Sponsored

Empower Review: Is This Financial Hub the Right Tool for You?

Empower offers you a way to see all your financial accounts and set savings goals in one digital hub.

If you're like many people, you probably have your financial accounts spread out over various institutions. You could have your checking and high-yield savings accounts with one bank, your mortgage with another, credit cards with multiple lenders and your 401(k) and/or investment accounts with other brokers.

In turn, it creates a fragmented overall view of your finances. One of the best ways to unify perspectives is with budgeting apps or websites.

With them, you're able to see a full depiction of your finances in real-time. And one of the best budgeting options to consider is Empower.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What is Empower?

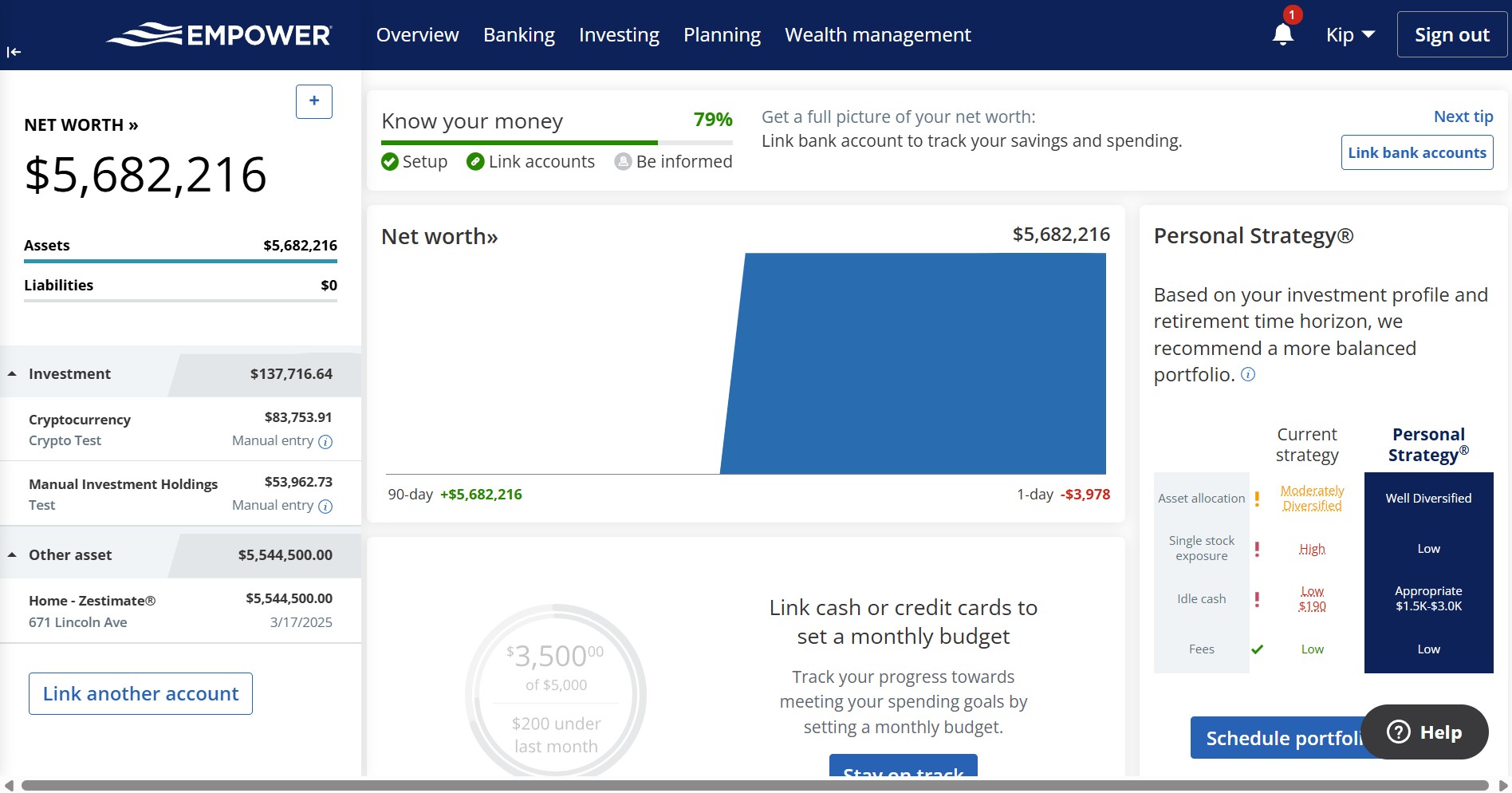

Empower is a financial services company that provides the free Empower Personal Dashboard, where you can organize and manage all of your financial accounts in one place. This includes checking, savings accounts, credit cards, mortgages and investment accounts, including cryptocurrency.

Signing up for an account is easy to do and only takes a few minutes. Once registered, you can link all of your accounts through the website, providing an expedited way to pool financial information into one hub.

Once you set it up, you'll gain a full picture of your net worth, cash flow projections, transactions from both banking and credit accounts, even your home's Zestimate.

One of the best features of Empower is how easy it is to use. The interface is clean and easy to find the information you need, as shown below:

Empower doesn’t just give you a snapshot of your finances — it actively helps you manage them. The platform breaks down your spending trends, tracks your income versus expenses and helps identify where you might be overspending.

It has retirement planning tools, showing whether you’re on track to meet your long-term goals based on your current savings and investment performance. By bringing all of this together in one place, Empower makes it easier to make informed financial decisions.

Benefits of Empower

Empower offers you a full perspective of your finances in one hub. Along with this, it offers the following perks:

- It's free: Empower is free to sign up and use. If you opt for one its advisory services, there will be fees associated with it. Even still, having free features is an excellent benefit compared to other budgeting apps that charge for these services.

- Advisory services: If you feel your portfolio is underperforming or want a fresh perspective on your investments, Empower offers fee-based advisory services. These services include personalized investment management and retirement planning tailored to your financial goals.

- Personalized planning: The platform offers planning tools for savings and retirement accounts to keep you on course to achieving your goals.

- Simple to use: Among the budgeting apps I've used, this is one of the cleanest and easiest to find information.

Considerations to keep in mind with Empower

While Empower offers many enticing perks, here are a few things to keep in mind when using the service:

- Limited budgeting tools: While the platform compiles all transactions from your linked accounts, it doesn't allow you to input manual transactions. So, if you buy some things in cash, the platform can be limiting.

- No credit management tools: One area that Empower doesn't touch is having access to your credit report. It's not a big deal, as you can pair this service with another one like myFICO to see your credit scores, but it would have been a nice inclusion to round out your financial profile.

- App can be glitchy: Empower also has a free mobile app, offering many of the same features found on its website. Recently, users have expressed frustration with using the biometric tool (fingerprint) upon logging in. If you encounter this issue, a simple workaround is to log into the website instead.

Is Empower worth it?

If you're struggling to see a full picture of your finances because you have accounts with multiple banks, Empower puts the pieces of the puzzle together for you. It offers you a digital hub to see how all your accounts are performing with just one simple login.

Most importantly, it's free. That on its own makes Empower a terrific value.

However, also consider some of the platform's limitations such as limited budgeting tools and no credit management options. If you already have a system that works well for budgeting and tracking credit, you might not find those features in Empower essential.

But if you want to try something new, there isn't an easier platform to use.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sean is a veteran personal finance writer, with over 10 years of experience. He's written finance guides on insurance, savings, travel and more for CNET, Bankrate and GOBankingRates.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

The Best Short-Term CD for Your Cash in 2026

The Best Short-Term CD for Your Cash in 2026This strategy can help you earn thousands in months.

-

Thinking of Switching Phone Carriers? Do These 8 Things First

Thinking of Switching Phone Carriers? Do These 8 Things FirstSwitching carriers is easier than ever, but overlooking the fine print could cost you. Here’s what to check before you make the move.

-

Samsung Galaxy S26 Ultra: What to Know Before You Upgrade

Samsung Galaxy S26 Ultra: What to Know Before You UpgradeThe Galaxy S26 Ultra brings new features and strong launch deals, but whether it’s worth upgrading depends on what you already own.

-

What Is an Assumable Mortgage and Could It Save You Thousands?

What Is an Assumable Mortgage and Could It Save You Thousands?With mortgage rates still elevated, taking over a seller’s existing home loan could lower monthly payments — if the numbers work.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and Cash

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and CashWhat you can learn about protecting your cash and values from where Olympians store their medals.

-

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal Crime

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal CrimeSeveral medical professionals reached out to say that one of their bosses suggested committing a crime to fulfill OSHA requirements. What's an employee to do?