How to Lower Home Insurance Rates When Climate Change Increases Costs

A top insurer warns the damage climate change creates make it cost-prohibitive for insurers to cover some areas. Learn how to protect your home and lower costs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The weather is causing so much damage, home insurance companies are struggling to keep up. For example, wildfires in California caused more than $250 billion in damages.

It's created a situation in which some insurance companies such as State Farm had to drop coverage in more risk-prone areas of Los Angeles.

According to insurance expert Günther Thallinger, a board member with Allianz SE, this is a preview of coming attractions. "We are fast approaching temperature levels — 1.5C, 2C, 3C — where insurers will no longer be able to offer coverage for many of these risks,” he told The Guardian.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This would have an effect on other financial sectors, as well. "This applies not only to housing, but to infrastructure, transportation, agriculture and industry,” he remarked.

The good news is solutions are available that can slow climate change's speed, such as zero-emission options. The bad news is that some countries are slow to adopt such solutions, while in other nations, such considerations aren't on the table.

How the U.S. fails to address climate change threats

Since taking office, President Donald Trump has worked to undo many efforts that his predecessors set up to combat climate change while calling it "a hoax." He withdrew the U.S. from the Paris Agreement, an international treaty in which countries pledge to work together to limit climate warming to less than 2 degrees Celsius.

In addition, members of his cabinet are dismantling other agencies that aid in assisting those impacted by climate change.

Homeland Security Secretary Kristi Noem said she supports the dismantling or severe reduction of the Federal Emergency Management Agency (FEMA). While a dismantling hasn't happened yet, the new administration changed the way it works.

Recently, FEMA announced the discontinuation of the Building Resilient Infrastructure and Communities program, which was responsible for helping communities prepare for climate change events such as flooding and wildfires. The program ended due to efforts to remove "fraud, waste and abuse."

If you feel as if you're on your own with all of this, you would be accurate. However, there are some things you can do to lower costs and protect your home.

How to save when home insurance rates rise

The average cost of home insurance on a $300,000 dwelling is $2,267 annually, according to Bankrate.

That said, your costs can vary based on a variety of factors. The age of your home, its size, claims history, weather in your area and other variables will create a more accurate depiction of what you'll pay for home insurance.

The easiest and most effective way to save when home insurance prices surge is to request a fresh quote on your property.

Using this tool from Bankrate can show you an idea of what it takes to insure your property:

Last year, I received a policy renewal that was going to add a hundred dollars per month to my home insurance premium. I didn't file any claims, but others in the area did due to hail damage.

Conducting a quick quote search allowed me to save not only on my home insurance but my auto, too. It pays to shop around for home insurance.

Improvements to make your home more climate-resistant

Doing some of the following improvements can help your home better withstand the rigors of inclement weather, and they might save money on your homeowners insurance:

- Install a metal roof: If you have an older roof, you're probably paying a little more for home insurance. By replacing it with a metal roof, you shelter your home from hail and winter weather, and you might earn a discount.

- Add storm shutters: Storm shutters can protect your windows from hail damage, and in some instances, it could earn you a small discount.

- Install a security system: Security systems can lower your home insurance because it can prevent crimes of opportunity. Some home security systems also come with excellent detection tools such as fire and water sensors, which can alert you to problems quicker.

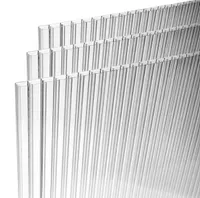

Let the light in while still protecting your windows and doors. 16 mm clear polycarbonate 3 wall construction. Easy to install and remove for storage after the storm has passed.

Make sure to notify your insurance carrier of any home improvements you do so they can reflect this in your premiums.

In the case of metal roofs, it might not lower your insurance costs, but it will lower the costs incurred by storm damage. Metal roofs also last 40 to 70 years on average, meaning your replacement costs would be minimal for the life of ownership.

The bottom line

The damage wrought by climate change creates a situation in which some locations are too risky for insurance companies, and in other areas, it's raising rates for many homeowners.

One of the best ways to lower rates is to shop around before your policy renews, which can save hundreds of dollars annually.

By making some improvements to your home, you can also help it become more climate-resistant while lowering insurance costs.

Related section

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sean is a veteran personal finance writer, with over 10 years of experience. He's written finance guides on insurance, savings, travel and more for CNET, Bankrate and GOBankingRates.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

5 Laundry Habits That Are Costing You Money

5 Laundry Habits That Are Costing You MoneyYou might be flushing money down the drain if you have any of these laundry habits.

-

My First $1 Million: Banking Executive, 37, Nashville

My First $1 Million: Banking Executive, 37, NashvilleEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

New Ways to Keep Your Online Accounts Safe

New Ways to Keep Your Online Accounts SafeAs cybercrime evolves, the strategies you use to protect yourself need to evolve, too.

-

Can Your Car Insurance Add Strangers to Your Policy? A Florida Class Action Lawsuit Could Decide

Can Your Car Insurance Add Strangers to Your Policy? A Florida Class Action Lawsuit Could DecideA Florida driver says GEICO added complete strangers to her car insurance policy and jacked up premiums as a result.

-

Life Loves to Throw Curveballs, So Ditch the Rigid Money Rules and Do This Instead

Life Loves to Throw Curveballs, So Ditch the Rigid Money Rules and Do This InsteadSome rules are too rigid for real life. A values-based philosophy is a more flexible approach that helps you retain confidence — whatever life throws at you.

-

The Best Short-Term CD for Your Cash in 2026

The Best Short-Term CD for Your Cash in 2026This strategy can help you earn thousands in months.

-

What Is an Assumable Mortgage and Could It Save You Thousands?

What Is an Assumable Mortgage and Could It Save You Thousands?With mortgage rates still elevated, taking over a seller’s existing home loan could lower monthly payments — if the numbers work.