Are You Going to Be OK in Retirement? 1 Easy Calculation Can Provide the Answer

Running out of money in retirement is a common fear, but knowing you have enough cash on hand to get through a severe stock market downturn can help. It’s a figure I call your “Withdrawal War Chest,” and it’s simple to calculate.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market goes through recurring cycles that look to us like the four seasons. Fear is rarely apparent in spring or summer and barely palpable even in the fall. However, the “winter” portion of a stock market cycle is typically the harbinger of emotion-filled missteps by many investors.

“Am I going to be living under a bridge?” This is a “winter” question that I have often been asked over the past four decades, especially by prospective clients without a plan, even those with millions of investable dollars. This is because much of the “top of mind” space in our brain is allocated to thinking about our basic needs, including food, clothing, shelter, health care, transportation and education. When the stock market goes down, the reptilian, self-preservation portion of people’s brains often takes over, and they worry first and foremost about funding their basic needs.

The next and most important “winter” question I get asked is, “Am I going to be OK?” This is often due to a misperception that “something seems to be different this time.” Different in a potentially very bad way, more unusual than anything we’ve ever seen, and as a result, I may not be able to live and enjoy anywhere near the quality of life I had planned throughout retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

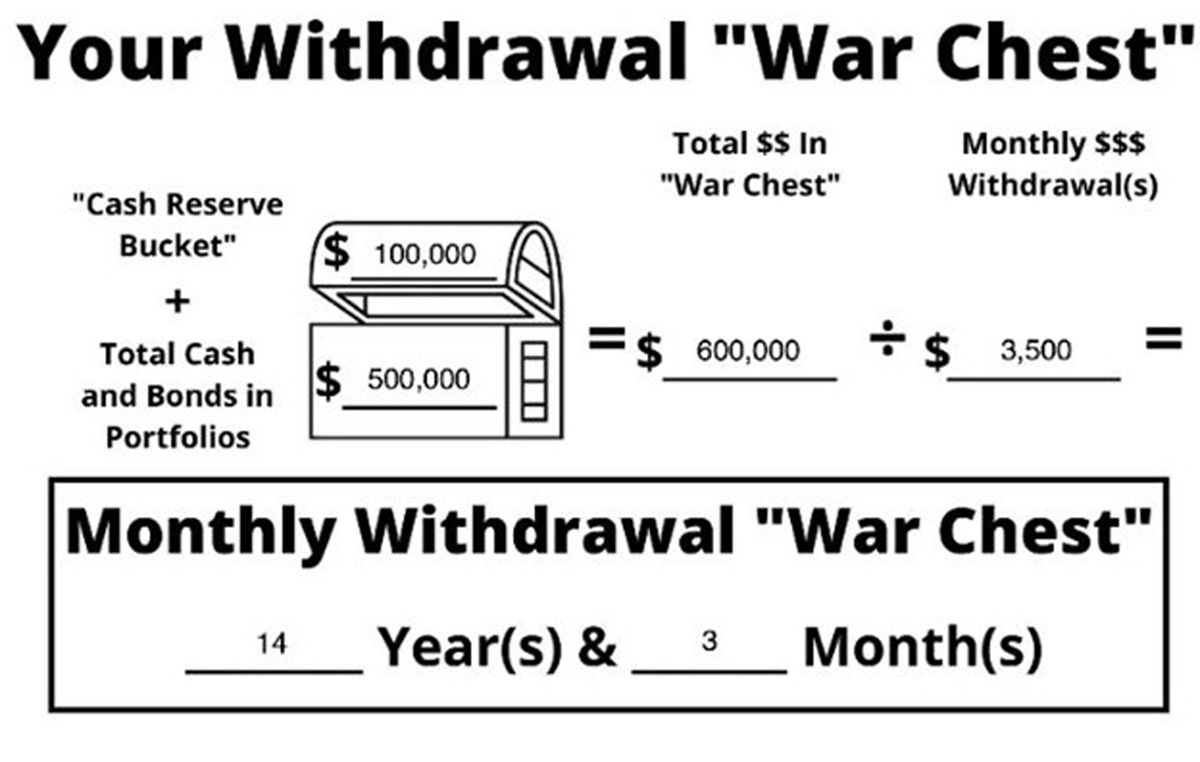

At our firm, we have created a tool to provide clients with peace of mind showing them approximately how long they will be “OK.” I call this the “Withdrawal War Chest.” A war chest has historically been defined as a fund accumulated to finance a war, and recently, has expanded its meaning to a fund earmarked for a specific, challenging purpose. There are few financial endeavors more challenging than planning for retirement. Luckily, knowing your Withdrawal War Chest makes such planning much less stressful.

So how do you figure out your Withdrawal War Chest? Here’s our simple process:

- Add your total cash reserves AND total cash and bonds in your portfolios to get your War Chest.

- Divide your total War Chest by your monthly retirement withdrawal.

- That’s it.

This calculation provides an estimated time frame in which your War Chest (cash and bonds) alone could support your cash flow needs without withdrawing or selling a single penny from equities (stocks). To show you what that calculation could look like, let’s look at a hypothetical couple — John and Jane — who have a nice cash cushion saved up.

While the War Chest calculation is a simple one, its impact is tremendous. Your monthly Withdrawal War Chest is not only protection, but most importantly, peace of mind. Take John and Jane from our example above. They have 14 years and 3 months’ worth of withdrawals that is completely independent of the stock market. They don’t have to worry about it bouncing up, down or sideways. It’s just a quick snapshot, but it’s one that offers people confidence, because if the stock market goes through an extended “winter,” people are sure they can withstand it by not being forced to sell low.

The majority of people who liquidate most or all of their stocks while going through stock market downturns don’t have a plan and give in to fear. These types of emotional decisions often result in financial losses that are never recovered. This is not something you want to say when reflecting back on your life savings. While there is no magic wand to wave to take the emotions out of a decision, having a plan in place and knowing your Withdrawal War Chest can make those winter periods much less stressful.

Our typical retirement monthly Withdrawal War Chest has 10+ years of withdrawals. That being said, each individual household and family has their own unique needs. However, if you have a plan and know your Withdrawal War Chest, you can take a lot of anxiety out of investing and planning throughout retirement.

This information is prepared by DiNuzzo Wealth Management, and all opinions are the judgment of author P.J. DiNuzzo, as of the date of publication and could be subject to change. This material is provided for educational purposes only and readers should not rely on the content as the only basis for investment or retirement decisions or advice. Always consult with your personal financial adviser and tax adviser before making any financial decisions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

P.J. DiNuzzo, CFA, PFS, AIF, MBA, MSTX, is the founder, president and chief investment officer for DiNuzzo Private Wealth Inc./DiNuzzo Wealth Management in Beaver, PA. The firm has been helping pre-retirees and retirees make smart money and best-life choices for 31 years. P.J. is also the author of the book "The Seven Keys to Investing Success."

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.