Target Date Funds: How to Evaluate If Yours Is a Good Fit

Look beyond the retirement year associated with your 401(k) fund. Dig deeper to see if the fund’s assumptions match your own situation, or whether it could use some tailoring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Fabulously wealthy people can walk into a car dealership or clothing store and buy a custom-made product whether they need it or not. But assuming you’re not Jeff Bezos or Elon Musk, the decision to spend more on a bespoke alternative to what is on the showroom floor needs to be carefully weighed. And in the world of 401(k) plans, what factors should you consider before deciding to purchase a customized asset allocation for your plan balances?

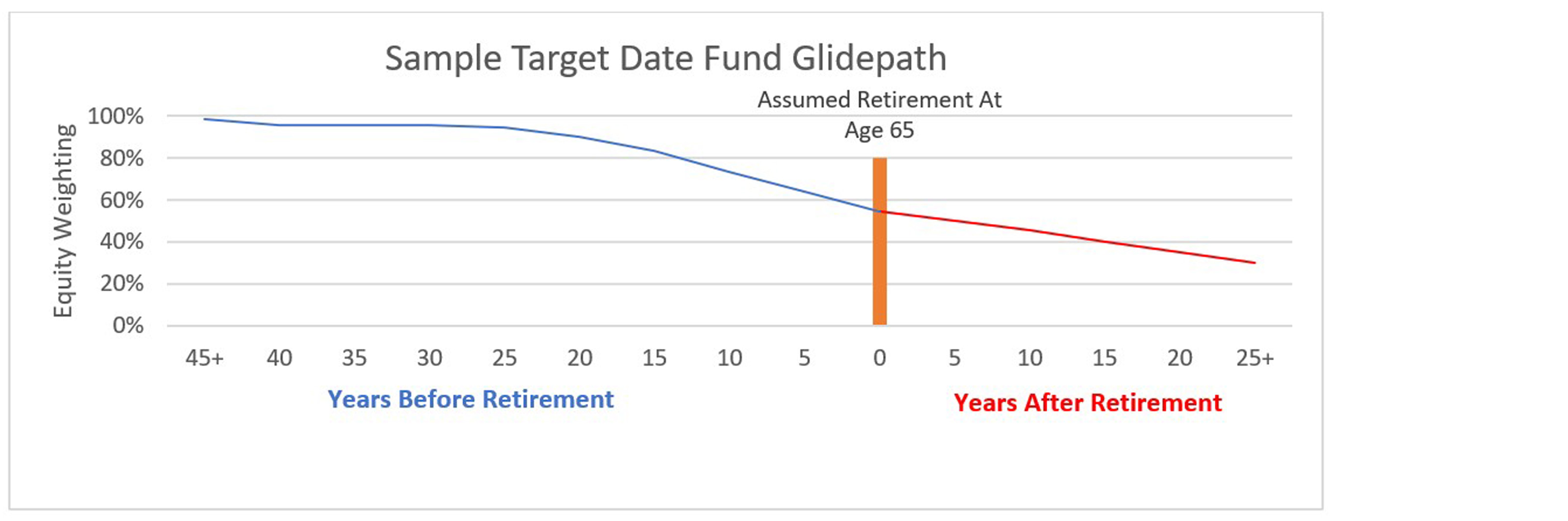

For participants who want a do-it-for-me approach to allocating their plan balances, more than 80% of 401(k) plans now offer a suite of target date funds (TDFs). These are prepackaged, age-appropriate investment strategies that are intended to help support post-employment income needs while reducing investment risk near and through retirement. This is accomplished through use of a “glide path” in which the fund’s asset allocation changes over time based on the participant’s retirement age.

Each target date fund makes certain assumptions about the average participant: These include assumptions about other benefits, such as Social Security, risk preferences, salary levels, saving behaviors, work spans, life spans and post-retirement spending behavior. In most plans, TDFs serve as the plan’s default option and contributions are automatically directed — unless the participant elects elect otherwise — into the fund with year closest to their assumed retirement date at age 65. (For instance, someone born in 1970 would be defaulted into a Target Date 2035 Fund.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Alternatively, around 40% of plans (higher for employers with more than 1,000 employees) also offer a service known as managed accounts. Managed accounts customize your asset allocation within a plan’s investment options based on your unique financial situation. In addition, many managed account services offer additional guidance on savings levels, when to start receiving Social Security payments and a sustainable decumulation strategy. But delegating the asset allocation and fund elections of a participant’s balance is at the heart of the service.

Fees for managed accounts vary but typically range from 20 to 50 basis points on top of the investment expense of the underlying plan funds. This can really add up over an extended period. For example, if you put $10,000 per year in a 401(k) plan over the course of a 30-year career at a 6% return, an additional 30 basis point fee will cost approximately $50,000 over the period.

For more on whether you are a good candidate for a managed account, please read “Should Your 401(k) Be ‘Custom Made’?”

Evaluating the target date investment strategy

To make a high-level determination regarding whether your plan’s target date fund is appropriate for your situtation, you need to understand the manager’s investment strategy. This is far easier than it sounds as you can typically find what you need on the fund fact sheet or in a summary prospectus. And if you cannot find it on your own, you can contact your plan recordkeeper for the information.

Participant profile

First look for the section that describes the assumptions being made about the average investor. To illustrate, here are a few sentences drawn from the summary prospectus of one of the largest target date funds offered in defined contribution plans:

“The fund is managed based on the specific retirement year (target date) included in its name and assumes a retirement age of 65. The target date refers to the approximate year an investor in the fund would plan to retire and likely stop making new investments in the fund. The fund is primarily designed for an investor who anticipates retiring at or about the target date and who plans to withdraw the value of the account in the fund gradually after retirement.”

Just in these three sentences you can glean some key assumptions used in shaping the fund’s investment strategy:

- Participant will continue to contribute to the fund up until age 65 and then begin the drawdown process.

- Participant will avoid any large withdrawals during their working years, dedicating these balances to providing post-retirement income.

- Participant will gradually withdraw their balances over time, eschewing any large distributions at retirement.

A fund manager working under these assumptions would assume that fund investors can withstand higher levels of volatility, because they have a longer period to recoup any losses incurred during their working life. So the manager would focus on asset accumulation by investing a high percentage of fund assets in equities prior to retirement and then shifting to a more conservative approach in the post-employment period.

So what happens if you anticipate operating under a different set of assumptions? For instance, you may plan on terminating employment at age 55 and using these funds to purchase a new home or pay for educational expenses. In this case, you may prefer a more cautious investment strategy than this fund offers. Alternatively, you may have sufficient assets to avoid withdrawals before the required minimum distribution date of age 72. In that case, you may not want to shift to a more conservative allocation at age 65 but instead continue with a more growth-focused strategy given your longer timeframe.

Glide path

You also need to review the fund’s glide path, specifically the percentage of assets held in equities or other higher risk asset classes at different ages. Here is a sample glide path borrowed from one of the largest target date fund series offered in defined contribution plans:

As one would expect based on the stated investment strategy, the glide path starts off almost entirely invested in equities and remains at 55% even at the assumed retirement age. And while declining after retirement, it still remains at 30% equities even at age 90 and later.

So, just based on this basic information, you can consider whether this approach is appropriate for your financial situation. For example, if you are a conservative investor with a low risk tolerance, either due to temperment or financial situation, this fund might not be appropriate given its percentage of equity holdings. (FYI this glide path is not out of line with the approach of all the major target date funds used in defined contribution plans.)

Hacking the decision

There is a simple shortcut, or hack, you can use if you have concerns about the default target date fund in your plan but don’t want to pay the additional cost for a more customized solution.

As a reminder, you are typically defaulted to the fund where the year included in the fund name is closest to when you turn age 65. For example, someone born in 1961 would be defaulted into target date fund 2025. But you can pick a different fund based on your risk preferences. So regardless of your birth year, if you want a substantially lower level of risk, consider a fund maturing at an earlier date (target date 2015, 2020, et al.).

The opposite applies if you want to focus more on asset appreciation than your default fund allows. And remember, your initial election is in no way permanent. If your financial situation charges (for example, acquiring substantial equity holdings through your job), you can dial down the equity holdings in your 401(k) plan by picking an earlier maturity date from the series.

Conclusion

This is obviously only a basic guide to evaluating target date funds as more complex issues like the type of equity assets, credit quality and duration of fixed income holdings, inflation hedging, use of alternative asset classes, or active versus passive fund management can all come into play.

For the typical investor considering whether to abandon their plan’s default target date fund for a customized option, reviewing the basic assumptions of a TDF is a good place to start.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Alan Vorchheimer is a Certified Employee Benefits Specialist (CEBS) and principal in the Wealth Practice at Buck, an integrated HR and benefits consulting, technology and administration services firm. Alan works with leading corporate, public sector and multi-employer clients to support the management of defined contribution and defined benefit plans.