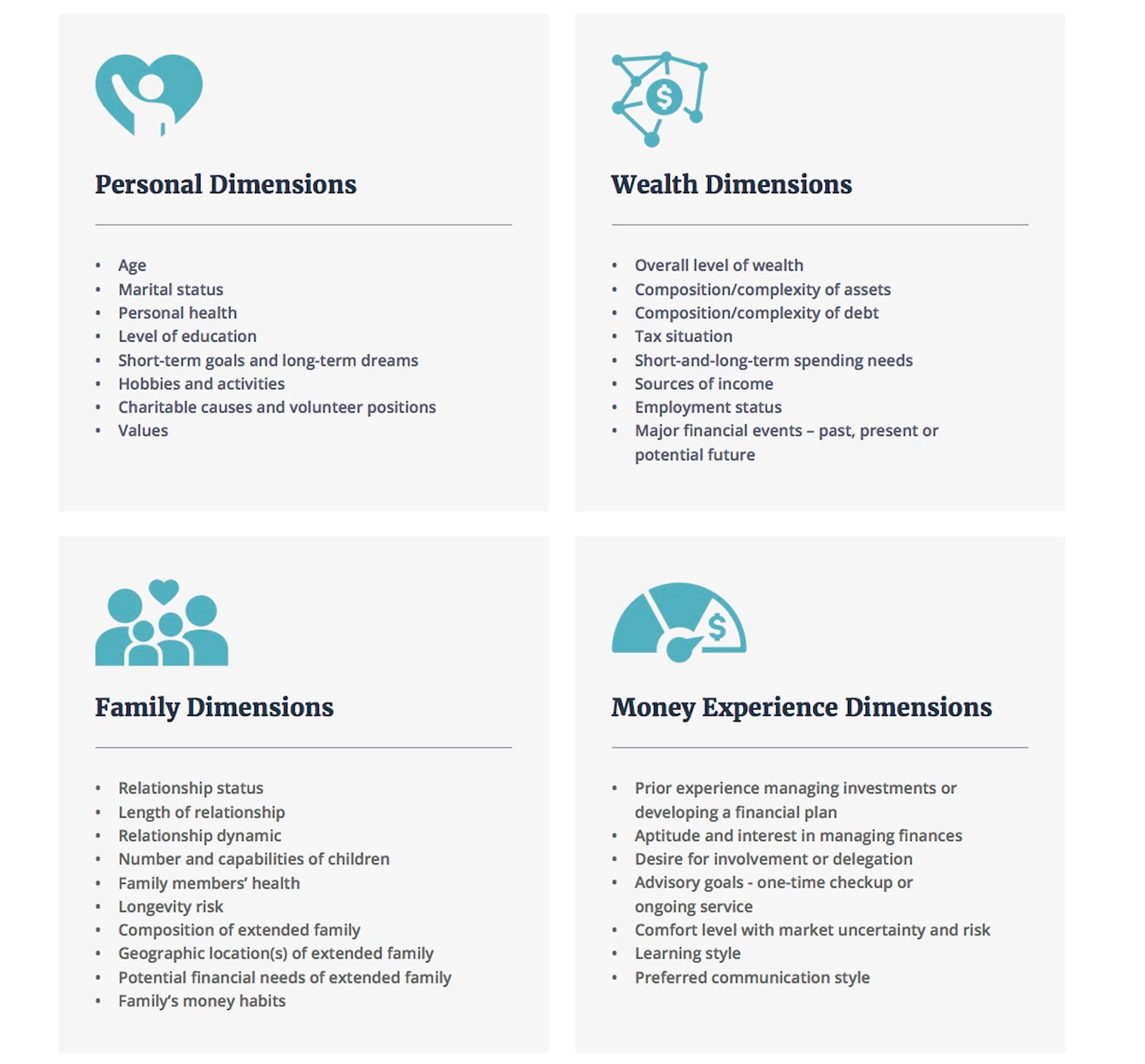

The following outlines the dimensions of wealth and how they influence your financial path.

1. Personal Dimensions

While some personal dimensions are simple to identify — age, marital status, etc. — other attributes that color financial decisions are more subjective. Dimensions like personal values, long-term dreams and charitable interests tend to be more fluid and prone to evolve as one moves through life. Therefore, these need to be routinely re-examined.

2. Wealth Dimensions

Income, saving, spending, investing, debt and taxes all are interconnected; overlooking even one area can be costly.

Your sources of income — from salary, real estate, pensions or investments — affect how you structure your portfolio. As income composition changes over time, you may need to deploy different investment strategies. Unexpected life events, financial losses and legislative changes also call for a nimble and thoughtful plan.

Changing course is easier if you have advice based on all your circumstances, rather than being squeezed into a box that doesn’t quite fit.

3. Family Dimensions

The size of your family, ages of your children, and any age difference with your partner can play a big role in determining sufficient savings levels for things like college funding, health care costs and retirement income.

While family circumstances should be an important consideration across portfolio management and tax planning, legacy and estate settlement planning, in particular, require a more delicate and thoughtful approach in weighing sensitive situations and dynamics. A child’s special needs, health issues and/or money management skills should be reflected in your financial plan and in estate planning to provide for your loved ones.

4. Money Experience Dimensions

Your prior experiences with money color your financial decisions going forward.

Awareness of behavioral factors and understanding how they may affect your decision-making can help to avoid reacting in a way that is detrimental to financial success. Some questions to ask yourself when evaluating this dimension may include:

- Do you have the knowledge to assess how risky an investment may be?

- Are you comfortable asking an adviser how much you’re paying in fees?

- Have you had past experiences with planning and investing that may impact your current decisions?

- What is your interest in managing your money, and do you have the time, or will you need to delegate this task?

- If you are married, how do you and your spouse interact when discussing money matters?

Applying the dimensions of wealth

A single factor can have an incredible impact on the outcome of a financial decision. Consider how the dimensions of wealth might impact the following common planning scenarios:

For sustainable retirement withdrawals, the standard “4% rule” says you can spend 4% of your principal balance annually during retirement without exhausting your portfolio during your lifetime. However, upon layering in the dimensions of wealth, we find that this rule doesn’t apply universally. For example:

- Family: If your family dimension includes a history of a chronic illness, you may need to preserve more funds for assisted living costs as these conditions may render you uninsurable for long-term care. Asset preservation is also a factor if you have a younger spouse.

- Wealth: If you receive a pension or other source of income that reliably covers a majority of your living expenses, you may be able to withdraw more than 4% per year because you are less likely to be forced to liquidate portfolio assets during down markets.

Another common scenario that requires thoughtful consideration of the family and wealth dimensions is educational planning. For families preparing to send their children to college, starting a 529 college savings plan helps to defray tuition costs. However, when factoring in different dimensions of wealth, we see that 529 plans may not be the optimal savings vehicle for every family:

- Family: If your child has any earned income, a Roth IRA may be preferable over a 529 plan, especially if you are not certain they will attend college. Similarly, a 529 plan may not be right if your child might qualify for financial aid or scholarships, or if they have special needs.

- Wealth: If you have significant family wealth, you may not qualify for aid at all. In this case, funding a 529 plan is a better way to save for college and might also be used to transfer assets to future generations.

We can see that generic advice often can lead people to make misguided financial decisions. Another “rule of thumb” that falls short is the notion that one should have enough emergency funds on hand for three to six months. However, this amount of cash may be insufficient to sustain many individuals with a particular set of attributes:

- Wealth: People facing job instability and high debt levels should have closer to one year’s worth of cash on hand as a cushion.

- Personal: Single people or sole breadwinners might want to maintain more than one year’s worth of cash reserves in case of unexpected disability or the sudden need to step back from full-time work.

- Family: Similarly, if someone is facing marital problems or serves as the primary caregiver for a loved one, then they may need higher levels of cash reserves.

One size fits one

In layering specific dimensions to the above scenarios, we see that a standard rule rarely applies. Conventional wisdom practiced by many robo-advisers and DIY investors often fails to realize the nuances that may call for a more restrained or aggressive approach to financial planning.

These various dimensions of wealth can result in an endless range of combinations. Since your dimensions of wealth are as unique as you, it’s important to ask if any of the financial advice you are following reflects the many facets that make up your financial life.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dawn Doebler is a Senior Wealth Adviser at The Colony Group, providing wealth management, financial planning and corporate finance solutions to clients for over 25 years. As an MBA, CPA, Certified Financial Planner (CFP®) and a Certified Divorce Financial Analyst (CDFA®), she understands the challenges and financial needs of clients from executives to entrepreneurs, women in transition, and single breadwinner parents. Dawn is a co-founder of Her Wealth®, an organization to empower women with financial confidence.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.