Invest in Gold and Give Your Portfolio Some Shine

With a weaker dollar and inflation stirring, it could be a good time to diversify with a little gold.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

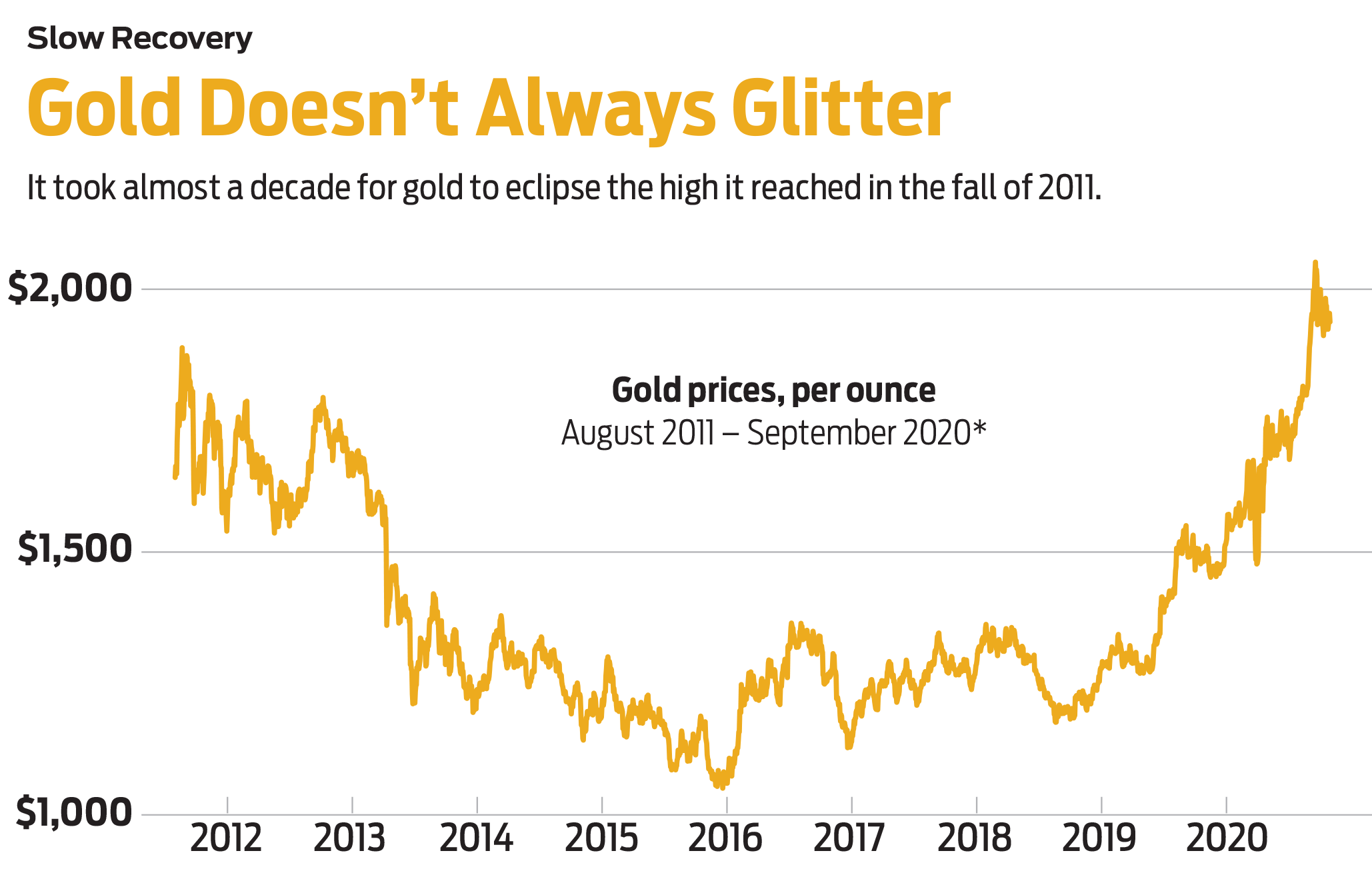

The year 2020 hasn’t felt like the golden age of anything, except maybe for gold itself. Early August saw the shiny yellow stuff hit an all-time high of more than $2,000 an ounce. Prices have fallen back since then, but it has still been an excellent year for gold investors so far: The price of the metal has risen by 27.5% in 2020, compared with a 21.8% total return for the Nasdaq Composite stock index and a 4.8% total return for the S&P 500. Even longtime gold detractor Warren Buffett recently purchased stock in a gold mining company. (Prices and returns are through September 11.)

Gold’s glow-up has come even though it produces no earnings or income in the form of dividends, as would a stock. Unlike the case with other commodities, such as copper and tungsten, gold’s prices don’t rise and fall along with industrial demand.

So, why the gold rush? For one thing, basement-low interest rates mean that many bond investors currently earn yields lower than the rate of inflation. In such a climate, gold’s lack of yield is much less of a drawback, says Doug Ramsey, chief investment officer at the Leuthold Group. “Any competition gold had from fixed income has vanished,” he says.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also contributing to gold’s rise: the Fed’s decision to flood the U.S. economy with unprecedented amounts of stimulus money in the wake of the COVID-19 pandemic. Gold is a classic inflation hedge, and investors have snapped up the metal on the premise that the stimulus will eventually drive up prices if the influx of cash causes consumer demand to rise faster than the supply of goods and services.

And because gold has been considered a currency for millennia, investors may believe they can find a “store of value” in the metal when they lose faith in paper currency, says Brian Andrew, chief investment officer at investment firm Johnson Financial. The U.S. dollar has fallen 8% against a basket of other currencies since March due to the Fed’s drastic monetary policies, among other factors, and some market watchers are beginning to question the currency’s preeminent status on the world stage. “Real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge,” wrote Goldman Sachs analysts in a recent note.

Finally, investors tend to flock to gold amid periods of uncertainty—in financial markets and in the world at large, says Andrew. To find more than enough uncertainty, consider the geopolitics of the Brexit transition and the U.S. presidential election, as well as the ongoing pandemic and its impact on the global economy.

Mixed track record. But gold has a spotty history when it comes to fulfilling investor expectations. Its record as a hedge against inflation, for instance, is only so-so. In successive 12-month periods from December 1973 through May 2020, gold outpaced the rise in consumer prices only 51% of the time.

And although the metal has proven its mettle in some market downturns, there’s no guarantee that gold will protect your portfolio when markets go bad. In the summer of 2011, when the S&P 500 slid 19% between April and October, gold hit a record high. But when stock returns struggled to crack 1% in 2015, gold prices fell 11%. Had you bought gold at its previous peak, in 2011, you’d have had to wait until July of this year to break even.

Nevertheless, investors looking to diversify their portfolios—a proven strategy to smooth returns over time—should add some of the shiny stuff, says Ramsey. He says investors should hold 2% to 5% of their portfolio in gold as a portfolio diversifier. Moreover, he believes that concerns that the Fed is devaluing the dollar by pumping unprecedented amounts of cash into the economy are justified.

How to buy. There’s more than one way to own gold, and the way you go about buying it should depend on why you’re investing, says Andrew. If, for whatever reason, you’re worried that the money in your wallet may become severely devalued, you’ll want physical gold, he says. The U.S. Mint doesn’t sell bullion coins directly to the public, but it does list authorized buyers of such coins on its website. Reputable sellers typically fold in a 6% to 10% markup over the current gold spot price, which you can find at sites such as www.kitco.com. In addition, you’ll likely have to pay to insure and store your gold, unless you’re comfortable stashing bullion in your sock drawer.

If you’re investing in gold as a portfolio diversifier, consider an exchange-traded fund, which makes trading gold cheap and easy. Funds such as SPDR Gold Shares (symbol GLD, $182) and iShares Gold Trust (IAU, $19) track the price of gold that the trustees hold in vaults and are forbidden from lending out. Though the SPDR fund is older and bigger, the iShares fund comes with lower expenses, charging an annual 0.25% of assets, compared with 0.40% for the SPDR fund. A caveat: Because the IRS treats precious metals as collectibles (the same as a stamp collection), long-term capital gains taxes on these funds are steep—up to 28%. (The same rates apply for physical gold, should you sell it.)

If you’re especially bullish on gold, you may be tempted to wade into stocks of gold mining companies. Because these firms have relatively fixed production costs, a spike in gold prices can supercharge the companies’ profitability, and their stocks often shoot up faster than the price of bullion. (A sharp decline in gold prices has the opposite effect.) Investors looking to gold in order to diversify their exposure away from stocks should avoid miners, whose returns are more correlated to the stock market overall than to movements in bullion prices, says Invesco chief global market strategist Kristina Hooper.

Still, miners (which, unlike gold, generate earnings and dividends) have their fans among stock investors, including the Oracle of Omaha. Berkshire Hathaway, Warren Buffett’s holding company, recently bought 21 million shares of miner Barrick Gold (GOLD, $30) for about $563 million. Matthew Miller, an analyst at investment research firm CFRA, also recommends Barrick, as well as rival Newmont Corporation (NEM, $66). He’s optimistic about the two firms’ recently established joint mining project in Nevada, which he says should help both companies boost earnings for the next several years.

For a broad-based play on miners, consider VanEck Vectors Gold Miners ETF (GDX, $41), which holds stock in 53 companies from across the world that mine gold and other precious metals. The fund, which charges 0.53% in annual expenses, has returned 40% so far this year. A slightly top-heavier option, iShares MSCI Gold Miners (RING, $34), holds 36% of assets in Barrick and Newmont, compared with 26% for the VanEck fund. The iShares fund comes with a cheaper price tag, charging 0.39% of assets in expenses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.