Stock Market Today: S&P Surges to Fourth Gain in a Row

Signs that the Federal Reserve's tactics might indeed be pushing back on inflation helped lift stocks to yet another win Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The S&P 500 matched its longest winning streak of the year Thursday as data continued to suggest that the Federal Reserve just might have some breathing room soon.

The Department of Labor reported that 234,000 Americans applied for unemployment benefits during the week ending July 2 – 4,000 more claims than the previous week, and the highest such level in nearly six months.

"It's never a good thing to see layoffs, but the pressure on wages may have now peaked," says Jamie Cox, managing partner for financial planner Harris Financial Group. "A few more weeks of these types of numbers and maybe, just maybe, financial conditions are tight enough to allow the Fed to throttle back on the scale of rate increases."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A much stronger indicator of whether the U.S. central bank will do just that comes tomorrow morning, in the form of the June jobs report.

"The key for tomorrow's jobs report is that it furthers the idea that we've hit 'peak hawkishness' with the Fed and 'peak inflation,'" says Tom Essaye, editor of the Sevens Report. "If the jobs report reflects those two realities, it'll likely spur a continued relief rally. If it implies the opposite, look for another painful decline."

Also helping to drive stocks was data suggesting global supply-chain disruption might be easing. Jeffrey Roach, chief economist for independent broker-dealer LPL Financial, notes that New York Fed data showed that global supply chains were under less pressure in June compared to May.

"The small improvement in supply chains will eventually filter through to improved consumer pricing," says Roach, who adds that supply-chain effects take about four months to affect headline consumer prices.

Energy stocks (+3.6%) were the top sector Thursday, led by the likes of APA (APA, +7.8%) and Devon Energy (DVN, +5.2%). Data from the Energy Information Administration showed a recent snap-back in gasoline demand, helping U.S. crude oil futures rebound 4.3% to $102.73 per barrel.

Technology stocks (+2.1%) also produced robust gains, largely on the back of the semiconductor industry. Just a few days after Micron (MU, +2.6%) warned that it expected demand for consumer-product components to wane, Samsung triggered a relief rally after saying it expected second-quarter revenues to improve by 22%; Qualcomm (QCOM, +5.8%), Advanced Micro Devices (AMD, +5.2%) and Nvidia (NVDA, +4.8%) were among the beneficiaries.

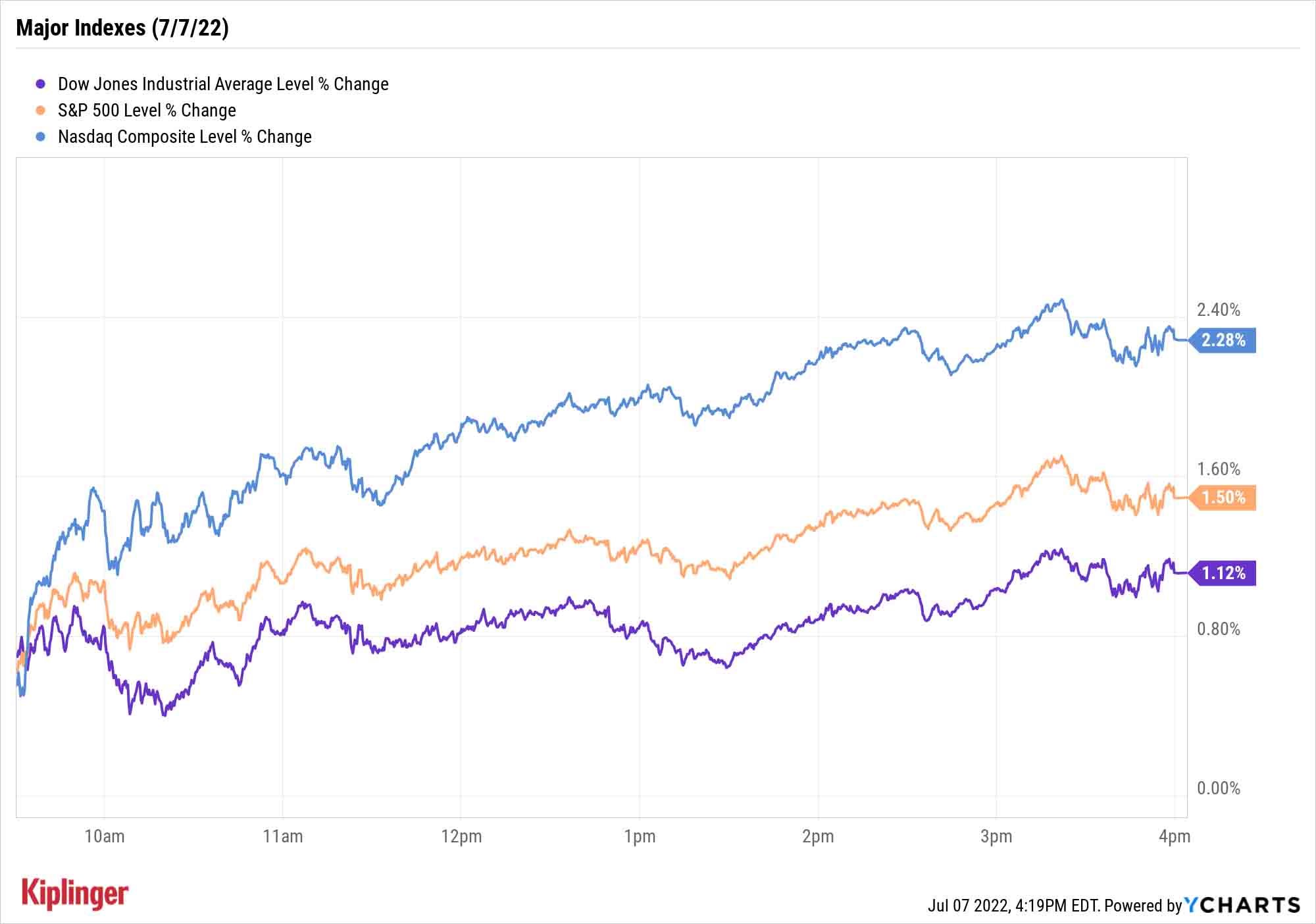

The S&P 500 (+1.5% to 3,902) posted its fourth consecutive gain to equal its previous 2022-best streak during the end of January and beginning of February. The Nasdaq Composite (+2.3% to 11,621) also made it four in a row, while the Dow Jones Industrial Average (+1.1% to 31,384) strung together two days of black ink.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 2.4% to 1,769.

- Gold futures snapped their seven-day losing streak, adding 0.2% to settle at $1,739.70 an ounce.

- Bitcoin rallied 7.3% to $21,780.17. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- GameStop (GME) soared 15.1% after the video game retailer joined several other companies this year by announcing a stock split. The board-approved move will split GME stock in a 4-to-1 ratio – and will give stakeholders three additional shares for each one they own at the close on Monday, July 19. It will also lower GME stock's price on a split-adjusted basis beginning on Friday, July 22. Based on today's close at $135.12, shares would go for roughly $34 apiece.

- Virgin Galactic Holdings (SPCE) shot up 12.1% after the space exploration company announced a partnership with Aurora Flight Sciences, a subsidiary of Boeing (BA, +2.7%), to develop two additional aircraft carriers, with the first expected to be ready to launch in 2025. Reagrdless, CFRA Research analyst Keith Snyder today initiated coverage on SPCE stock with a Sell rating. "While it will take a number of years to work through the current customer list, our Sell recommendation reflects our view that its main competitor, Blue Origin, has already begun commercial operations and offers tickets at a much lower cost compared to the $450k charged by SPCE per seat," Snyder says. "In addition, companies like SpaceX could easily enter the space tourism market with its vastly superior and flight proven launch technology."

Don't Fall for These Debunked Myths

You know how you've heard that you should pay off your debt before you start investing? Well … that's not necessarily true. Sometimes it pays to knock out your IOUs first, but depending on how high or low your interest rate on that debt is, investing might actually be a better use of your money.

That's just one example of several investing myths that are often touted as conventional wisdom.

Most of the time (but not always), the people who peddle these misconceptions don't have ill intent – sometimes, they pick it up from other people they respect, and sometimes, things that used to be true have simply changed over time. All the same, these myths could result in financial decisions that aren't right for you.

Today, we'd like to put some of these myths to bed. Read on as a group of financial experts review seven of the most common investing myths and explain why they don't hold up.

Kyle Woodley was long AMD and NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.