Buffered ETFs for a Rocky Market

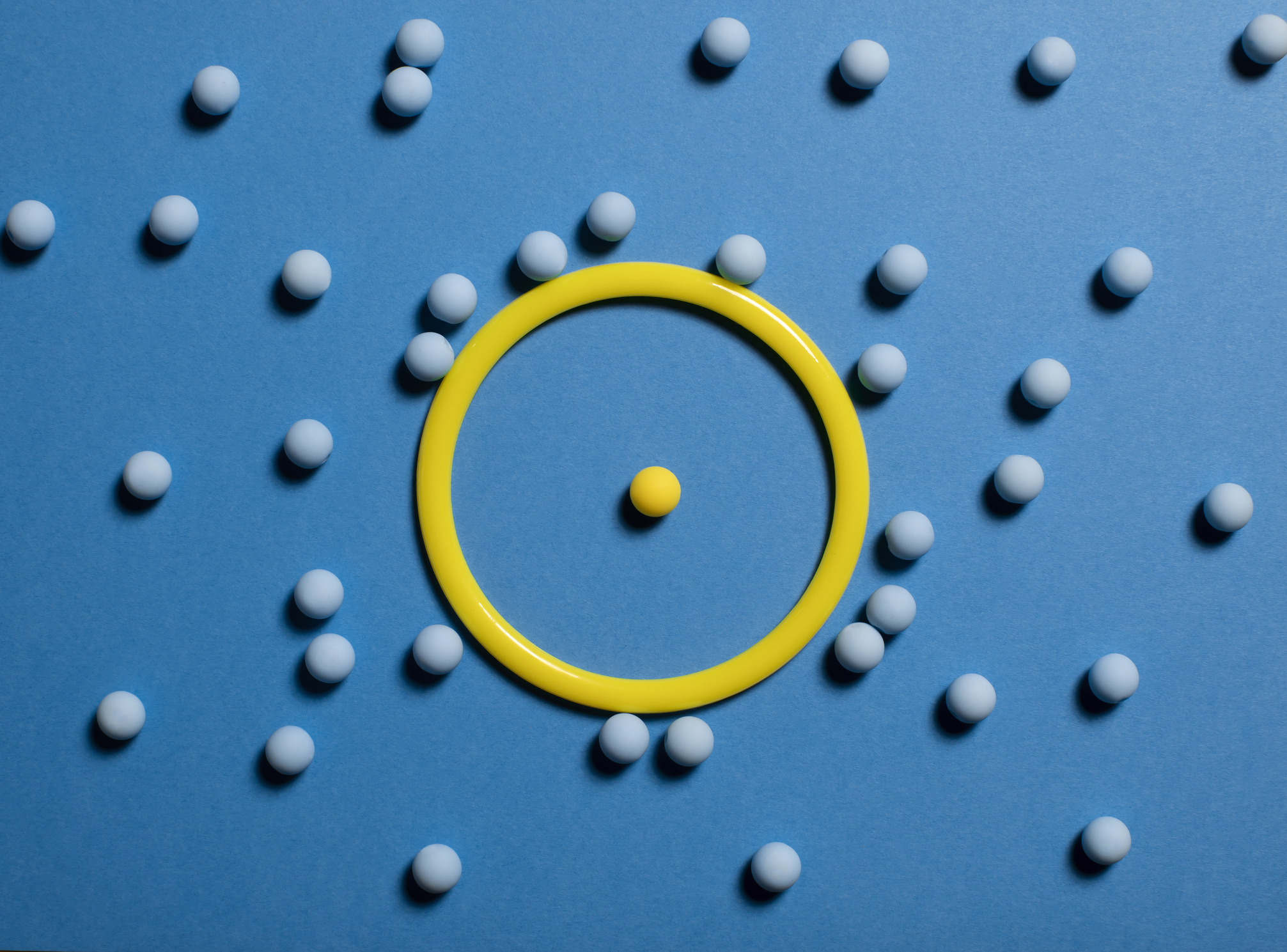

Buffered ETFs provide protection during market downturns, but in exchange, your gains are capped.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Rocky markets have put a spotlight on defined-outcome exchange-traded funds (ETFs), which protect investors from a portion of stock market losses in exchange for capping some of the gains.

These funds, also called buffered ETFs, invest in options linked to a broad benchmark in order to provide a specific amount of downside protection – 9%, 10%, 15%, 20% or even 100% – over a distinct time frame called the outcome period, typically one year (though three-month funds are now popular).

How much you forfeit in gains depends on the amount of protection the fund offers. The bigger the cushion, the smaller the potential gain.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A recently launched PGIM fund tied to the S&P 500 Index with 100% protection on losses over one year had a 7% cap on upside returns, while an Allianz ETF with a 10% shield sported a cap of roughly 16%, net of fees.

It's important to find a fund that aligns with your investment objectives and risk tolerance, says Mike Loukas, chief executive of the firm behind TrueShares defined-outcome funds.

To get you started, we've highlighted a few buffered ETFs that may work for investors with certain risk tolerances. Use these suggestions to start your own research.

How to find the best buffered ETFs for you

Bear in mind that the strategies, which charge average annual fees of 0.72%, are structured around specific outcome periods because of the options they buy, but the funds themselves are designed to be buy-and-hold investments.

When a fund's outcome period expires, the fund managers reset it by buying new options for the next cycle.

That said, the timing of purchases should be deliberate. To take advantage of a fund's full downside buffer, it's best to buy shares in a defined-outcome fund a day before the start of the period (the day the fund resets).

"I recommend buying on the reset day, an hour or so before the market closes,” says Beverly Hills, California, adviser Stuart Chaussee. Remember, the advertised protection and cap on gains only apply over the full outcome period.

And note that the cap on gains will likely vary from one outcome period to the next because it is based on options prices at the start of the period, which fluctuate.

For conservative investors: A 100% buffered fund protects against a colossal stock market loss over a one-year period. And if the market doesn't falter, you might do better than a money market fund.

The current cap on gains for the iShares Large Cap Max Buffer (MAXJ), which will reset June 30, is 10.6% for investors who bought at the start of the outcome period last June.

A 20% buffer fund is another option. Chaussee likes the AllianzIM U.S. Large Cap Buffer20 July (JULW). The fund's current cap, which resets July 1, is 11.64%.

For moderate-risk investors: Funds with 15% buffers on declines are the most popular with investors. The July-dated fund of a popular series, the Innovator U.S. Equity Power Buffer ETF July (PJUL), had a cap of 13.7% on gains for investors who bought shares last June. It will reset June 30.

For aggressive investors: Funds with 9% cushions against losses are the obvious choice here. The current cap on the Innovator U.S. Equity Buffer ETF July (BJUL), which will reset on June 30, is 17.4%.

Bullish investors could consider TrueShares Structured Outcome funds. Instead of a cap on gains, investors can expect to reap 73% to 85% of the S&P 500's price return, in exchange for 8% to 12% protection on losses. The TrueShares Structured July-dated fund (JULZ) resets June 30.

This item first appeared in Kiplinger Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.