What to Make of Bitcoin

The digital currency has delivered dizzying gains—and is just as volatile as ever.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

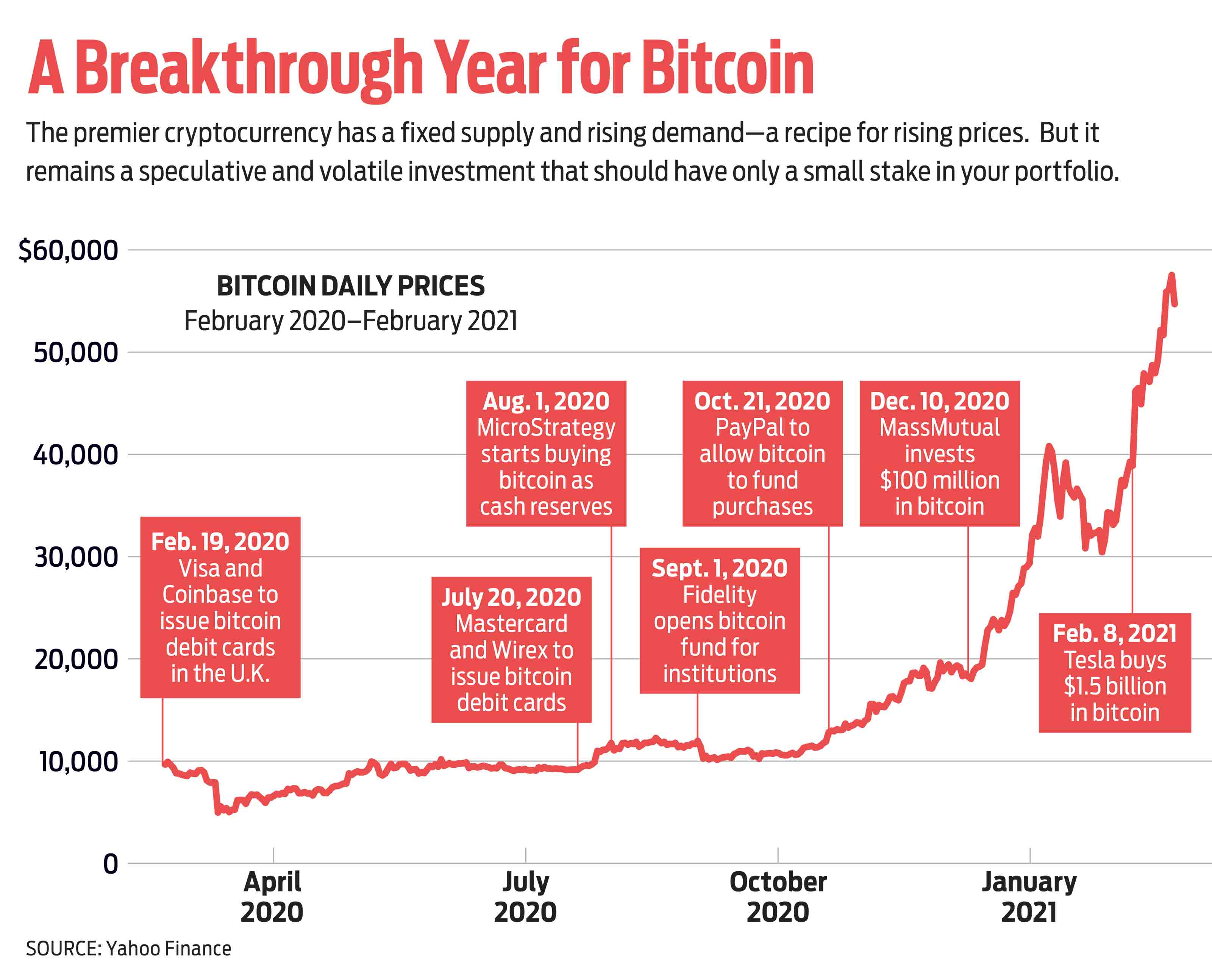

The price of bitcoin was already soaring when Tesla announced in February that it had bought $1.5 billion worth of the digital currency, sending its value climbing higher. The electric-vehicle maker said it would soon accept bitcoin as payment for its products, too. But in truth, Tesla was a tad late to the party.

Several well-known firms had already embraced bitcoin in one way or another. Massachusetts Mutual Life Insurance, a 170-year-old insurer, bought $100 million worth of bitcoin in late 2020 for its general investment accounts. MicroStrategy, a business services company, has been buying millions in bitcoin, which represents the majority of its cash reserves. And Mastercard and PayPal have each said customers will soon be able to use bitcoin to pay for purchases through their respective networks. All told, demand has driven up the price of the cryptocurrency by nearly 450% over the past 12 months. Its market value is just under $1 trillion. (Returns and data are through March 5.)

Does that mean it’s time for regular folks to buy bitcoin? Not necessarily. There are pros and cons to buying it, and its recent popularity doesn’t erase its drawbacks, whether you view it as an investment or as a currency that you can use to buy things.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What is bitcoin? The 11-year-old cryptocurrency was the first of its kind. It gets its name from the technology behind it—every transaction is encrypted by computer code, known as blockchain technology, which eliminates the need for a middleman or a central bank. Ethereum, bitcoin cash (a spin-off of the original bitcoin) and litecoin are other well-known e-coins.

What’s driving the price? There is a finite supply of bitcoin. Only 21 million tokens will ever be made, and nearly 19 million bitcoins are already in circulation, so there are fewer than 3 million left to be created. And the rules around how the tokens are created—they’re awarded to bitcoin “miners” who solve complicated math problems—along with other restrictions mean a dwindling number of tokens will be issued in the coming years. The final bitcoin will be minted more than 100 years from now, in 2140.

Such scarcity is driving demand, says Tom Jessop, head of digital assets at Fidelity Investments. The brokerage and investment firm launched a passively managed bitcoin fund with a minimum $100,000 investment requirement, targeted at institutions. Since then, Fidelity has seen a lot of interest from a diverse group of clients, including hedge funds, registered investment advisers, pension and endowment funds, and corporate clients.

Will other digital assets displace bitcoin? Scarcity and increased demand could help bitcoin stay dominant. Yassine Elmandjra, a cryptocurrency analyst at Ark Investments, believes bitcoin will capture the lion’s share of the market for digital assets over time. “There may be room for two to five additional currencies that capture 25% to 35% of the total market share,” he says.

Is bitcoin a good investment? It has been over the past 12 months. But some investment professionals still view the virtual currency skeptically, including Matt Andrulot, executive director of research at Verdence Capital Advisors, an advisory firm for ultra-high-net-worth investors, in Hunt Valley, Maryland. “It’s volatile and speculative,” he says.

He’s right about the volatility. In just two weeks in January, bitcoin lost 25% of its value. During the pandemic sell-off in 2020, the price of bitcoin fell 49% from its peak to its trough (the S&P 500 index, by contrast, dropped 34%). And few holders are likely to forget its 83% fall between December 2017 and December 2018. Because bitcoin doesn’t generate any cash flow or earnings—and never will—its price is driven purely by demand, so it’s speculative. “Be prepared to lose the entirety of your principal,” says Thomas Stapp, a certified financial planner in Olympia, Wash.

That said, bitcoin could still have a small place in an investor’s portfolio. But given the sky-high volatility, it should take up no more than 1% to 3% of your assets, say many advisers. Limit your investment to an amount you can afford to lose, says Leo Marte, a certified financial planner in Huntersville, N.C. “That kind of mind-set will bring you to the right allocation for you.”

If you do invest, consider it exposure to an “alternative” asset class. Traditional alternative investments, such as gold or a basket of commodities, offer your portfolio diversification from stocks or bonds. Many investors hold gold, for instance, as ballast against market downturns or to hedge against inflation. Bitcoin’s unique characteristics make it more commodity-like than stock- or bond-like. In fact, the U.S. Commodity Futures Trading Commission considers virtual currencies to be commodities, and therefore subject to oversight under its authority.

On paper, bitcoin has superior properties as a store of value compared with gold. It’s scarce because of the finite supply; by contrast, gold miners regularly find new deposits. Bitcoin is portable and easily stored; in that regard, 100 gold bars might prove onerous. Plus, bitcoin is divisible to eight decimal places and can be easily transferred to others. However, it’s also three or four times more volatile than gold. But the more acceptance grows, says Fidelity’s Jessop, “the more bitcoin gets to become a superior store of value.”

Will bitcoin take off as a form of payment? There’s a lot of promise but little in practice so far. “You can’t go to Starbucks and buy a cup of coffee,” says Stan Kiang, director of exchange-traded funds at Aberdeen Standard Investments. “When that happens, I’ll be a believer.” Bitcoin is gaining some momentum on that front, though, as people buy crypto assets and either use them directly or convert them to traditional currencies to spend. The trend is “unmistakable,” says Raj Dhamodharan, head of Mastercard’s digital assets, blockchain products and partnerships, in a recent company blog post.

Spending bitcoin can involve some rigamarole. For a payment to go through the Mastercard network for a Starbucks latte, say, the dollar price would be translated into digital assets, then those digital assets would be exchanged for dollars at one of Mastercard’s crypto-payment platform partners (BitPay, Wirex or LVL) before the purchase is transmitted on the Mastercard network.

There may be tax implications, too. Because the Internal Revenue Service views digital currencies as property, they are subject to capital gains taxes. If you buy a cup of coffee using bitcoin, it’s akin to selling an asset to do so—you may have to report your cost basis and any potential long- or short-term gain or loss on the digital currency. That would make paying with bitcoin “challenging,” says Fidelity’s Jessop.

How can I buy bitcoin or invest in it? To buy the actual tokens, you’ll have to open an account at an exchange; Coinbase is the biggest. Digital assets in Coinbase accounts aren’t covered by any kind of insurance, but U.S. dollars in the accounts are FDIC-insured, up to $250,000. There’s an easier path, but it’s pricey. Grayscale Bitcoin Trust (symbol GBTC, $44, expense ratio 2.0%), an investment fund of sorts, holds actual bitcoin tokens. “Each share is backed by bitcoin,” says Rayhaneh Sharif-Askary, director of investor relations and business development at Grayscale.

The trust is a bit of a cross between a closed-end fund and an exchange-traded fund. It’s easy to buy and sell in a brokerage account. But you should be mindful of the premium you’ll pay: Over the past five years, the fund has traded at an average 38% premium to its net asset value, according to data provider Y Charts. But in volatile times past (namely 2017), the premium has reached 133%.

Over the past 12 months, GBTC gained 419%. That beat the S&P 500, of course, which rose 29%, but the bitcoin trust experienced three times the volatility, too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Elon Musk's $1 Trillion Pay Package Passes: What's at Stake for Tesla Stock

Elon Musk's $1 Trillion Pay Package Passes: What's at Stake for Tesla StockMore than 75% of Tesla shareholders voted to approve a massive pay package for CEO Elon Musk. Here's what it means for the Mag 7 stock.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

21 Last-Minute Gifts for Grandparents Day 2025 to Give Right Now

21 Last-Minute Gifts for Grandparents Day 2025 to Give Right NowHoliday Tips Last-minute gifting is never easy. But here are some ideas to celebrate Grandparents Day.

-

Is Crypto Investing Coming to a Credit Union Near You?

Is Crypto Investing Coming to a Credit Union Near You?Credit unions are getting in on crypto investing through partnerships with third-party platforms, but the risks to investors still apply.

-

Texas Sales Tax-Free Weekend 2025

Texas Sales Tax-Free Weekend 2025Tax Holiday Here's what you needed to know about the Texas sales tax holiday.