Why I Love Boring Stocks: Glassman

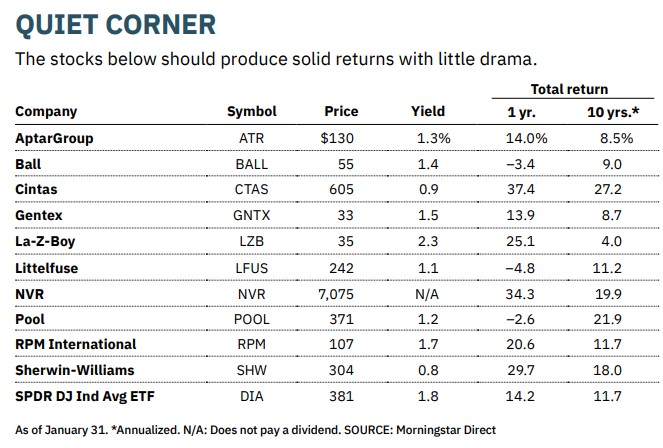

The best "boring stocks" can produce solid returns for investors with little drama. Here are a few that I like.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

With wars raging in Ukraine and the Middle East, a former president on trial, federal deficits running into the trillions and just general tumult all around, wouldn't it be nice to be bored once in a while? Stocks can provide the respite you need.

Well, certain kinds of stocks. Not Tesla (TSLA) certainly, or AMC Entertainment Holdings (AMC), the movie chain that has gone from over $500 a share to under $5 in less than three years. No, I am talking about shares of companies in boring businesses that just keep making money doing quotidian things. (Stocks I like are in bold; prices and other data are as of January 31.)

Consider Littelfuse (LFUS) a 97-year-old manufacturer based in Des Plaines, Illinois. As you might have guessed, Littelfuse makes little fuses or, more elegantly, circuit-protection devices used in cars, trucks and industrial products. When I wrote about Littelfuse in May 2004, it was trading at $41 a share; it's now $242.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Littelfuse was a selection of Elliott Schlang, an analyst in Cleveland whose specialty is finding numbingly mundane companies in the Midwest. Kevin Hassett and I highlighted Schlang in our 1999 book, Dow 36,000, and he didn't disappoint. One of his favorites: Cintas (CTAS), provider of work uniforms. It has risen from $45 a share to $605 over the past 20 years.

Then, there's AptarGroup (ATR), a Crystal Lake, Illinois, maker of pumps, closures and aerosol valves. Boring enough. It's gone from $20 to $130 over the same period. I'm using 20-year figures because if you want to own boring stocks, you need to have a long time horizon – 10 years or more. It can take a decade or two for investors to wake up to the value of these companies.

My favorite boring stock of all time is RPM International (RPM), which makes coatings for waterproofing and rustproofing. Based in Medina, Ohio, RPM has risen from $17 to $107 in the past 20 years. Its dividend payout has increased every year for the past half-century. The current yield is small today (1.7%), but if you had bought shares in 2004, RPM would be paying you more than 10% annually on your original investment.

A consistently rising dividend is a sign that a boring stock has a true moat, or protection against competitors. Companies with a strong niche – through patents, a brand or just reputation with customers – can increase their profits and dividends regularly, even in tough times. Schlang told me 20 years ago that you don't have to be a genius to find firms with moats. Just look for the evidence: those rising earnings and payouts. Cintas has raised its dividend for 41 straight years; Aptar for 30.

What makes a boring stock?

From Schlang's imparted wisdom and my own experience, I have gleaned other advice about finding the best mundane stocks:

They are largely self-funding. In other words, firms that tend to make capital investments out of their own profits rather than through outside borrowing. You won't find many businesses that have no debt, but you should favor companies that have little. RPM, with a market capitalization (price times shares outstanding) of $13.7 billion, has about $3 billion in debt – about the same as three years ago. Its interest expense last year was just $126 million.

Few analysts follow them. When a company's shares are covered by lots of financial experts, the company is unlikely to be a "hidden gem," in Schlang's words. It has been priced by an efficient market. But some stocks are so boring that their prices may be inefficient – that is, lower (or, in some cases, higher) than they ought to be. Apple (AAPL) is covered by 37 analysts. La-Z-Boy (LZB), a stock whose name practically puts you to sleep, is covered by three, and Tootsie Roll (TR), a Schlang obsession for decades, is covered by none at all.

Insiders are on board. You want founders, directors and managers with skin in the game and interests that align with those of their investors. Insiders own 15% of Cintas, with a market cap of $61 billion.

They stick mostly to the U.S. One way to keep things simple is by owning firms that do most of their business in the U.S. Then, you don't have to worry so much about currency fluctuations or geopolitical threats. A good example of a boring domestic sector is homebuilding. It's why I like NVR (NVR), which has soared in 20 years from $460 to $7,075 (that's not a misprint). I have long been a fan of Pool (POOL), a Louisiana-based distributor of pool supplies. The stock soared from $21 in 2004 to a high of $565 in 2021, getting a big boost from the stay-at-home trend during the COVID pandemic. Shares have now settled to $371, an attractive price.

Stock valuations are reasonable. Cheap stocks are a bonus. Schlang once told me that "preference is given to a great company over a great stock." Yes, but always look for bargain. One is Gentex (GNTX), maker of rearview mirrors. In 2023, revenues rose 20% compared with the previous year, and profits were up 34%, but the stock trades at just 16 times earnings, based on the 2024 consensus projections of analysts (just nine of them).

Integrity counts. "Companies are the sum total of the human beings that manage them," Schlang once wrote. It's hard to gauge the integrity of most CEOs, but when you find one who acts erratically or has evidenced little regard for the humanity for employees, shareholders or customers, then sell the stock.

The Dow Jones Industrial Average in the past was dominated by firms in mundane businesses. Now, it includes a few sexy stocks, such as Salesforce (CRM) and Nike (NKE), but the components remain largely boring: Walmart (WMT), McDonald's (MCD), Verizon Communications (VZ) and the like. The best way to buy the Dow is through SPDR Dow Jones Industrial Average (DIA), an exchange-traded fund also known as Diamonds.

One mutual fund family that's proud of investing in boring companies is Parnassus. In a message to shareholders last year, its management wrote: "We often find that what may strike some as boring companies are in fact durable businesses with interesting drivers that can compound quality over the long term. In our research, we find some common threads running through these companies: They are defensive in tough times. They have strong economic moats. And they are often quietly innovative in ways that add value."

The portfolio of Parnassus Core Equity (PRBLX) includes such boring wonders as Ball, which was founded in 1880 as a glass-jar maker and now focuses on aluminum packaging. Another of the fund's holdings is Sherwin-Williams (SHW), the Cleveland-based paint company whose shares have gone from $12 to $304 in the past 20 years.

Yes, good investing is just like watching paint dry.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks and funds mentioned here, he owns NVR and SPDR Dow Jones Industrial Average. You can reach him at JKGlassman@gmail.com.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

The Merger Market is Heating Up. Here's How to Cash In

The Merger Market is Heating Up. Here's How to Cash InInvesting in takeover deals can be a low-volatility way to diversify your portfolio.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Private Capital Wants In on Your Retirement Account

Private Capital Wants In on Your Retirement AccountDoes offering private capital in 401(k)s represent an exciting new investment opportunity for "the little guy," or an opaque and expensive Wall Street product?

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Yes, Artificial Intelligence Stocks Are Booming

Yes, Artificial Intelligence Stocks Are BoomingIt's fair to ask about the latest tech boom, "Is it really different this time?"

-

A Value Focus Clips Returns for This Mairs & Power Growth Fund

A Value Focus Clips Returns for This Mairs & Power Growth FundRough years for UnitedHealth and Fiserv have weighed on returns for one of our favorite mutual funds.

-

Small-Cap Stocks Gain Momentum. That's Good News for This iShares ETF

Small-Cap Stocks Gain Momentum. That's Good News for This iShares ETFThe clouds appear to be parting for small-cap stocks, which bodes well for one of our favorite exchange-traded funds.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.