‘Advisor’ vs. ‘Adviser’: What’s the Big Deal?

You’ve seen the term written both ways, so which one is right – and can one simple letter make a difference in the credentials of the financial professionals you work with? Here’s the backstory of how the two terms diverged and what it could mean for you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The use of “advisor” or “adviser” is far from subjective as some articles on the subject might suggest. In fact, arguing the case for either spelling can send one down an unending dictionary rabbit hole. Either way, the favoritism of one title over another appears to be a source of confusion for investors.

Both titles have deep roots and have been used interchangeably for decades. Webster’s suggests that either advisor or adviser can be used, as both spellings define an individual who engages in the act of advising or offering recommendations. The Associated Press Style Guide, the veritable tome of grammar for editors and writers alike, favors the “-er” version.

The one distinction that most can agree upon is that while “adviser” is the preferred term, both spellings are correct, provided they are used consistently throughout a content piece.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If both “advisor” and “adviser” mean the same thing, then, what exactly is the big deal about the spelling within the financial services industry?

A Schism with Regulatory Roots

Whether the preferred title a financial professional uses today is “advisor” or “adviser,” the choice of spelling is steeped in history. In the distant past, financial professionals labeled themselves as “advisers,” but a rash of malfeasance by advisers — followed by regulatory changes made in the 20th century — brought about a mass migration of firms adopting the “advisor” label instead.

You see, in the 1920s, during the early days of mutual funds, gross abuse plagued investment funds. Funds were often created by “advisers” who dominated the boards of directors for these funds. Rather than increase the value, they placed their own interests, and those of their associates, ahead of investors. So, at this time, many financial professionals chose to label themselves as “advisors” to distance themselves from the nefarious actions of their “adviser” counterparts.

During the Great Depression, it became obvious that a crackdown was necessary to end the abuse that was running rampant in this grave era. In response, the U.S. Investment Advisers Act of 1940 was passed — and while the Act has done a lot of good, its name contributed to the spelling conundrum we see today. A regulatory distinction was inadvertently created because of that choice of spelling. In the eyes of financial professionals, the “adviser” spelling was more related to the regulatory act and financial services regulations.

Another shift occurred naturally. The naming of governing bodies and the verbiage spelled out in the Investment Advisers Act have come to characterize the widely accepted legal and regulatory spelling adoption as “adviser.” The Act requires financial professionals to register with a governing body. Thus, someone who calls himself or herself an “advisor” might work for a Registered Investment Adviser (RIA), or they may be an Investment Adviser Representative of a firm (IAR). The bottom line is that if a professional is engaged in providing ongoing investment advice for compensation, they are required to register as an “investment adviser” regardless of whether their title or the name of the company they work for uses the term “advisor.”

Applying this historical context, it is not surprising to see that the “adviser” spelling has been in print use much longer and may explain why it is the preferred spelling for many long-established dictionaries and journalist sources.

The Current Growing Popularity of Advisor over Adviser

Outside of the regulatory language, there are other driving forces that may have helped instigate the shift in spelling for what financial professionals choose to call themselves today. The “advisor” adaptation that began taking off likely originated from the root word “advisory.” Professionals gradually adopted the more impressive-sounding “advisor” version as a means of inflating their importance as well as distinguishing themselves from the more regulatory adviser governing body.

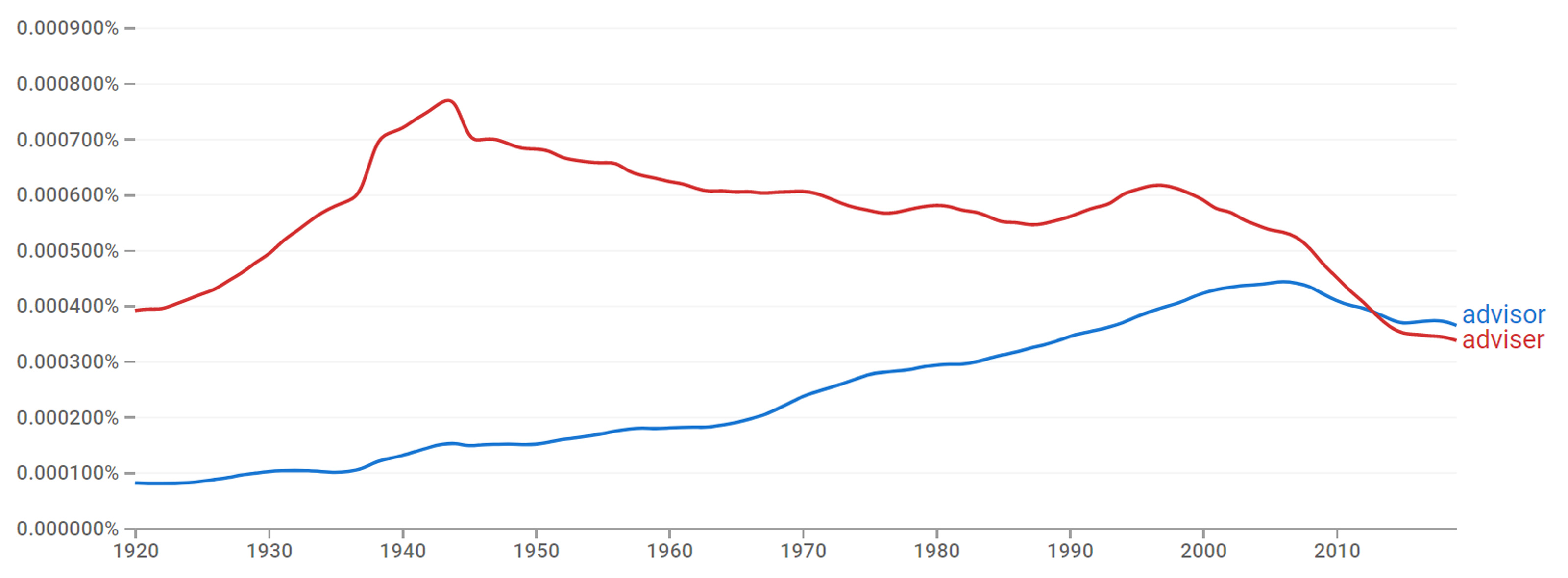

Over time there also appears to be a shift in public perception. An “advisor” is generally recognized synonymously as a professional. Though some professionals do still prefer the -er version, the numbers have dwindled since the 1940 Act. According to Google NGram Viewer (Figure 1), which is an indicator of the use of words in print, the use of “advisor” has overtaken the use of adviser since 2012.

Figure 1:

Financial Advisor vs Financial Adviser

Historical Use of Advisor vs Adviser in print from 1920-2019

Source: Google Books Ngram Viewer

Adding Distance

The Wall Street Crash of 1929 and ensuing Great Depression lasting through 1939 was an impetus for change in the financial services industry. It’s not difficult to see why professionals might want to distance themselves from the rogue “advisers” and their unscrupulous activities prior to the 1940 Act. Since then, the switch has been widely adopted, and it is now customary to use the -er spelling as related to a legal, governing body and the -or spelling as relating to practicing professionals.

Though the Securities and Exchange Commission (SEC) has not weighed in on any regulatory distinction between the spellings, they do focus on whether a professional conforms to laws designed to protect investors. Notably, a portion of this regulation involves avoiding misrepresentation.

The reality is that while financial professionals have long been accused of rearranging the spelling to inflate their importance, that sentiment would not pass regulatory muster without the SEC establishing rules on such use.

When searching for a financial professional or wading through a stream of planning strategies, depending upon the site searched, it may net different results if seeking an “adviser” versus an “advisor.”

Regardless of which spelling financial professionals use, you should expect to receive the same professional services you are searching for. That is, after all, what is more important than a lesson in spelling.

Editor’s Note: Kiplinger’s Personal Finance adheres to the AP Style rule in preferring “adviser” over “advisor.” We use the former in all cases except proper nouns.

References:

Advisor, Adviser. (2021). Google Books NGram Viewer. Retrieved Aug. 10, 2021, from https://books.google.com/ngrams/graph?content=advisor%2Cadviser&year_start=1920&year_end=2019&corpus=26&smoothing=3

Weiner, M. B. (2020). A historical analysis of the investment company act of 1940. Michigan Business & Entrepreneurial Law Review, 10(1), 67-83. https://repository.law.umich.edu/mbelr/vol10/iss1/4/

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kris Maksimovich, AIF®, CRPC®, CRC®, is president of Global Wealth Advisors in Lewisville, Texas. Since it was formed in 2008, GWA continues to expand with offices around the country. Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.