How to Get a Refund for a Delayed or Canceled Flight

Travelers can turn to these flight refund guidelines when their plans are disrupted by bad weather or airline mishaps.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It can be a challenge navigating holiday travel. Even with tedious planning, that kind of peak-season congestion can lead to delays, cancellations and missed connections.

Whether your trip is interrupted by severe weather or airport overcrowding, it’s important to know your rights.

From getting a refund to rebooking your flight, understanding airline policies and federal regulations can help you avoid paying out of pocket when your plans go sideways. So, how can you get your money back if you're affected?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Protect your travel plans from weather delays

When traveling it's common for storms to pop up. If you live in or plan to travel in an area where inclement weather is common, make sure to pay close attention to weather forecasts.

Even with preparation, things can happen that cause delays: Airline staffing issues, computer glitches and delays from connecting airports can cause a ripple effect that could add time to your travel.

Airlines aren't always prepared to respond, despite years of warnings. Compensation for passengers can be slow and painful to extract.

So educate yourself before you head to the airport, and use the compensation guidance below if your travel plans get derailed.

How to get your refund

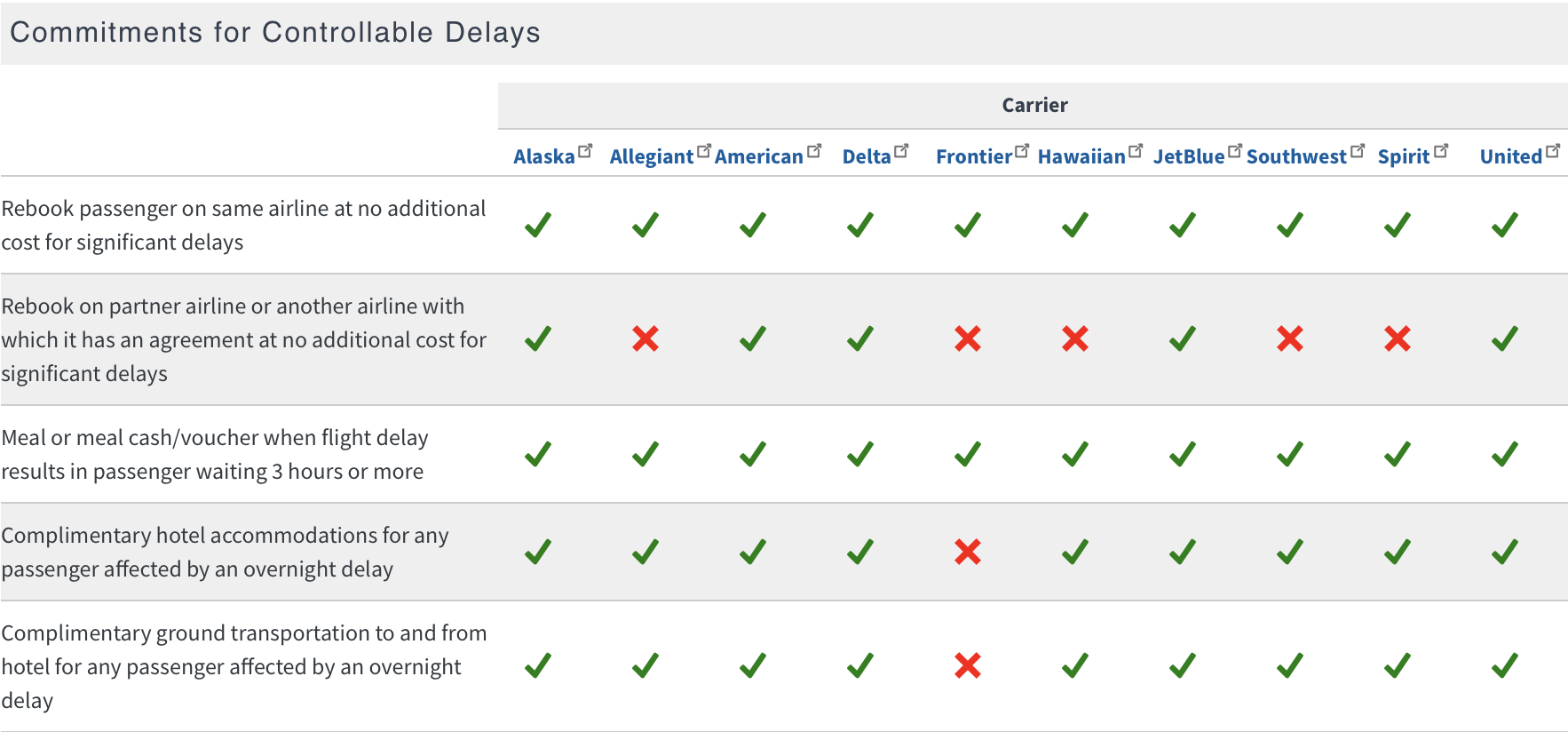

So your flight was canceled or delayed — now what? Visit the U.S. Department of Transportation (DoT) Airline Customer Service Dashboard, where you can compare the refund and reimbursement policies of the 10 biggest U.S. airlines.

According to the DoT's information, Alaska and JetBlue are the top carriers in terms of assisting customers with disrupted travel plans, while Frontier is by far the worst.

Find your airline in the tables below and check if your disruption is covered under their policies.

Airline customer service list

Once you've determined whether your airline covers your situation, contact them via their respective customer service website:

- Alaska Airlines

- Allegiant Air

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airlines

- Southwest Airlines

- Spirit Airlines

- United Airlines

Airport travel tips:

- Download your airline's app: If your flight delays, chances are customer service phone and physical lines will be long. Often, you can reschedule flights through your airline on their app quicker.

- Consider an airport lounge: Airports charge excessive prices for food and water. Instead of waiting in long lines, an airport lounge gives you a quiet place to relax, have a good meal, and even with a delay, you can rest comfortably.

- Have a credit card with trip insurance: Cards like the Chase Sapphire Reserve® offer trip cancellation insurance if a flight cancels due to unexpected inclement weather, sickness and other covered events.

Earn rewards faster and enjoy exclusive perks, including complimentary airport lounge access when you add one of Kiplinger's top airline cards to your wallet, powered by Bankrate. Advertising disclosure.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ben Demers manages digital content and engagement at Kiplinger, informing readers through a range of personal finance articles, e-newsletters, social media, syndicated content, and videos. He is passionate about helping people lead their best lives through sound financial behavior, particularly saving money at home and avoiding scams and identity theft. Ben graduated with an M.P.S. from Georgetown University and a B.A. from Vassar College. He joined Kiplinger in May 2017.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.