Donor-Advised Funds: A Tax-Savvy Way to Rebalance Your Portfolio

Long-term investors who embrace charitable giving can easily save on capital gains taxes by donating shares when it’s time to get their portfolio back in balance.

Rebalancing your portfolio regularly is one of the basic fundamentals of sound long-term investing. The good news for long-term investors is that if you regularly give to charity, there is a tax-efficient way to rebalance your portfolio — the donor-advised fund.

Why rebalance? Over time, higher-risk assets, like stocks, will dominate a portfolio, leading to higher volatility. Without rebalancing, it is too easy for portfolios to drift significantly from the risk-reward balance that is right for your personal financial goals. But if you rebalance too often, you can hurt your long-term returns with higher trading costs and by triggering expensive capital gains taxes.

Some of the best research to date on how to rebalance a multiasset portfolio has come from Vanguard, which looked at a wide variety of approaches and thresholds. Their conclusion? Most investors would be better off by rebalancing their portfolios once per year, with a 1% or 2% threshold for variation.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, that research did not take into account the donor-advised fund, one of the most useful and rapidly growing types of tax-advantaged accounts available to investors.

The Problem with Rebalancing and Taxes

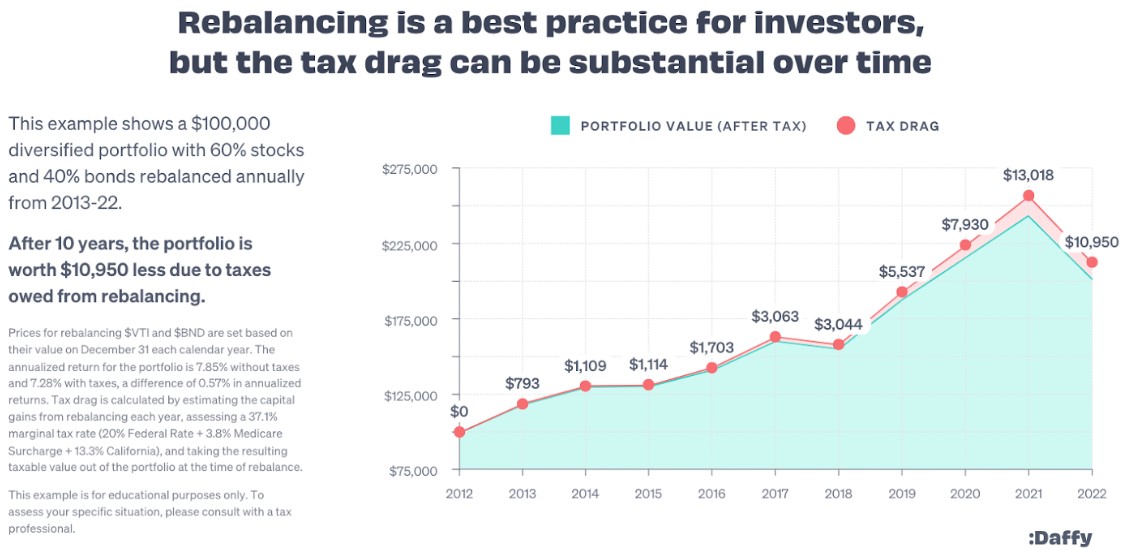

Most people follow a relatively simple process for rebalancing their portfolios, and robo advisors and target-date funds do this automatically for investors. However, one of the fundamental problems with rebalancing is the drag introduced by triggering capital gains taxes.

By definition, rebalancing a portfolio involves selling assets that have outperformed the overall portfolio and buying assets that have underperformed. This makes sense, as the performance year-to-year of various asset classes is unpredictable, and rebalancing forces investors to periodically “buy low and sell high.”

The problem is that selling assets that have outperformed inevitably leads to realizing capital gains, which means capital gains taxes. In a high-tax state like California, that can mean taxes of up to 37.1% on long-term capital gains (20% federal rate + 3.8% Medicare surcharge + 13.3% California rate).

While this issue is not a problem for tax-deferred accounts like 401(k)s or IRAs, it can seriously impact the performance of a taxable brokerage account.

How to Use Charitable Donations to Rebalance

Between 60 million and 70 million households in the United States donate to charity every year. If you are one of those households, there is a better and more tax-efficient way to rebalance your portfolio and support the charities and causes you care deeply about.

In the traditional method, rebalancing a portfolio involves two sets of transactions. First, you sell off the excess amount of the assets that have outperformed the portfolio. Second, you use the cash to purchase shares of the underperforming assets.

But if you regularly give to charity, you can save taxes by changing the first step of this process.

To understand this new method, you need to recognize only two simple insights:

- When you donate stocks, ETFs or mutual funds that have long-term capital gains, you get the full income tax deduction (up to 30% of your AGI) for the market value of the securities.

- There is no “wash sale rule” for donating securities.

As a result of these two facts, you can dramatically increase your tax savings every year when you rebalance by donating appreciated shares instead of selling them, and then using the cash that you would have normally donated to charity to purchase the underperforming assets.

Let’s look at a simple example to illustrate. Imagine an investor who has a $100,000 portfolio made up of 60% stocks and 40% bonds, as represented by Vanguard Total Stock Market Index Fund (VTI) and Vanguard Total Bond Market Index Fund (BND).

This investor has been holding their portfolio for a few years without rebalancing, and in that time period, stocks have outperformed bonds, so the portfolio is now a $120,000 portfolio made up of 70% stocks ($84,000) and 30% bonds ($36,000). To rebalance this portfolio back to the desired 60/40 split, the investor would normally sell $12,000 of VTI and use those funds to purchase $12,000 of BND.

Unfortunately, that would trigger $12,000 of long-term capital gains, which at top rates could mean a $4,452 tax bill for federal and state taxes.

But if this investor normally donates $6,000 per year to charity, they can save half of that tax bill.

Instead of selling $12,000 of VTI, they can donate half of those shares ($6,000) to charity instead. They get the same charitable deduction they would have received for donating cash, and they never trigger those capital gains taxes. Since they did not use the $6,000 in cash they normally donate to charity, they can use that money to buy $6,000 of BND to help rebalance their portfolio, saving up to $2,262 in taxes.

That’s a huge number. $2,262 is a 1.9% drag on a $120,000 portfolio. Think of how many investors work diligently to lower their investment expenses by even 0.5%, and these annual savings could be several times bigger!

This sounds too good to be true, so if you are looking for a catch, there are a couple. First, most charities do not accept securities donations. In fact, out of the over 1.7 million registered charities in the U.S., only a few thousand accept securities. Second, you may want to spread out your charitable donations to organizations over months or even years.

Fortunately, donor-advised funds solve both of these problems. A good donor-advised fund will accept securities donations and let you invest the proceeds of that donation tax-free until you are ready to recommend a grant to a specific charity.

Donor-advised funds used to have high minimum balances and even higher fees, but there are now modern, low-cost options, like Daffy.org, which charge as little as $3 per month.

So rest assured. You no longer have to choose between sound long-term investing and lower taxes. By taking advantage of the ability to donate your appreciated securities, you can now rebalance your portfolio annually and save money on taxes.

Assumptions that were used in the above graphic: Prices for rebalancing VTI and BND are set based on their value on December 31 each calendar year. The annualized return for the portfolio is 7.85% without taxes and 7.28% with taxes, a difference of 0.57% in annualized returns. Tax drag is calculated by estimating the capital gains from rebalancing each year, assessing a 37.1% marginal tax rate (20% federal rate + 3.8% Medicare surcharge + 13.3% California rate), and taking the resulting taxable value out of the portfolio at the time of rebalance. This example is for educational purposes only. To assess your specific situation, please consult with a tax professional.

The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Nash is the co-founder & CEO of Daffy.org, the Donor-Advised Fund for You™, an innovative, fast-growing platform for charitable giving. With no minimum to get started, industry-low fees and ground-breaking technology, Daffy brings the donor-advised fund back to its original goal of helping people be more generous, more often. Adam has served as an executive, angel investor and adviser to some of the most successful technology companies to come out of Silicon Valley. He is currently on the Board of Directors for Acorns, the country’s fastest-growing financial wellness system, and Shift Technologies.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Higher Summer Costs: Tariffs Fuel Inflation in June

Higher Summer Costs: Tariffs Fuel Inflation in JuneTariffs Your summer holiday just got more expensive, and tariffs are partially to blame, economists say.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

Know Your ABDs? A Beginner's Guide to Medicare Basics

Know Your ABDs? A Beginner's Guide to Medicare BasicsMedicare is an alphabet soup — and the rules can be just as confusing as the terminology. Conquer the system with this beginner's guide to Parts A, B and D.

-

I'm an Investment Adviser: Why Playing Defense Can Win the Investing Game

I'm an Investment Adviser: Why Playing Defense Can Win the Investing GameChasing large returns through gold and other alternative investments might be thrilling, but playing defensive 'small ball' with your investments can be a winning formula.

-

Five Big Beautiful Bill Changes and How Wealthy Retirees Can Benefit

Five Big Beautiful Bill Changes and How Wealthy Retirees Can BenefitHere's how wealthy retirees can plan for the changes in the new tax legislation, including what it means for tax rates, the SALT cap, charitable giving, estate taxes and other deductions and credits.

-

Portfolio Manager Busts Five Myths About International Investing

Portfolio Manager Busts Five Myths About International InvestingThese common misconceptions lead many investors to overlook international markets, but embracing global diversification can enhance portfolio resilience and unlock long-term growth.

-

I'm a Financial Planner: Here Are Five Smart Moves for DIY Investors

I'm a Financial Planner: Here Are Five Smart Moves for DIY InvestorsYou'll go further as a DIY investor with a solid game plan. Here are five tips to help you put together a strategy you can rely on over the years to come.

-

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the Summer

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the SummerWorn, underinflated tires and other degraded car parts can fail in extreme heat, causing accidents. If your employer is ignoring needed repairs on company cars, there's something employees can do.

-

'Drivers License': A Wealth Strategist Helps Gen Z Hit the Road

'Drivers License': A Wealth Strategist Helps Gen Z Hit the RoadFrom student loan debt to a changing job market, this generation has some potholes to navigate. But with those challenges come opportunities.